4 Benefits for Alberta Seniors You Should Know About

There are various financial benefits available to Alberta seniors over the age of 65 that you need to be aware of and how to apply for them. Every province and territory has similar benefits. Simply do a Google search on Benefits for seniors in "Your Province".

You are eligible to apply for the Seniors Financial Assistance programs if you meet all of the following criteria:

-

You are 65 years of age or older

-

You have lived in Alberta for at least three months before applying

-

You are a Canadian citizen or have been admitted into Canada for permanent residency (landed or sponsored immigrant)

-

You and your spouse/partner have not chosen to defer receipt of the Old Age Security pension

1. Alberta Blue Cross Drug Plan.

Every Alberta resident over the age of 65 can qualify for this benefit. The coverage is only for an individual 65 and over. It does not cover any expenses for a younger spouse.

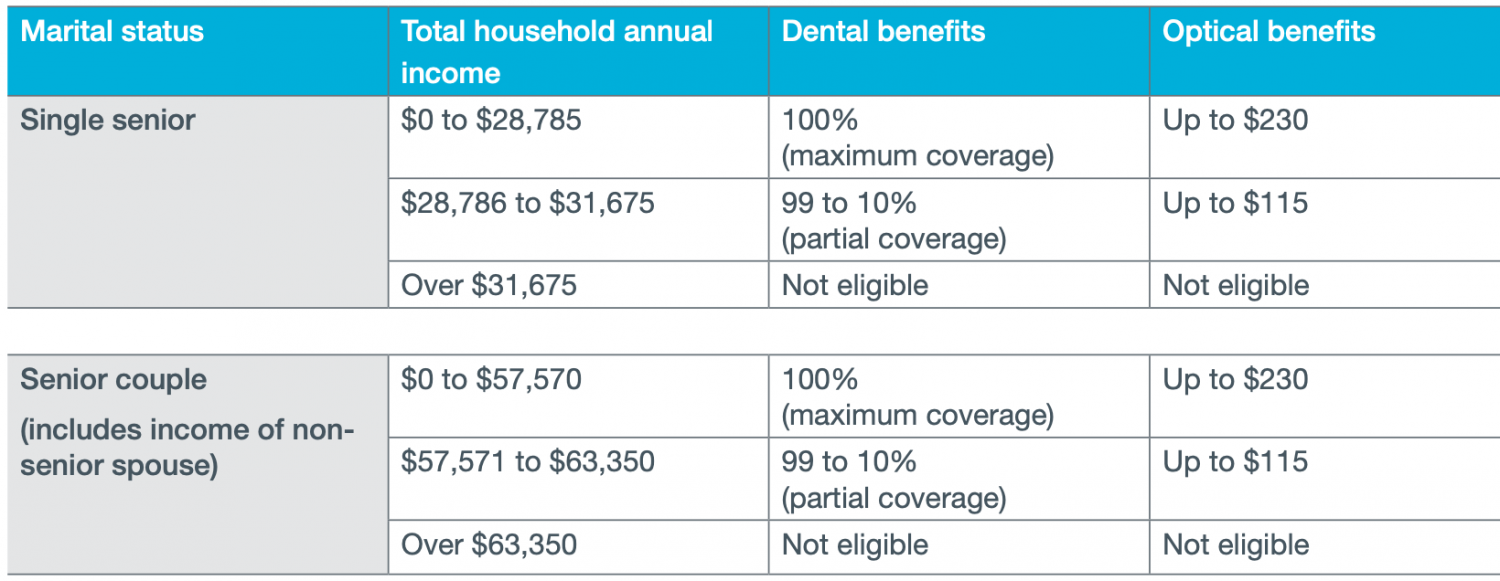

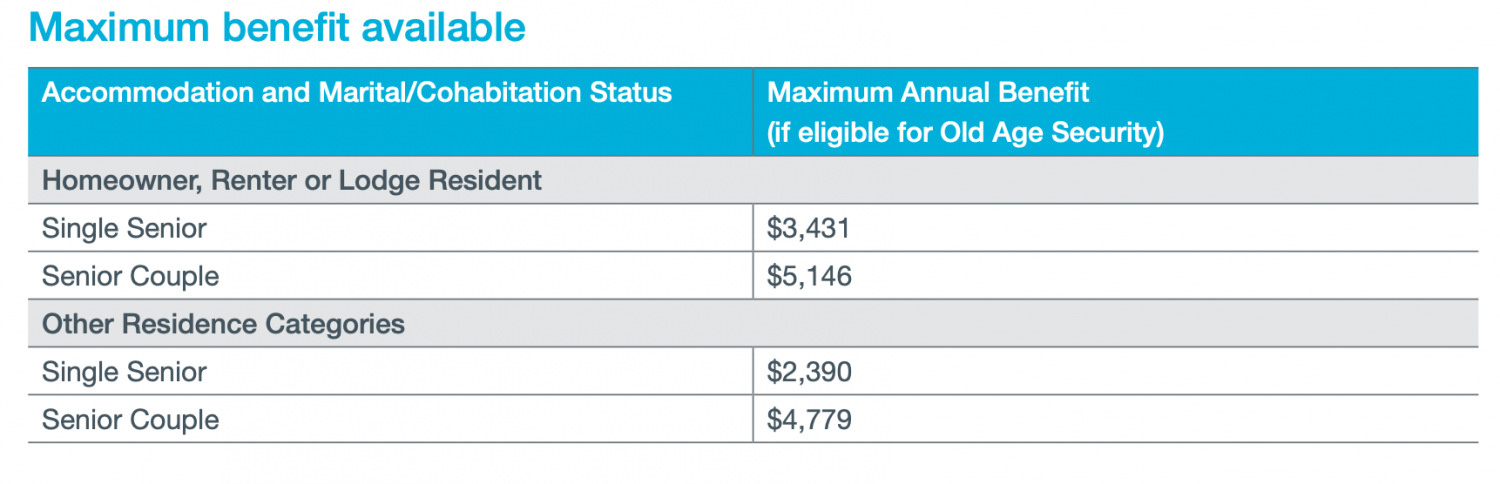

2. Alberta Blue Cross for Extended Health Benefits

These benefits are for things like dental, eyeglasses, optometrist, massage therapy, chiropractor, and physio.

As with most government benefits, qualification is based on levels of income.

The Dental Assistance for Seniors Program provides basic dental coverage to a maximum of $5,000 every five years. This includes services such as examinations, scaling/root planing, fillings, extractions, root canals, and dentures.

The Optical Assistance for Seniors Program provides assistance to a maximum of $230 towards the purchase of prescription eyeglasses every three years Eye exams for seniors are paid for by Alberta Health, once per year.

Who is eligible

The amount of coverage you receive is based on your total annual income (line 15000 of your personal tax form):

Tutorial on calculating your potential Alberta Benefits.

Alberta Seniors Benefit Calculator. Click here to try the calculator and use your numbers to see if you qualify.

3. Seniors Home Adaptation and Repair Program (SHARP)

The Seniors Home Adaptation and Repair Program provides low-interest home equity loans to help senior homeowners finance home repairs, adaptations, and renovations.

The program provides a maximum loan amount of $40,000. A loan will be repaid upon the sale of the property, or earlier if the senior chooses with no penalty. Monthly repayments are not required.

Who is eligible?

To qualify for a loan under this program you must meet all of the following criteria:

-

be age 65 years or older

-

be an Alberta resident for at least three months

-

own a residential property in Alberta

-

have an annual household income of $75,000 or less

-

maintain a minimum of 25% equity in your home

What is covered?

The Seniors Home Adaptation and Repair Program is designed to help cover the cost of home repairs, adaptations, and renovations that help seniors remain safe and secure in their homes. Adaptations or repairs will be considered if they improve energy efficiency or increase the physical safety, mobility, independence, or health and well-being of the senior homeowner.

Interest charge

Simple interest (not compounded) will be charged once a loan is approved. The interest rate is variable and is reviewed twice a year in April and October and may be adjusted accordingly. The current rate is 2.45%.

Applying to the program

You must complete and submit a Seniors Home Adaptation and Repair Program application form in order to apply to the program.

To request an application form or for more information on eligible items and current interest rate, visit their Site or call the Alberta Supports Contact Centre toll-free at 1-877-644-9992. There are grants available to low-income seniors. Click here for more information about the program.

4. Seniors Property Tax Deferral Program

The Seniors Property Tax Deferral Program allows eligible senior homeowners to defer all or part of their property taxes through a low-interest home equity loan. If you qualify, the Government of Alberta will pay your residential property taxes directly to your municipality on your behalf. You re-pay the loan, with interest, when you sell the home, or sooner if you wish. Monthly repayments are not required.

Who is eligible?

To qualify for the Seniors Property Tax Deferral Program, you must meet all of the following criteria:

-

be age 65 years or older

-

be an Alberta resident for at least three months

-

own a residential property in Alberta

-

have a minimum of 25% equity in your home

Only residential properties are eligible. The home must be your primary residence (that is, the place where you live most of the time).

If you owe arrears from previous years’ property taxes, you can still apply to the Seniors Property Tax Deferral Program, as long as you have a minimum of 25% equity in your home.

Interest charge

The Seniors Property Tax Deferral Program charges simple interest (not compounded). Interest charges start the day the program pays your residential property taxes to the municipality on your behalf and ends when the loan is paid in full. The interest rate is variable and is reviewed twice a year in April and October and may be adjusted accordingly. Currently, the rate is 2.45%.

Applying to the program

Complete and submit a Seniors Property Tax Deferral application form in order to apply to the program.

For an application form or for information on the current interest rate, visit their website here or call the Alberta Supports Contact Centre toll-free at 1-877-644-9992.

Learn more about our Flat-fee Retirement Income Planning Services for those 55+

Retirement Income, Investment & Tax Planning

Willis J Langford BA, MA, CFP

Nancy R Langford CRS