You can't benefit from what you do not know. And, when it comes to your CPP benefits it is up to you to know what you can benefit from. They do not have a person in Ottawa reviewing the files of Canadians to see if they are entitled to more benefits from CPP. In fact, every benefit from CPP, except one, has a requirement by you to apply for it. The exception exists for the Post Retirement Benefits which you earn if you are collecting a CPP pension and still working during your 60's.

It begs the necessary question "what might you qualify for?"

Let's explore the benefits available to the surviving spouses (Widows and Widowers) of deceased individuals who have contributed to CPP during their working lives.

These benefits are available to individuals who were married or lived in a common-law relationship for at least 1 year and were still living in a conjugal relationship prior to their partner's death.

How is a Survivor benefit calculated?

It is based on age and the calculated amount of the deceased person's normal age 65 CPP pension. For example: If the survivor is 65 years old or more they will receive 60% of their deceased spouse's age 65 CPP pension to a maximum of $784/month. In 2023 the maximum amount of a normal age 65 pension is $1306/month. (few people get the max.) If a survivor is under 65, they will receive a flat rate of $197.34 and 37.5% of the deceased spouse's normal age 65 CPP pension for a maximum of $707/month.

Survivor benefits are based on the CPP amount the deceased contributor was receiving but do not include any post-retirement benefits he or she was receiving.

A surviving spouse who is age 35 or younger would not qualify for anything until they are age 65, at which time they can apply to get a survivor's pension.

If a widow is under the age of 45 they will see a reduction to their survivor pension of 1/120th for each month that they are under the age of 45. Basically, a widow or widower can receive a survivor pension between the ages of 36-45 at a reduced amount.

Children's survivor benefit

If an individual CPP contributor has contributed to CPP for the lessor of 10 years within their contributory period or 1/3 of the years in their contributory period, but not less than 3 years, then their surviving children qualify for a CPP benefit in the amount of $282 per month (2022 number). The child must be under the age of 18 or under the age of 25, and attending a qualified post-secondary educational facility. The benefit would be doubled if both parents were to be deceased and both met the eligibility requirements noted above. The best thing to do is always apply and let Service Canada make the determination.

Note: CPP contributions are mandatory and deducted from your paycheque between the ages of 18-65. Contributions are optional for workers between the age of 65 and 70 if they are collecting CPP.

Some rules to remember

- If a person is receiving both a "regular" CPP pension and also qualifies for a "survivor pension", the total of both pensions cannot exceed the maximum Regular CPP benefit for a person age 65. In 2023 that amount is $1307. In some cases, a surviving spouse may not qualify for a survivor's pension if they are already getting the maximum regular CPP pension.

- There are special circumstances for survivors receiving the "combined pension" (both a survivor's pension and their own regular pension) when they turn 65. They will most likely see a reduction in their overall paycheque. I think Doug Runchey does a good job of explaining this. Check out his post here.

- You cannot receive more than one CPP survivor benefit. If you have been widowed more than once, your benefit will be based upon the scenario that will pay you the highest benefit amount.

- Even if you re-marry or live common-law, you still get to keep your survivor pension. It's yours until the day you die.

- A survivor pension is indexed for life. Meaning that it will increase, each January, according to the Consumer Price Index (CPI).

- If you qualify for a survivor pension you have to apply to receive these benefits. Here's a form to complete.

- There are many unique circumstances that could make you eligible for benefits from the Canada Pension Plan - do not hesitate to ask.

- Survivor benefits are taxable income.

- There isn't an estate value for a single CPP contributor. If the contributor hasn't started their CPP by age 70 and they pass away, their estate representative can apply for 1 year's worth of benefits.

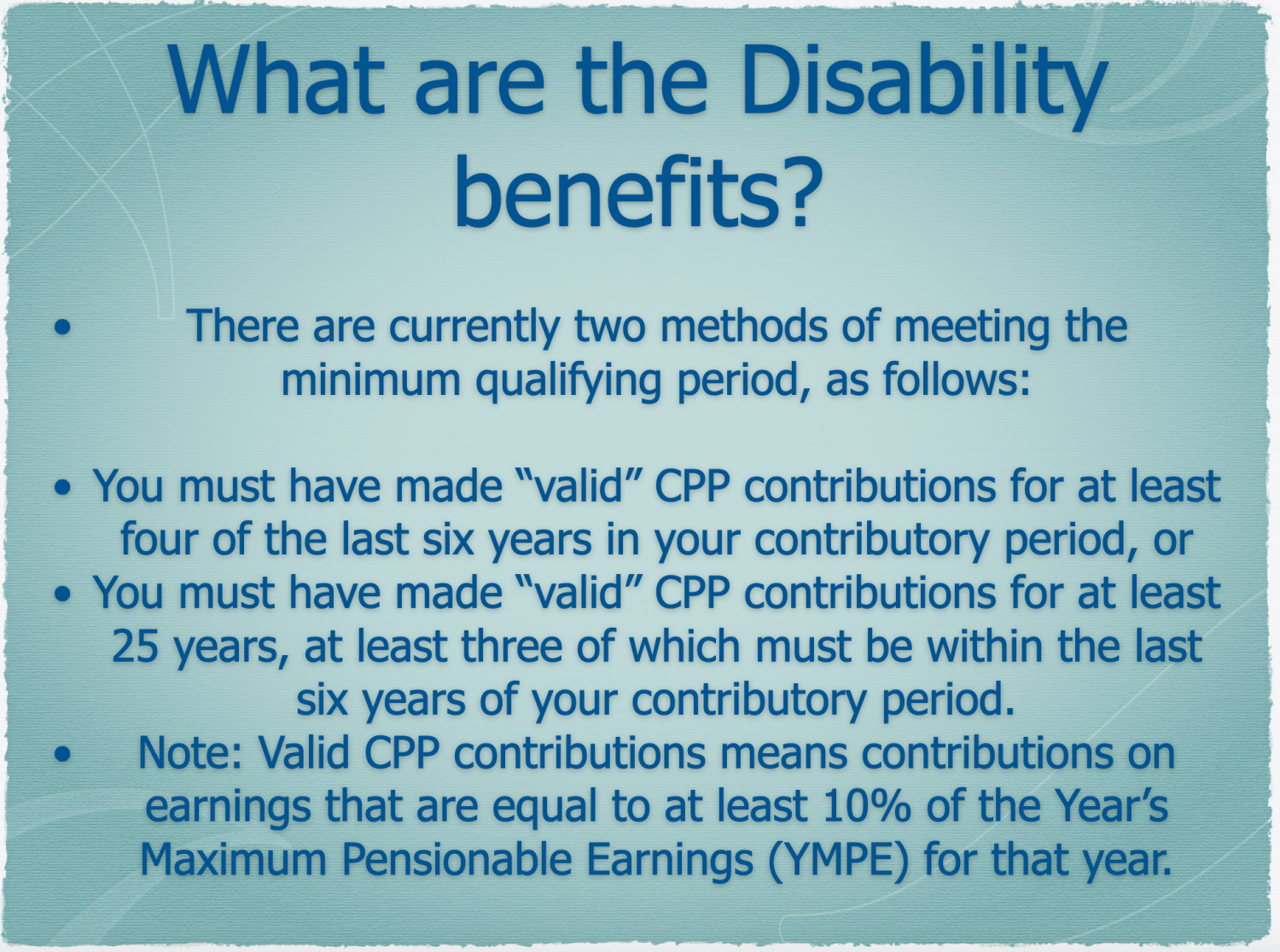

A CPP disability benefit is a monthly benefit that consists of a flat-rate portion ($558 for 2022) plus 75% of a person’s calculated CPP retirement pension. The Maximum is $1538. Applicants must have made contributions to the program in four of the last six years, with minimum levels of pensionable earnings ($3500) in each of these years, or three of the last six years for those with 25 or more years of contributions.

If you are collecting a CPP disability pension your benefit will change at age 65 and become your regular CPP pension, based on what you qualify for. It will most likely be less than what you were receiving from the disability CPP. You will also start receiving OAS at age 65 if you choose.

We appreciate your feedback. Let us know what you like or do not like and how we can make the presentation easier to follow. Send us an email: info@langfordfinancial.ca

Learn more about our planning services for those 55+

Fee-Only Retirement Income, Investment & Tax Planning

Willis J Langford BA, MA, CFP

Nancy Langford CRS