April 5, 2020

As you know the situation in Canada is changing by the minute and the various levels of government are scrambling to find solutions. These are challenging times and we all need to work together and be patient.

The feds have anounced a large financial package to help employees and employers with the needed emergency cashflow to navigate through this storm and then help with the economic recovery. The details of these programs are subject to change.

Here are some of the more relavant programs:

1. Canada Emergency Response Benefit (CERB) $2000 /month for up to 4 months

- This program is available for employees who have lost their job temporarily due to the pandemic.

- You can apply as of Monday, April 6th: Apply at this link.

- You could get money within 3-5 days.

- You cannot apply for regular EI benefits and the CERB. At this point, you'll just get the CERB.

- If you have already applied for EI and you claim has not been processed your claim will default to the CERB.

- If you are still unemployed after 4 months you can apply for regular EI.

- You can still earn upto $1000/month while still collecting CERB.

2. Temporary Emergency Wage Subsidy

- The program allows elegible employers to reduce the amount of payroll deductions they remit to CRA for 3 months.

- The subsidy will equal 10% of pay upto a maximum benefit of $1375 per employee and a maximum benefit of $25,000 per employer.

- It appears that any business can qualify for this one.

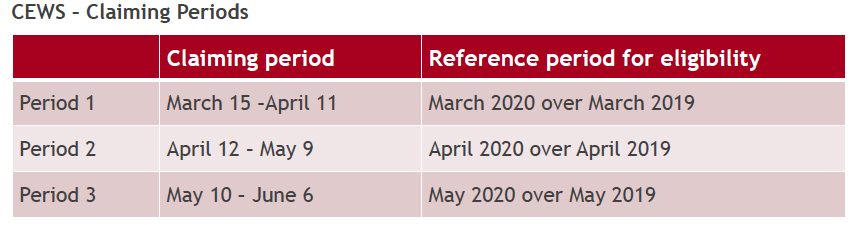

3. Canada Emergency Wage Subsidy

- 75% wage subsidy for qualifying businesses, for up to 3 months. Must show a decline of 30% in revenue during the same period in 2019 or a drop in revenue since January and February of 2020.

- Must be applied for separatly each month.

- Subsidy will cover 75% of first $58,700 of employees wage to a aximum benefit of $847/week per employee.

- Application process will be available April 27th at CRA "My Business Account".

4. Canada Emergency Business Account

- Government guaranteed loan upto $40,000 for elegible business to help cover operating costs.

- The loan is interest-free.

- The loan does not require a personal guarantee.

- If the loan is repaid by December 31, 2022 the business will qualify for 25% loan forgiveness upto $10,000.

- To qualify the business would have to demonstrate they paid between $20,000 and $1,500,000 in payroll during 2019.

- These loans can be applied for at any Canadian bank through an online portal only.

- My TD rep gave me this website at www.td.com/covid19 for updates as they come available.

5. Increasing the Canada Child Benefit

- $300/child

- If you are receiving these benefits no need to reapply.

6. Increasing the GST credit payment

- $400 for singles and $600 for a couple.

- This will be automatic.

7. Reducing the required minimum withdrawals from RRIF by 25% for 2020.

- Minimum withdrawals from Registered Retirement Income Funds will be reduced by 25% for 2020.

- The government expects this minimum withdrawal deferral to cost $495 million.

- This initiative that will enable seniors to avoid unnecessary liquidation and withdrawals while stock market conditions are unfavourable and also allows deferral of tax on funds not needed to meet living expenses.

8. Moratorium on the repayment of Canada student loans.

- Effective March 30, we are placing a six-month interest-free moratorium on the repayment of Canada Student Loans for all student loan borrowers. No payment will be required and interest will not accrue during this time. Students do not need to apply for the repayment pause.

9. Mortgage deferral for 6 months.

- All of the banks are offering this a temporary solution.

- Use it only if necessary. The interest is still accumulating and will be amortized into your mortgage. ($6000 of deferred interest will cost you an extra $10,884 over 20 years)

- There will be no impact on your credit score for doing this.

10. Credit card rate reductions

- Most of the banks have reduced their credit card rates by 50%.

- Try to negotiate more

- Consider consolidating your debt at a lower rate

11. Relief and benefits for seniors

- You can reduce your RRIF minimum by 25%. This will help you minimize the effect of taking money out of your RRIF during a time when the markets are down.

- One-time extra payment of $300 tax-free on your OAS cheque for the month of June. You need to be over age 65 and collecting your OAS.

- One-time extra payment of $200 tax-free for those receiving GIS.

- Extra GST credit in the month of April. Basically, a doubling of the normal GST credit for those who qualify.

- The government announced last year that Senior's will get a 10% increase to their OAS once they turn 75. There is also a possible 25% increase to CPP survivor benefits as well. This should start in July of 2020.

More information about these programs can be found at the Government of Canada site.

Learn more about our fee-only planning services

Fee-Only Retirement Income & Investment Planners,

Willis J Langford BA, MA, CFP

Nancy R Langford CRS