The big story of 2022 has been inflation.

I recently checked the price of a hotel in Kalispell, MT for the month of July and the mid-week nightly rate at The Hampton Inn would set me back more than $500/night. A bag of avocados has more than doubled in the past 6 months. Have you seen the price of beef lately?

Everyone wants more. Milk has increased this year and now the dairy farmers want more. How many hands can fit into our pockets? Do you think it's bad here? The OECD estimates that annual inflation in Turkey will come in around 76% in 2022.

There are two parts to inflation that you need to understand.

Headline Inflation

This is the total cost of goods. Often referred to as CPI - consumer price index. They take the same basket of goods and services and compare it month over month.

Core Inflation

This is the cost of goods, excluding food and energy.

Inflation impacts each person differently. A retired couple with one car who no longer drives very much is not going to feel the pain as much as a family with 2 teenage boys participating in numerous activities.

What has led to rapid inflation?

Supply chain bottlenecks

War in Ukraine

COVID stimulus and government spending on additional programs

Energy (oil)

What impact will rising interest rates have on lowering inflation?

So far, very little. It takes several months to determine the impact of rate hikes. Core inflation has dropped a little year over year. It's food and energy that are growing at the fastest pace. This is mostly the result of the Ukraine war and pent up demand as people are moving about after two years of lockdowns.

What is the correlation between inflation, interest rates, and the stock market?

They are interconnected. First, lower interest rates mean a lower cost of borrowing which results in more growth opportunities for large publically traded businesses. There are also more opportunities for retail investors to invest in the stock market or buy real estate. On the flip side, if the cost of capital goes up, there is less profit margin. Secondly, investors prefer to take on as little risk as possible so when rates rise they prefer to save their money in fixed income vehicles rather than invest in stocks. In essence, people sell stocks and buy bonds.

There is a silver lining

1. There's a repricing of everything taking place. Valuations on stocks are coming down which is making many stocks more attractive. You can buy a lot of good quality stocks at a 20% discount. You can buy tech at a 50% discount. But, you have to be prepared to wait for the recovery.

2. Bonds. There is an inverse relationship between bond prices and interest rates: as interest rates rise, yields rise and bond prices fall (and vice versa). The longer the maturity of the bond, the more it fluctuates in accordance with changes in the interest rate. Bonds have been horrible investments for the past decade, however, new bonds will have better yields going forward. Just not yet. Interest rates have to normalize first. You have to wait and see when central banks have got things under control. Have they ever had anything under control?

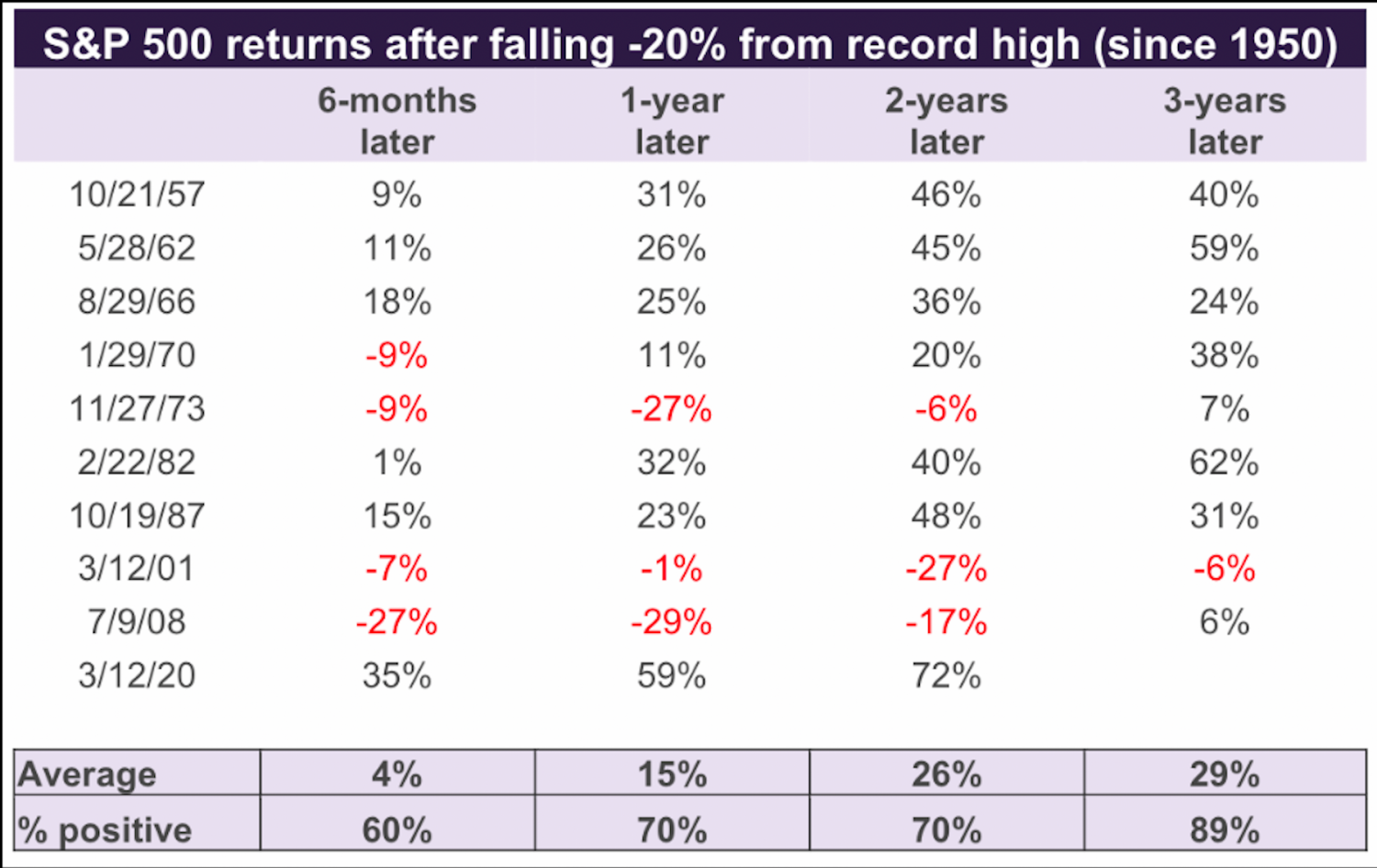

3. If this is a non-recessionary market correction then history has shown, since 1950, the return is, on average, 15% in the 12 months after the market bottoms.

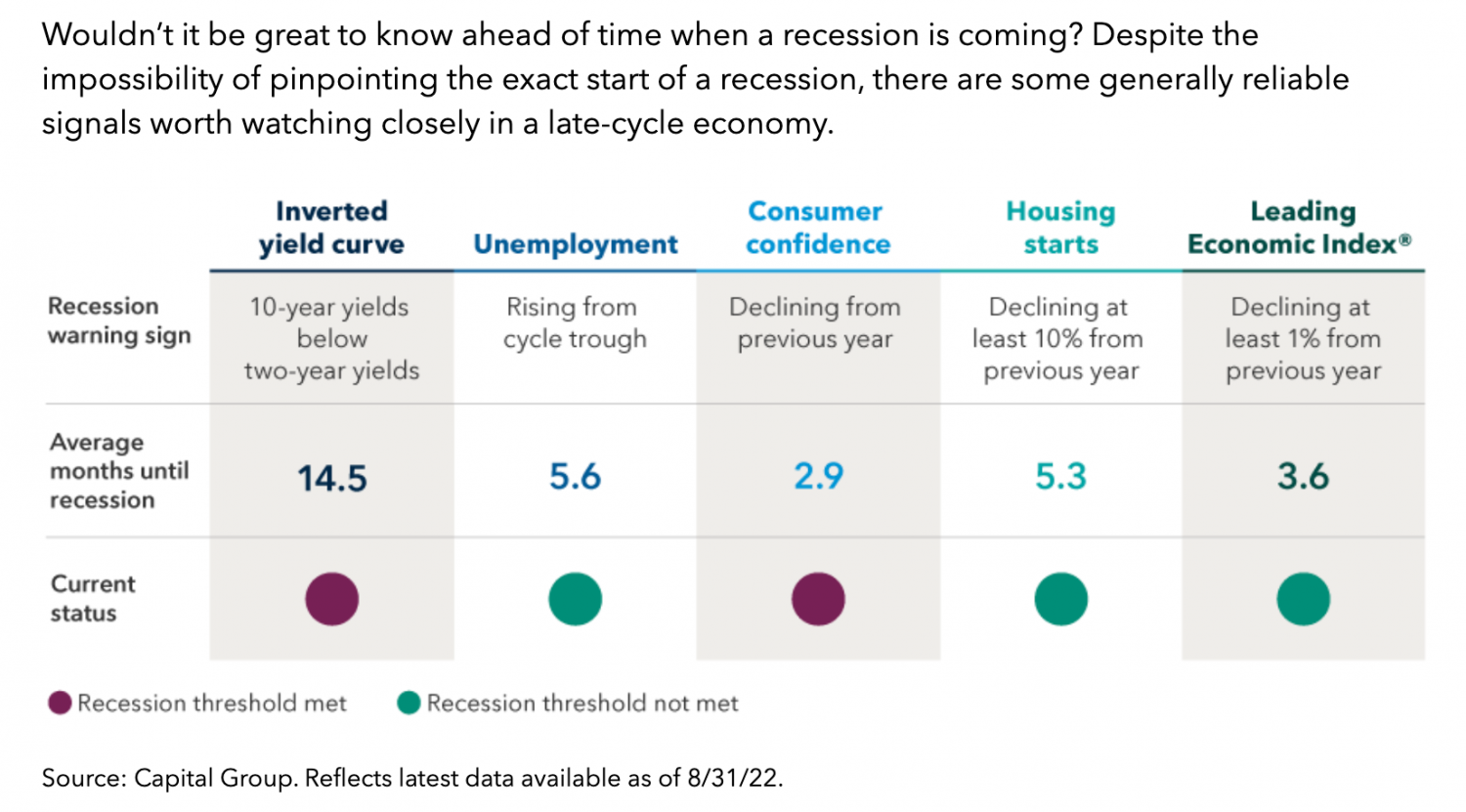

The big unknown is whether or not a recession is fast approaching. There are many leading indicators that still suggest no, especially since the job market is so tight. Most experts are saying it is unlikely, but we'll have to wait and see. Maybe a mild recession.

What to do in the meantime?

When the cost of everything is going up you either have to buy less or make more money. You can ask for a raise or work more hours. There's an old saying, "If your outflow is greater than your inflow, then your upkeep will be your downfall". Don't let inflation ruin your life. Be proactive. Look for ways to cut costs and for ways to increase your cash flow.

Be careful not to tie up your money in long-term GICs. It is silly to overreact and get out of the stock market by investing in 5-year GICS. First off, you'll probably get more if you wait - why lock in now if there's another full percent planned for the coming 2 months? It's better to choose a high-interest account with no restrictions. CI Direct offers a daily interest savings account that now pays 3.25% interest paid monthly with no lock-up or fees. That's a better deal while you wait.

Be patient. Corrections are a normal part of investing. They are painful in the short term, but they do not last forever.

Avoid making irrational, emotionally charged decisions right now that will have a lasting impact on your portfolio and your retirement.

Rather than draw more income from your declining portfolio consider using a line of credit or cash reserves.

Stick with large, mature companies that can weather the storms and come out stronger. Canada and the US appear to be the best 2 countries for investing right now.

Need help with your investments or income planning?

We offer independent and unbiased advice for anyone over 55. Click here to learn more about our flat-fee planning service.

Fee-only Retirement Income, Investment, and Tax Planning,

Willis J Langford BA, MA, CFP

Nancy Langford CRS