I opened my first RRSP when I was 18 and have been a participant in the markets ever since. My fascination with investing didn't start there; it started when I was in High School in Statistics class, where I learned about probabilities.

Understanding probabilities, diversification, and perspective are the 3 keys to successful investing.

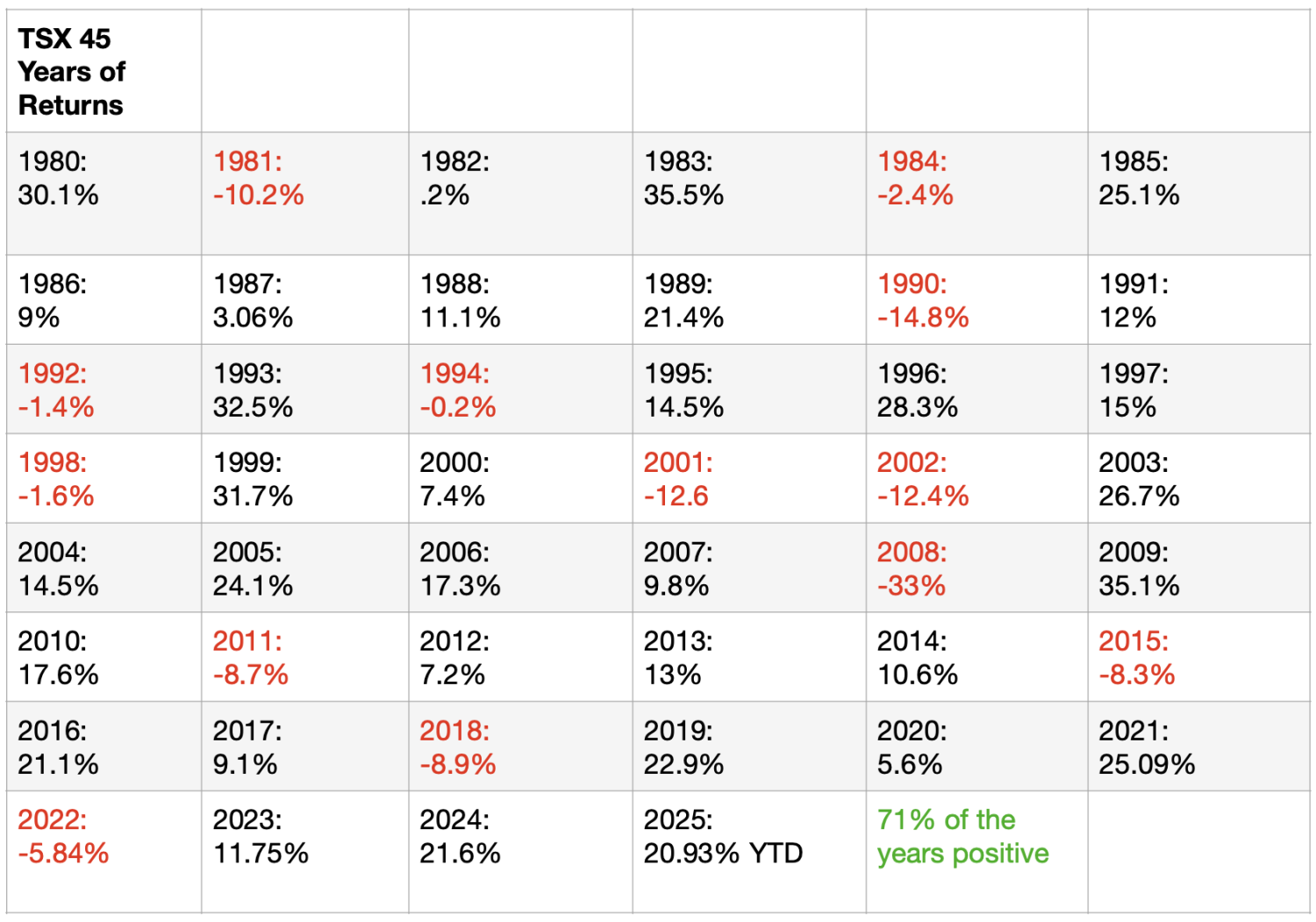

If we first look at probabilities, we can see that your likelihood of making money in the stock market is about 75-80%. This, of course, requires you to stay invested. Look at some charts below based on the calendar returns on the various stock markets over the past 40 years.

Basically, out of the last 45 years, the 3 main indexes on the US markets were negative only 10 years.

The Canadian stock market is similar, and it shows a similar pattern.

Even if you go back 100 years, you would see that the TSX has been positive more than 70% of the time.

The TSX was negative only 13 years out of the last 45 years. A couple observations are worth noting. One, both the US markets and the Canadian markets tend to be up or down in the same years. Two, the down years for the Canadian market tend to be less dramatic than in the US.

What can we conclude from this?

>The probabilities are stacked in your favour to make money by staying invested in the stock market.

>There are more up years than down years.

>We have to ride out the down years to enjoy the up years.

>Patience wins every time.

Our brains are wired in such a way that work against us. We think that if something is going in one direction, it will continue in that direction indefinitely, but that it isn't true. We know from the historical data that the markets have good and bad years, but mostly good years.

What are the common mistakes people make?

Jumping into the markets with unbridled enthusiasm at the peaks and then selling with unbridled fear when the markets are down. They never make any money because they keep repeating this cycle of stupidity. The other huge mistake is thinking you can time the markets. Get out at the high and get back in at the low. It's a fool's game.

In light of the fact that there will be down years, what do retirees do who need to take regular income payments from their portfolio?

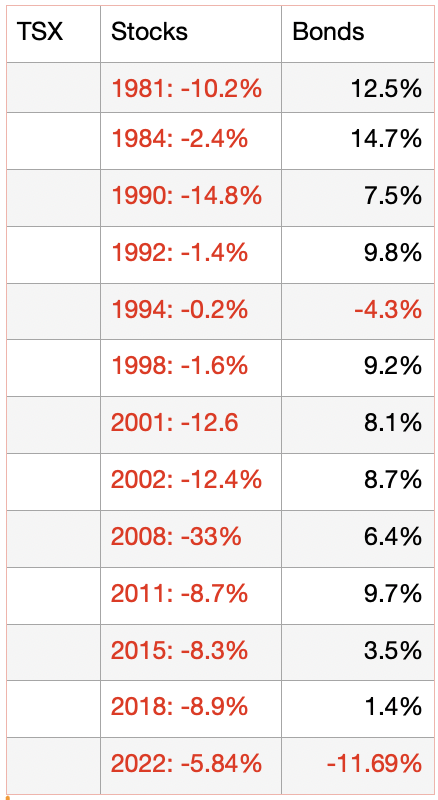

If you take out large amounts of money from your portfolio during times of decline, it is unlikely that you will ever recover - unless you follow it up with many years of not taking any withdrawals. A portion of your portfolio has to be dedicated to some sort of investment that has little or no volatility. This can be cash. It can also be a bond fund of some sort. Typically and historically, bonds will perform well when stocks are down.

The reverse is true as well, in that bonds will perform poorly when stocks are up. The good thing about bonds is that they don't tend to be negative (other than 2022, where both bonds and stocks declined in the same year). Bonds have a yield that may produce 2-4%/year. It's important to hold some bonds in your portfolio as a hedge - a war chest - during years of negative returns on the markets. It will provide a place to draw income from without putting pressure on your equities. If we look at the 13 negative years on the TSX and compare the bond returns for those years, here's what it looks like.

During the 13 years out of the past 45 years where stocks ended the year negative, bonds performed very well in 11 out of the 13 years. The years 2022 and 1994 were the 2 anomalies.

This is why it is so important, during your decumulation years, to have a diversified portfolio that includes both stocks and bonds. You will be drawing income from your portfolio for 30+ years, and although past performance is no indicator of future performance, you can make some reasonable assumptions.

First, the markets are probably going to be up more than they are down.

Second, if you have a plan where you can ride out the storms, you will win more than you lose.

Third, incorporate different types of investments like stocks and bonds from different sectors and countries.

Investing doesn't have to be complicated if you keep the right perspective. It becomes complicated when you involve your emotions, which are typically fear and greed. If you do not know what you are doing. If you do not want to take the time to learn, then hire a professional to do the work for you. The worst thing you can do is try and do it yourself but not put in the effort, or just ignore your portfolio altogether. Ignorance is not bliss when it comes to managing your money.

Conclusion

Retirement income planning is about looking at all of your various sources of income and then determining the most tax-efficient order for taking that income with as little market risk as possible. This is what we do for our clients. If you are uncertain about how to do this or you lack confidence in your current advisor’s ability to do this for you, then schedule a meeting with us.

Click Here to learn more about our process for creating your financial roadmap for retirement, getting your total financial house in order, and living your ideal lifestyle.

Retirement Income, Investment & Tax Planning for Those 55+,

Willis J Langford BA, MA, CFP

Nancy R Langford CRS