The biggest mistake to avoid right now is sitting on too much cash.

We are staring down the barrel of the biggest increase in inflation that most of us have ever seen and cash is losing value. There is just so much money being thrown into the system that it is bound to drive up inflation and make your current money worth less. The stock market is a forward-looking vehicle. A predictor of what is to come and it is forecasting incredible growth, and inflation. To not participate in this phenomenon will not only be a missed opportunity it is going to negatively impact your retirement income.

Lumber prices have quadrupled. Home prices are out of control; pretty much everywhere in Canada and the developed world. Copper prices are at an all-time high. Oli is on a significant upswing. Silver is at $27/OZ. All asset prices are increasing. A bag of avocados is a dollar more every time we go to Costco.

I was talking to a friend this week who sold his mountain bike on Kijiji for $100 more than he paid for it 15 years ago. What's driving this? There are 2 things.

1. Pent-up demand.

2. Lack of supply. Too many dollars chasing fewer goods.

The basics of economics are supply and demand and it's at work right now. We are not even out of lockdown yet and it's already a widespread problem - it's only going to get worse.

As we were selling off Nancy's mom's household goods a couple of weeks ago we were amazed at how quickly everything was selling. As fast as we could post it on Facebook Marketplace or Kijiji there were people lining up to buy it. People would e-transfer the full price just to guarantee to be first in line to buy it. It was amazing.

It difficult to fully understand it all, but it's happening. There's a shortage of a lot of items. The only real tool the government has for keeping inflation in check is to raise interest rates, but they don't want to do that because they are the biggest borrowers and higher interest rates mean higher borrowing costs for them. This is one of the reasons real estate is so hot. At some point in the coming months, interest rates will start to rise. Central bankers want to call it "transitional inflation" rather than what it really is, which is "substantial inflation". Fundamentals eventually take over and the economy always returns to equilibrium at some point before it tips the other way. No one knows yet how long this "transition" is going to take, but you don't want to be on the wrong side of it. And, the wrong side is to be sitting on cash, or poor investments, while everything is going up, except your portfolio.

Here are some keys points to keep in mind based on the environment we are in.

1. Put your money to work. Cash is losing purchasing power every day. You need to be earning growth on your money of at least 3% just to keep pace with inflation.

2. Every purchase you need to make is not going to get any cheaper. Consider buying sooner than later and consider second-hand. If you are planning to travel consider locking in your price now.

3. It's a good time to consider selling any larger assets you have like real estate and/ or personal property and locking in gains.

4. Consider renting. The rental market is very inexpensive compared to everything else.

5. Condos are still cheap to buy as they have not caught up with detached homes, making this a great time to downsize.

6. Ask for a raise - if you are still working.

Behavioral Finance

This is a good time to review some behaviors that drive financial decisions.

1. Linear thinking. We think in terms of straight lines. If something is going in one direction we think it will continue to go in that direction. If house prices are going up, they will continue to go up forever. If the stock market is going down it will continue to go down. The truth, however, is that just about everything goes in cycles. The economy goes in the cycle of recession, growth, peak, trough, recession. House prices go in cycles. The animal kingdom operates on the same principle. We cannot stop this cycle. All we can do is understand it and prepare for it.

One of the best ways to protect yourself is to have a portfolio designed to lessen the impact of the highs and the lows that result from the changing cycle. For example, using both growth and income type funds in your overall portfolio allows us to have someplace to draw a regular income from throughout the year and throughout the cycles. Another point to understand is that timing withdraws is also important as there are highs and lows throughout the calendar year. Typically May to September is the lows of the markets, with increased volatility, and October through April sees the highs.

Market Sectors

The markets are made up of several sectors. Check out the 11 sectors in the chart below.

Based upon where we are in the economic cycle one sector performs better than another. As we come out of the pandemic and into recovery the sectors that will perform the best are industrials, consumer staples, consumer discretionary. In an inflationary environment, real estate, utilities, and industrials tend to do the best. As the economy heats up the demand for commodities increase - as we are now seeing.

Understanding sector rotation

There are two significant theories when it comes to investing. They are called growth and value.

Growth Companies: Large tech companies like Microsoft, Apple, Facebook, Amazon, Google, etc. These companies grow their revenues and profits at a fast pace year over year. There are more growth companies than these and they have been driving the markets for the past 2 decades, but especially in 2020.

Value Companies: These are the large established blue-chip stocks that tend to pay consistent, and increasing dividends. These companies have low growth rates and actually had negative growth last year - mainly due to the economic shutdown. As the economy opens up they are expected to do well. So far this year they are leading the way, albeit, they had to make up for some of the losses from last year.

Growth vs Value - it doesn't have to be one or the other, you can own both.

Many investors believe that as the economy opens up, there will be a great rotation from growth to value. It's already been happening and we are probably at the peak of that happening. Based on the market experts we follow closely, this is unlikely to be an ongoing trend on a full-scale basis. Much of the growth so far this year has been from sectors that did not do very well in 2020 and are now catching up to the rest of the market. Keep in mind that the US and Canadian markets have seen increases so far this year, but the rest of the world hasn't done much but will start revving up as they roll our vaccines and open up their economies.

This isn't a time to cash in on growth and load up on value. First, it's probably too late. Second, there will be a lot of losers and winners within that sector. The companies that can sustain their dividend and continue to increase it will be the winners. The best approach is to own a properly diversified portfolio of equities from all over the world. (Canada, USA, International, and emerging markets.)

2. Herd Mentality

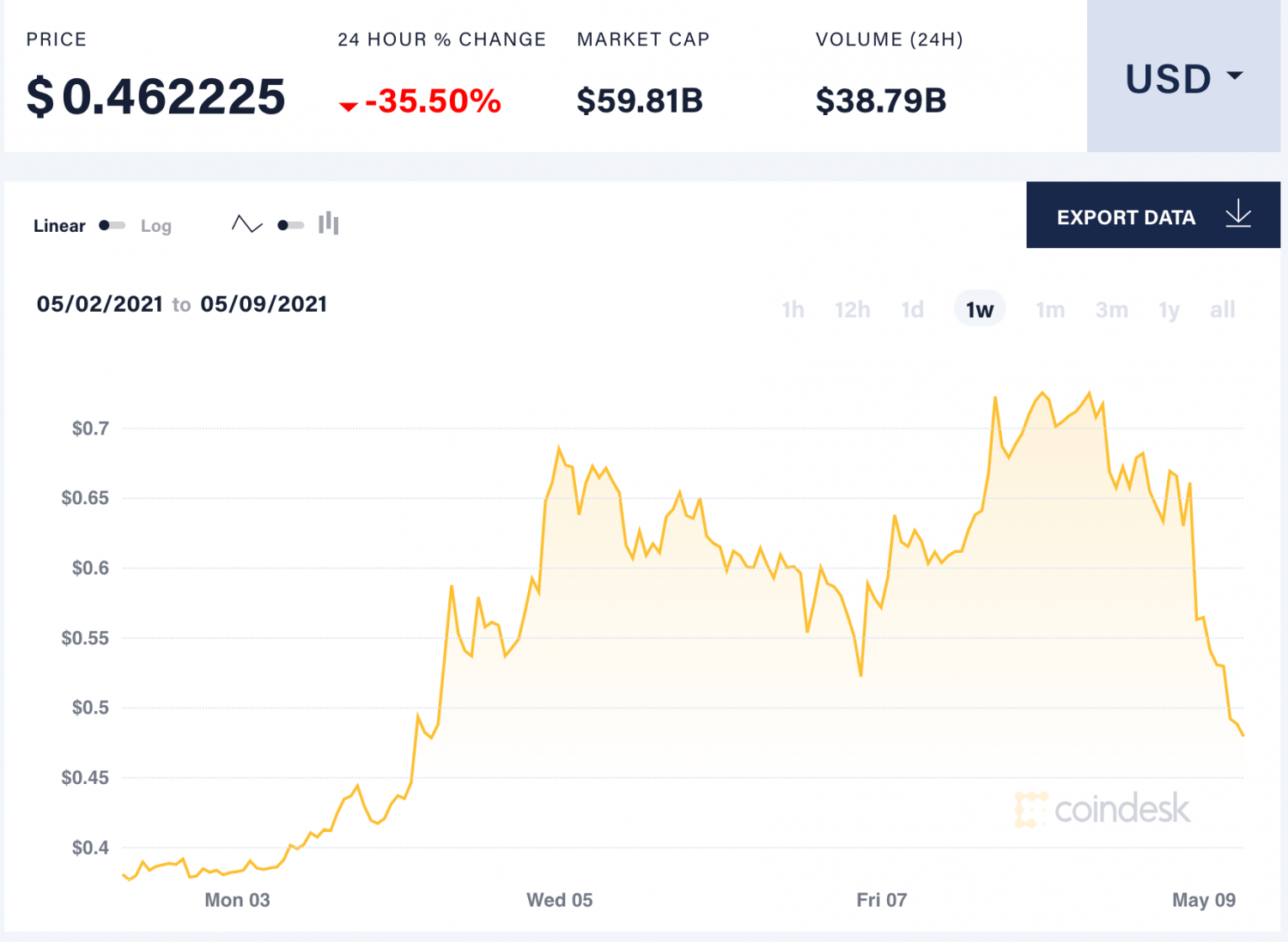

Usually evidenced by irrational exuberance. Nowhere is this more evidenced than in the cryptocurrency frenzy. This isn't investing, it is speculating. A form of gambling. This is a chart of Dogecoin in the past week. Simply because Elon Musk has been talking about it and was rumored to be mentioning the currency in his SNL monologue. Well, it turns out the big announcement was that he was giving some to his mom for Mother's Day. The value immediately dropped 35.5%.

"I believe it is critical not to be part of the herd when investing in financial markets. Just because most investors are moving in a particular direction doesn't make it the best direction. In fact, it has meant the opposite." -Jeffrey Vinik

Patience is the number one virtue of successful investing.

The world has just experienced the most significant event in our lifetime and the impact of that is still unknown. We are experiencing a seismic shift. In the coming 2-4 months, we should have a better picture of the future and what it will look like. We need to stay the course and make some slight adjustments.

You can't try and time the markets or jump on and off the fastest moving wagon. Any single part of your portfolio will outperform another part in any given month or year and each fund will have its day in the sun. We have to be investing for the long-term, not the next month or two.

There's only one thing that will drive the markets higher on a long-term basis - profits. No matter what happens in the short-term because of exuberance, inflation, pandemics, etc.; eventually there is always a return to the fundamentals. The next couple of years are going to be crazy and irrational and volatile. You are going to make a lot of money and feel richer than you are - because even though your portfolio may be going up rapidly, your cost of everything will be increasing faster than you can blink.

Hang in there and stay tuned for more updates.

Learn more about our retirement income planning process for clients 55+.

Retirement Income, Investment & Tax Planning,

Willis J Langford BA, MA, CFP

Nancy R Langford CRS

Our mission is to help our clients get their total financial house in order and retire more confidently with purpose & peace of mind