We have to rethink the way we think to create risk-appropriate and tax-efficient investment strategies. There are a lot more risks to consider than just your emotions.

In an effort to simplify and standardize the investment world, most institutions use a series of questions to determine what kind of portfolio is suitable for you. It was created to protect the institution, not the investor.

Basically, if it is determined that you are OK with more risk then you can have a higher concentration of equities and if you are not comfortable with fluctuations in the market, they will put you in a balanced or income portfolio that has a higher concentration of bonds or (fixed income).

A balanced portfolio will be about 40% bonds and 60% equities. (Balanced growth is 30/70)

An income portfolio will be about 50% bonds and 50% equities. (Conservative could be an 80/20 split)

There's a problem with this thinking

The first is the risk of running out of money in retirement because your rate of return is too low.

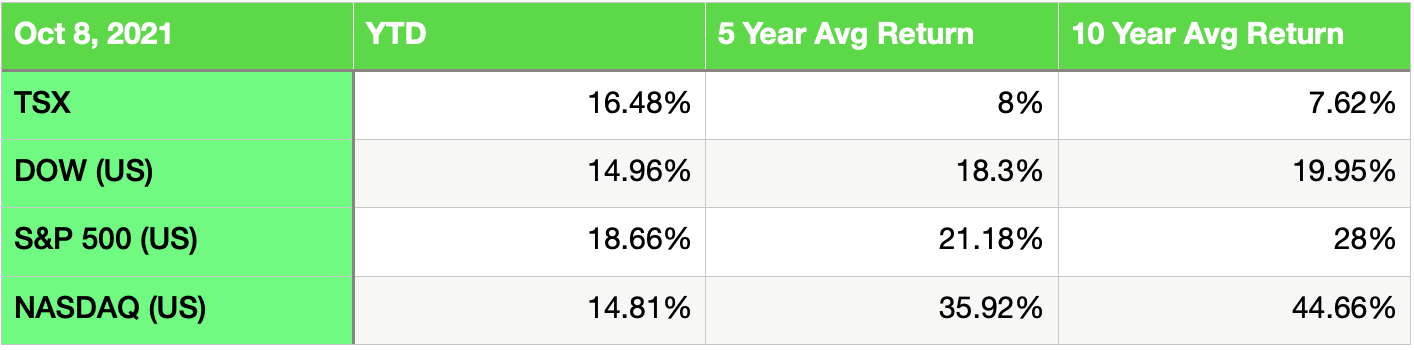

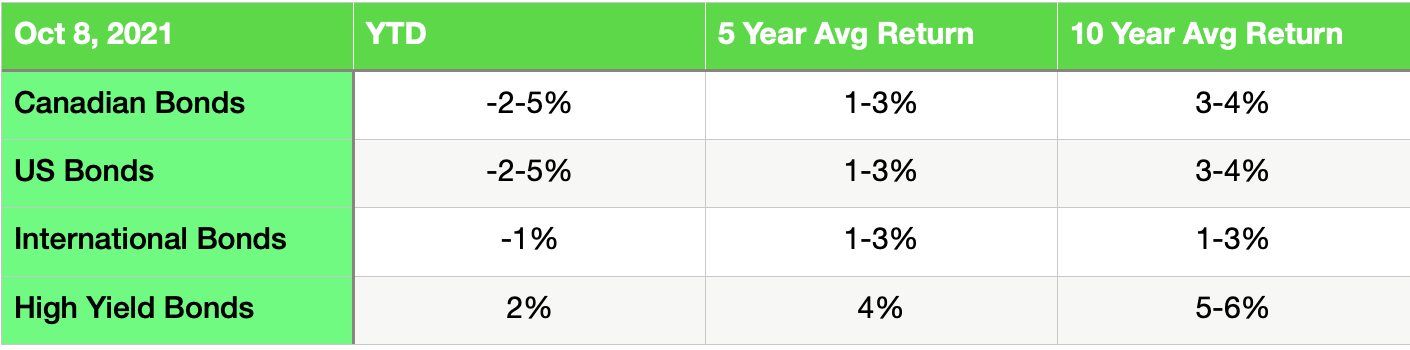

Let's look at market returns for three periods, YTD - (year to date - September 2021), 5 years, and 10 years.

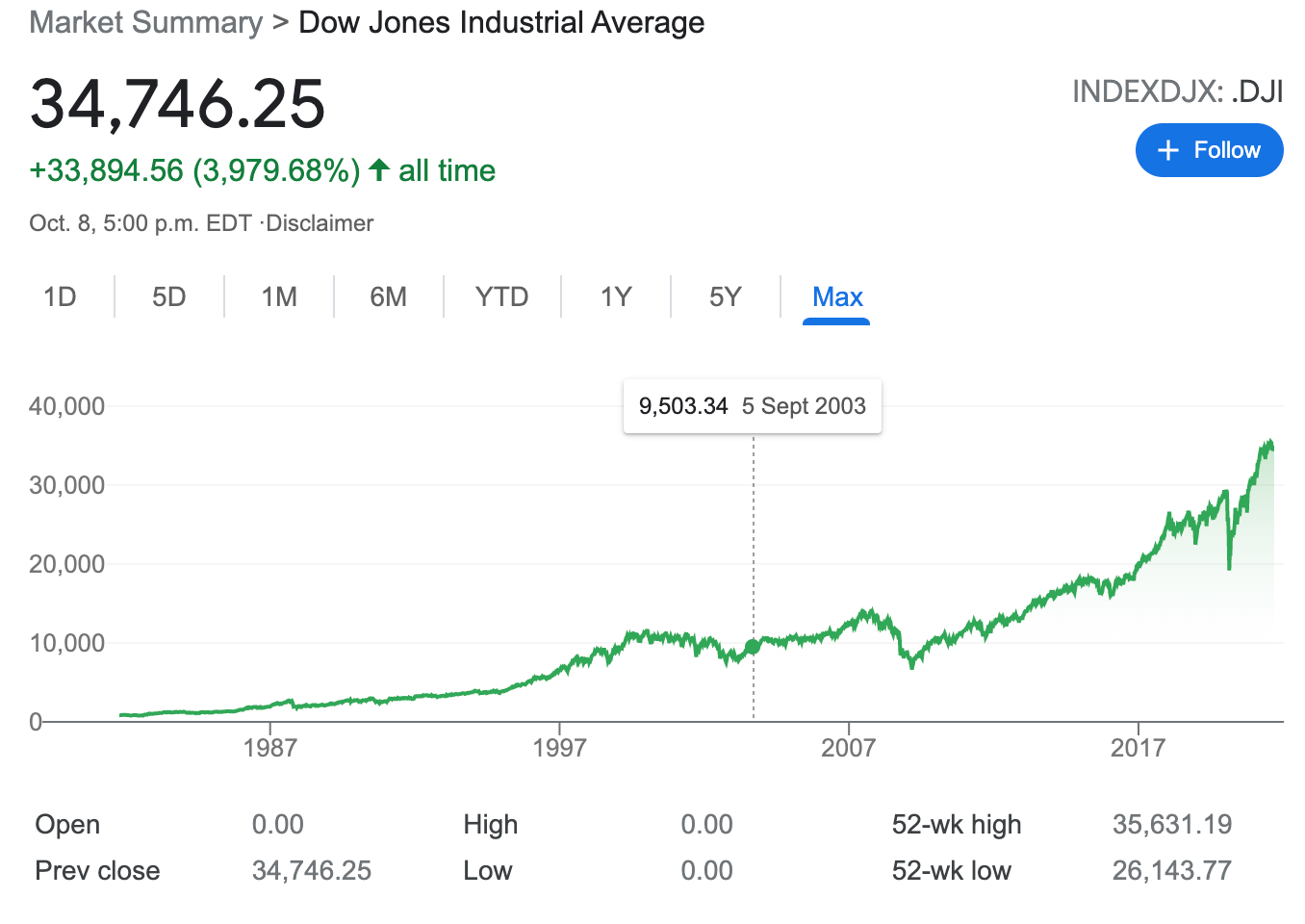

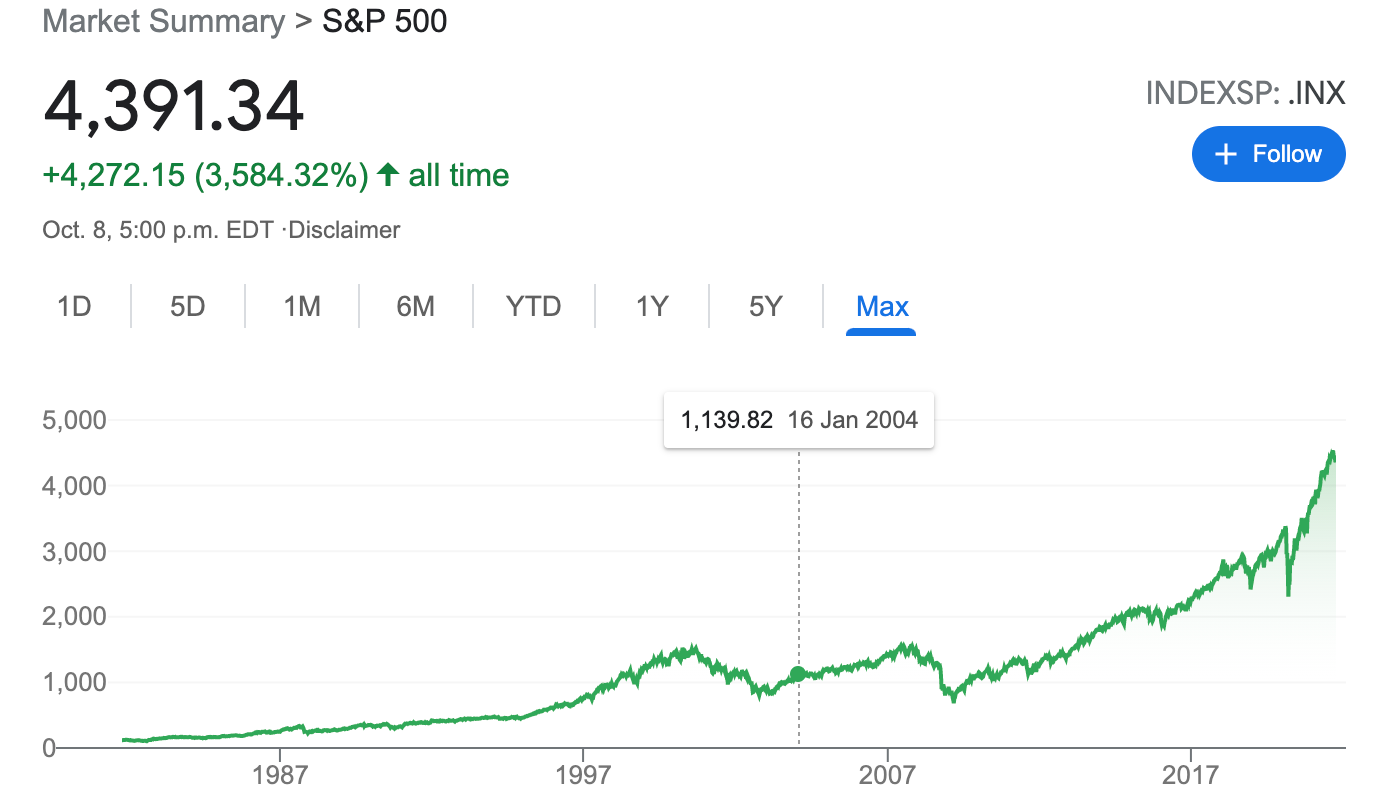

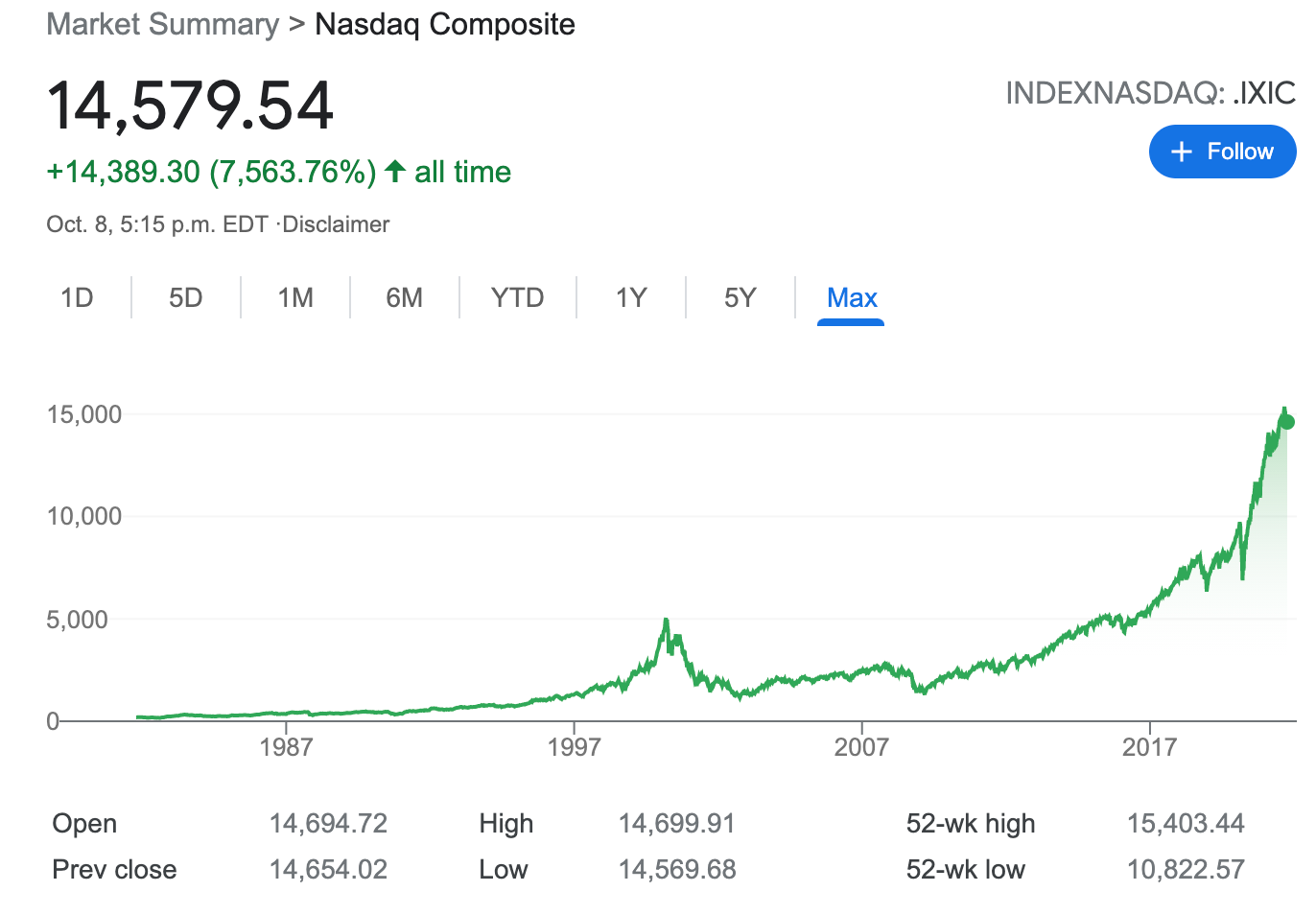

The past 10 years have been phenomenal for the markets and if you have had a diversified portfolio including Canada and especially, the US, you have done really well. I want to draw your attention to the fact that the past 10 years have seen such a dramatic spike.

Is this growth sustainable?

You can come to your own conclusion, but I don't think so.

The issue is what has happened with fixed income. Here's what Pimco, one of the world's largest fixed-income managers, recently said about fixed income:

"Fixed-income investors face hurdles to building resilient portfolios that meet their objectives. Low overall interest rates and compressed yield spreads portend weak returns in the coming years. At the same time, investors may be exposed to rising longer-term inflation and increased volatility as economies recover and central banks reduce support."

How have bonds performed over the past 10 years?

*High-yield bonds are typically low-quality issuers with a higher potential of default.

Interest rates have been on a downward slide for the past 30 years, but on a more rapid downward trajectory since the 2008 financial crisis. This has a huge impact on bonds yields, as they are based on interest rates.

Some of the primary reasons the stock market has grown so much:

- because of this cheap money supply from the central banks.

- investors have nowhere else to go to get some reasonable returns.

- public companies that trade on indices are using cheap money to buy back their own shares, or

- have been able to borrow money at near-zero rates to reinvest and grow their businesses.

What happens over the next 10 years?

Unless interest rates start a dramatic upward trend the bond market will either stay where it is or maybe even go lower. Can the stock markets sustain these record rates of growth?

I guess anything is possible. My concern for the 'balanced investor' or average investor is that you have 30-50% of your portfolio (and maybe more) tied up in bonds that have done very little for you in the past 10 years and in some cases hurt you.

The reality is, that the portion of your portfolio that is in equities has done all of the work - created all of the returns. So, if your returns have been 5-6% because of the record return on the equity markets what's going to happen if those equity returns come back to earth and normalize?

If equities do not have continued record returns, your portfolio is going to be in trouble over the next 10 years.

Where are the growth areas of the world?

Canada is moving up in the ranks as we produce a lot of what the world needs. Energy, natural resources, food, technology. The US is in a significant growth phase. Many of the big tech companies that operate on a global scale are based in the US. There are significant opportunities in developing countries (emerging markets) where more people are moving into the middle class and spending more money on homes and cars. The international markets have not advanced quite as quickly as Canada and the US over the past few years and it looks as though they have some catching up to do. The pandemic has impacted other places more severely than North America and the vaccine rollouts have been slower.

What are the growth opportunities looking forward?

Energy. The world needs it to live. I'm all for transitioning to clean and green, but it's going to take a long time to get there. As it gets there, it will need more of what Canada provides in the way of natural resources.

Technology. This is one of the most exciting opportunities of our time. The entire economy is becoming more digitalized.

Food. People have to eat and there are more mouths to feed.

Blockchain. Blockchain is a system of recording information in a way that makes it difficult or impossible to change, hack, or cheat the system. It's just so expansive. Read more here.

Supply-chain. This is all about the efficient movement of stuff around the globe.

Transportation. The stuff has to get from point A to point B.

Real estate. Everyone needs somewhere to live.

Warehousing. This has basically replaced the shopping malls. Products move from the manufacturer to the warehouse to your home - totally bypassing the mall and retail shops.

Healthcare. The way in which medical care will be delivered is changing. The system, especially here in Canada, is severely broken and the pandemic has exposed it for what it is. It is incapable of looking after more than 1% of the population at any given time.

Online gaming and eSports. One CTV report says this industry is worth $300 Billion....and growing.

Over the past 13 years the fake, fabricated, or superficial, environment made every business successful. In a sense the rising tide caused all boats to lift. This will not be the case over the coming years. There will be clear winners and losers and choosing the right companies in the right sectors in the right countries is crucial. Trying to build a portfolio of stocks is a daunting exercise. We prefer using specified pooled structures like ETFs and managed portfolios.

Some of our diversified INCOME strategies:

Strategic Income Pool: The 3-year average annual return is 6.67% with low volatility. Still up in 2022 at 8.12%.

Strategic Growth Pool: The 3-year average return is 15.22% and up 3.41% in 2022.

Real Assets Pool: The 3-year average return is 7.23% and up 8% in 2022.

Nicola Core Portfolio: The 5-year average annual return is 7.83% with the lowest standard deviation of 4.27.

Canadian Equity: The 5-year average return is 9.24% and flat in 2022.

We have to think differently about risk and stop confusing it with safety. I talk about this in another blog post, Building An Investment Portfolio For Retirement

As a retired investor, looking for stable returns, you have to assume it's not going to continue and you need a contingency plan.

What are your options?

1. You can have a higher percentage (up to 100%) of equities in a globally diversified portfolio. The broader your scope the more evenly dispersed your returns can be.

2. You have to be selective as to where you are taking your income flows each year. Don't set up a systematic withdrawal plan from any of your accounts where you take money out on a proportional basis. This could work against you if some of your funds are in negative territory. Instead, allocate some money to cash or a cash-like alternative.

3. Use a cash wedge strategy. You can always keep about 1-2 years worth of your income need in cash, a specialized portfolio, or in a mortgage fund. At the appropriate times during the year, you can sell some of your equities and move the money into your cash-wedge strategy. For example, using a RRIF for your monthly income flow. You can transfer some money from your RRSP into your RRIF in December. This allows you to choose what investments to sell and move. In any given year one part of your portfolio could be doing better than another.

4. Use a line of credit. If you have a line of credit on your home, you can access cash on a short-term basis. If the markets have a significant correction of 10% or more you have access to cash flow in the interim until you can wait out the storm.

5. Look at other fixed-income alternatives that are not tied to the public markets. I like to use the CPP fund as an example of the kind of income portfolio one needs in retirement. Only 15% of the more than $500 billion Fund is invested in Canada. And, it has a surprisingly low amount of bonds. Instead, it owns a lot of private equity and cash-generating assets like toll bridges and highways. This fund has a 10-year track record of 10% returns. None of us has access to this fund so is there an alternative?

Yes. The next best thing that I have found is the Core Portfolio offered by Nicola Wealth out of Vancouver. Their fund is made up of a broad range of investments spread across the globe. This unique strategy is what we use because it has delivered an average rate of return of over 7 %/year since 2000. They have done it with little variation from year to year and in fact, have had only 2 negative years out of the 21. (-04% in 2002 and -6.98% in 2008) As of this year, that's 13 years of positive returns.

If you have concerns about your retirement portfolio and you are not 100% confident with your current advisor or your own ability to manage it then consider making a change.

Learn more about our specialized tax, income, and investment planning for clients 55+.

Fee-Based Independent Retirement Planning,

Willis J Langford BA, MA, CFP

Nancy R Langford CRS