Tax Planning Is Important

Every dollar you save in taxes is a dollar you have available to spend on something that brings you joy or a dollar to reinvest and earn more money. You can remain ignorant and CRA will happily take your money.

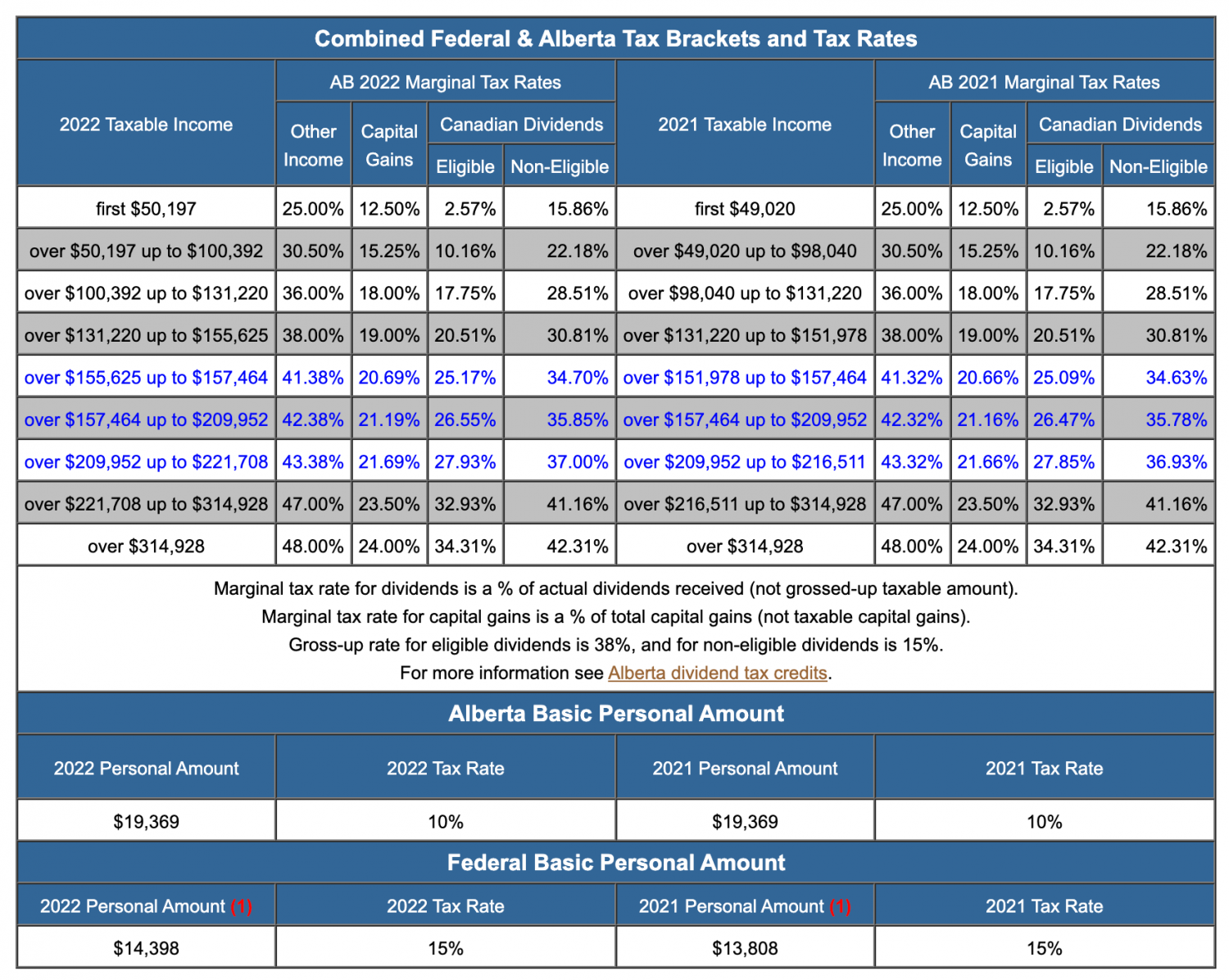

Marginal Tax Rates

There are two levels of income tax - provincial and federal. Each province has different rates, but the federal rates are the same.

We have a gradual rate system based on tiers.

As you can see from the Alberta/Federal chart, if your total taxable income is below $50,197, you would pay tax at 25%. (10% would go to Alberta and 15% to Ottawa)

You wouldn't pay tax on the entire amount. You can have a certain amount of income tax-free. In Alberta, that amount is $19,369 and for federal purposes, it's $14,398.

As your income increases up the scale, you are taxed at the new rate on only the money you earn in that category. These are your marginal tax rate.

What is your effective tax rate?

It is the amount of tax you owe divided by the amount of income you earned.

An Example: Let's say you earn $50,197 of income. Your total income tax payable would be $8453, which is an average tax rate of 16.8%.

If you have some tax deductions and credits, your total income tax will be reduced accordingly, and your average tax rate will decline. Things like charitable donations, tuition credits, CPP, EI contributions, digital news subscription, medical expenses, eligible pension income, and age 65 tax credits can be used to reduce the taxes you have payable. Once these credits have been applied, they can reduce your average tax rate. The more the better.

Tax deductions: These are items that reduce your total taxable income. For instance, RRSP contributions reduce your income dollar for dollar. Home office expenses, employment expenses. If you have rental income, you can deduct expenses like mortgage interest, upkeep, and property tax. If you borrow to invest you can deduct interest costs. These deductions are great and can also help reduce your average tax rate.

Why is this important?

Here are some practical insights.

1. An RRSP contribution is calculated at your marginal tax rate. Let's say you earn $60,197 of taxable income and you decide to put $10,000 into your RRSP. This contribution will reduce your taxable income to $50,197 - which is one tax bracket lower. You moved from 30.5% back to 25%. The contribution will entitle you to a refund of $3050. This is important when you are in the accumulation phase of your life and it's also important for the decumulation phase. Here's how. When you're taking money out, you are more concerned with your average tax rate. So let's say you are in retirement and taking $50,197 of income per year from various sources. Remember from above, your average tax rate is 16.8%. However, if you have some tax credits to apply, it will be much lower, in fact, it will most likely be in the 10-12% range.

2. Utilizing your Tax Bracket. There are two ways you can benefit from this strategy. The first is making an RRSP contribution that brings you down to the top of the lower tax bracket. The second idea is used when taking income in retirement, to try and stay within your same tax bracket. Most retirees tend to be in the second tax bracket where they pay tax at 30.5%. In essence, it doesn't matter if you take $80,000 or $90,000 of income, you are still paying tax at the same MTR.

3. An Albertan retiree should always take at least $19,369 of total income. It's TAX-FREE. Sure there will be a few taxes payable to the feds ($769), but essentially, you are maximizing your minimum free tax bracket. If you are over 65, then your age 65 tax credit would eliminate your taxes payable. Depending on how many tax credits you have, you can determine how much income you should take each year. Don't leave tax credits unused. You can control your taxable income by taking RRSP/RRIF money out, by realizing gains in a non-registered account, or by working more or less.

4. Income splitting. The single biggest tax advantage for retirees is being able to share income and tax credits with a spouse and in essence, pay less income tax.

The order in which you take income in retirement will be the single biggest decision you make as far as tax savings go and ensuring you don't outlive your resources. Most people mess this up by drawing income from what appears to be the easiest source. Here's another shocker for most people - taking more income than they need in order to smooth out tax planning and maximize every year's tax bracket. Remember, you can only kick the tax can down the road for so long.

Hope this helps.

Life is short. Retire. Be happy.

Check out our fee-only, independent, & unbiased retirement income planning.

Planning that isn't linked to products or misaligned corporate values.

Retirement Income, Investment, & Tax Planners,

Willis J Langford BA, MA, CFP

Nancy R Langford CRS