Consider Bob and Andrea who are now 65 years old. They have been taking advantage of the tax deductions they get from contributing to their RRSP for many years. They purposely kept their savings plans equal as both of them have been earning similar incomes. They both have $250,000 accumulated but are still working and plan to do so for the foreseeable future.

Bob decided to take his CPP at age 64 and receives $1000 each month. Andrea hasn't started her CPP yet, she thinks it's best to delay it and get more. They don't really need the money right now. Since they both just turned 65 they received a letter from Service Canada informing them that they can start receiving their OAS pension. They now have to decide if this is a good idea or not.

Bob works as a Mechanic and earns $80,000 a year, while Andrea is a Legal Assistant with an income of $65,000 per year.

What should they do?

Bob's total income is now $92,500 plus his CPP income of $1000/month, which totals $104,000. If he starts taking his OAS at this time he will be faced with a "Clawback".

The OAS pension is 'means tested' which basically means that if your total income is above a certain threshold, you will have a reduction in your benefit cheque. The threshold for 2024 is $90,997. For every dollar that you earn above this amount, you will see a reduction of 15%.

The current max OAS benefit at the time of writing is $718.33/month. In Bob's case, he is going to be about $13,500 over the limit, so he will lose 15 cents on every dollar he is over. If Bob decides to take his OAS he will get $2037 less per year or $169.75 less per month.

It's up to Bob, but why bother taking it if you are going to lose some of it? One way Bob can prevent an OAS clawback is to make a contribution to his RRSP in the amount of $13,500, which will bring his taxable income back below the OAS clawback threshold.

Andra's situation is a little different, in that she is earning less than the OAS clawback threshold, so taking her OAS at age 65 will not see a reduction in her benefit.

Both of them have the option of delaying their OAS until age 70. If they do delay it, they will get an increase to their OAS pension of .6% per month for every month they delay taking it. If they were to wait until age 70 they would get $962.44/Month. (60 X .6% = 36% more or $254.76)

If Bob and Andrea continue to contribute to their RRSPs at this point and are seeing modest growth, they can be closing in on $300,000 each by the time they turn 71. They have to decide what they want to do with their RRSP at age 71. They have 3 options.

1. Cash it out and pay a pile of taxes at one time.

2. Buy a life annuity and take a guaranteed income for life or,

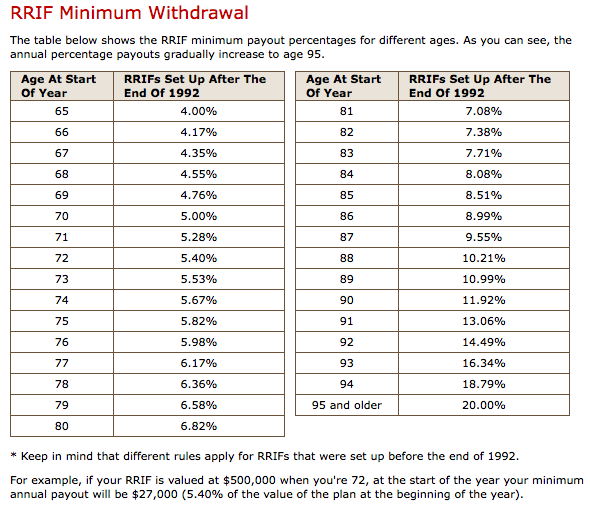

3. Turn it into a RRIF, which will require a minimum withdrawal each year, starting at 5.28% the first year and increasing every year thereafter.

Avoiding a Tax Trap

If they take the option to convert their RRSPs into a RRIF they will each have to take a minimum income of about $15,000. They are also collecting OAS of $11,717/Year because they delayed until age 70. They are also collecting CPP of $12,000 for Bob and $16,000 for Sandra because she delayed taking it to 70. They now have a total income of $81,098 between 2 of them. (Bob has $38,549 and Sandra has $42,549). If either of their income goes above $53,359 they jump to the next tax bracket, but more importantly, by keeping their taxable incomes at this level, they qualify for the maximum age 65 tax credit.

If they are both retired at this point then they have a relatively good amount of income to fund their basic living expenses and lifestyle needs. If they are still working and earning employment income then they will be faced with an OAS clawback and a requirement to pay more taxes. In fact, it would be advisable to earn less additional income or make RRSP contributions to decrease their taxable income below the threshold and subsequently eliminate the OAS clawback.

Keep in mind that RRSP contributions can only be made until age 71, however, you need contribution room.

There are a few other expenses that can help reduce your taxable income (line 23400) like moving expenses, pension splitting, carrying charges or loan interest related to a non-registered account. Click here for a list of a few others.

We help our clients create sustainable, predictable, and tax-efficient cash flow for retirement, to ensure they do not overspend and run out of money; or underspend and die the richest people in the graveyard.

Are you retiring soon?

We specialize in working with clients 55+ who want to draw down their assets in the most tax-efficient and sustainable manner.

Learn more about our services and book an appointment.

Retirement Income, Investment, & Tax Planners,

Willis J Langford CFP

Nancy Langford CRS