One of the challenges for creating retirement income is that interest rate yields have dropped so much over the past 30 years and now taxes are increasing - it's what we call adding 'insult to injury'. If you are over the age of 60 this is something that you may want to consider as a way to set up a guaranteed income stream for life. A guaranteed source of income is great for your fixed expenses like property taxes, vehicle registration, insurance, medical expenses, annual vacation, grandkids education, etc. There are other features you can add to an Annuity like joint life survivor, 10-year payout to a beneficiary and fixed term.

What is a Prescribed Annuity?

A Prescribed annuity is set up in such a way that a portion of your income is a return of your capital and a portion taxable interest.Bill is aged 65. If Bill were to buy a Prescribed Annuity Contract he could use his $100,000 to earn an income of approximately $5906.00/yr. (the amount is based on age and gender). So, in Bill's situation, he would only pay taxes on $980, at a 30% tax rate that would only be $294.00. That means Bill would be getting $5612.00 a year from his annuity for the rest of his life.

Who would benefit from a Prescribed Annuity?

- Someone who is 60+ and looking for a guaranteed source of income that will last the rest of your life

- You have some non-registered money sitting in a GIC or cash at the bank

- You do not want all of your investments exposed to the volatility of the stock market

- You want to minimize the tax payable on your income

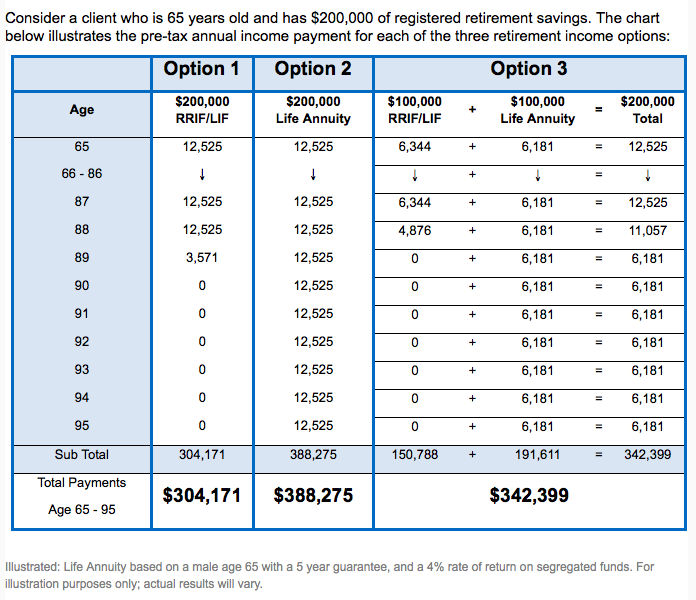

- Consider the following Example below:

Want to retire in the next few years? Would you like to work with a Retirement Planner who specializes in investments that produce lifetime income?

We specialize in fee-only planning helping our clients get their financial house in order and retire more confidently with purpose and peace of mind. Click here for more information on our services and pricing.

Willis J Langford BA, MA, CFP

Nancy R Langford CRS

587-755-0159