The average Canadian family:

- Spends about 170% of what they earn

- Works long hours

- Pays way too much in taxes

- May never be debt-free in their lifetime

- Spends more than $500,000 in iterests during their lifetime

- Statistics tell us that 60% of Retirees still have a mortgage when they retire

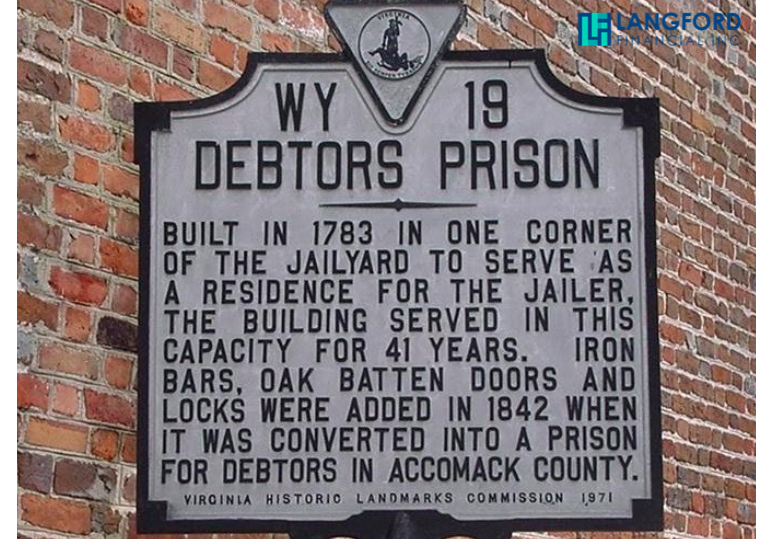

If you want to be part of this statistic: Continue to spend too much, Work all the time so that you can pay more taxes. Continue to have little to show for your money. Then just keep doing what you are doing and you will be the average Canadian statistic.

The Governement loves it when you work hard and make a lot of money. The benefit by collecting more taxes from you. The bank loves it when you are "maxed out" with a huge mortgage, car loan and credit cards. They know you cannot pay them off and they have you trapped and will make money from you forever. You think your well serviced because they keep offering your more debt products.

Just think of how difficult it can be to disentangle yourself from your beloved Bank.

How do you say goodbye to the Poorhouse once and for all? YOU TAKE CONTROL of your finances.

YOU decide that enough is enough and YOU set aside the time to "right the ship".

Book a free call with us! Let's start the conversation on how we can help you end the rat race and say farewell to the poor house for good.

In the Spring of 1998 we were tired of being broke and moved to Calgary, AB to start a new life. In 2001 we bought our first house and today we manage 5 of our own properties and growing business. We are just an average couple who took some bold steps to take control of our financial destiny. Because we have succeeded we want to help other couples change their circumstances. Stop being victims of the flawed system that loves keeping people broke and in the poorhouse.

Are you ready to take a BOLD step? Book a simple 15-minute call with us and let's see how we can help you get out of the trap the banks have lured you in to. We can start with one of our FREE workshops to learn more about getting your financial house in order. It's like a tune-up for your finances.

Want to retire in the next few years? Find out why a Retirement Review is necessary.

Your Retirement Income & Investment Advisors,

Willis & Nancy