The investment strategies you used during your accumulation years will not be appropriate during your decumulation years.

You have worked hard to build up your retirement savings and as you prepare to make the transition and start taking money out it can be a little intimidating. What is the proper choice between taking too much too early or not taking enough? I mean you don't want to cheap out now and have a bunch of money left over that you will wish you had spent and enjoyed. On the flip side, it's a horrifying thought to start running out in your mid 80's with a lot of life left to live.

The obvious questions are: What is a sustainable level of income to take? What is the best order for taking income? How can you pay the least amount of tax?

Determining a sustainable level of income

Basically, you need to determine a sustainable level of income based on a reasonable set of assumptions. Those assumptions are things like rates of return, inflation, interest rates on cash or fixed income, life expectancy, and survivor income. These assumptions need to be reasonable.

First, you have to consider all of your sources of income, not just your investment accounts. There are two types of income - guaranteed and non-guaranteed. It's nice, if possible, to have enough guaranteed income to meet your basic living expenses. This way you don't have to take money out of your investments if the markets have a sudden or prolonged downturn.

How long will you need to make it last?

The average 65-year-old man will live to about 87 and for a woman, it is 89, but you may be above average and live into your 90's or 100's. Creating projections to age 95 or 100 is a reasonable assumption.

The ebb and flow of income needs

You are not going to spend the exact same amount of money every year. Most people have seen a dramatic reduction in spending the past couple of years during the pandemic. Everybody is different in this regard, but generally speaking, you will spend more money during the first 10 years of retirement and less in the middle 10 years and then more the final 10 years, due to increased health care needs. Your 30-year plan can have this expectation built into it if you want.

The impact of low-interest rates

One of the biggest challenges currently is that you cannot get a reasonable return on the fixed income part of your portfolio, because it is tied to bonds and interest rates are at all-time lows. Not too easily anyway. One time, a retiree would have a relatively high degree of confidence that they could generate 3 or 4% returns on their bonds. This isn't the case now and in order to do so requires bonds with low "Junk" status. High yield bonds mean countries or corporations that have to pay higher interest because they have a higher risk of default. This is still an option, but needs to be a small part of your portfolio.

What are the alternatives?

Cash flow is king. You are trying to find investments that can consistently pay you some kind of income (cash) on your money.

Real estate. Imagine you own a couple of rental units in retirement and combined, they generate $1000/month of cash flow. Well, there's your fixed income. You may not need to own any other bonds or GICs.

REITs. These are publically traded stocks that are Real Estate Investment Trusts. This is a special tax structure that allows the trust to pay out the majority of its profits in the way of dividends. The annual yield on many REITs can be in the 4-6%/year.

Dividend Stocks. Mature companies like the Canadian banks pay a quarterly dividend in the 3-4% range. There's a whole range of blue-chip, mature companies in Canada that do this.

Private equity. There are a whole host of opportunities outside of the public markets where you can generate cash flow.

A simpler approach

You may enjoy research and making all of these little decisions every day and that's fine. If you don't want to try and figure all of this out for yourself and manage it or you can just buy a one-ticket solution like a managed portfolio.

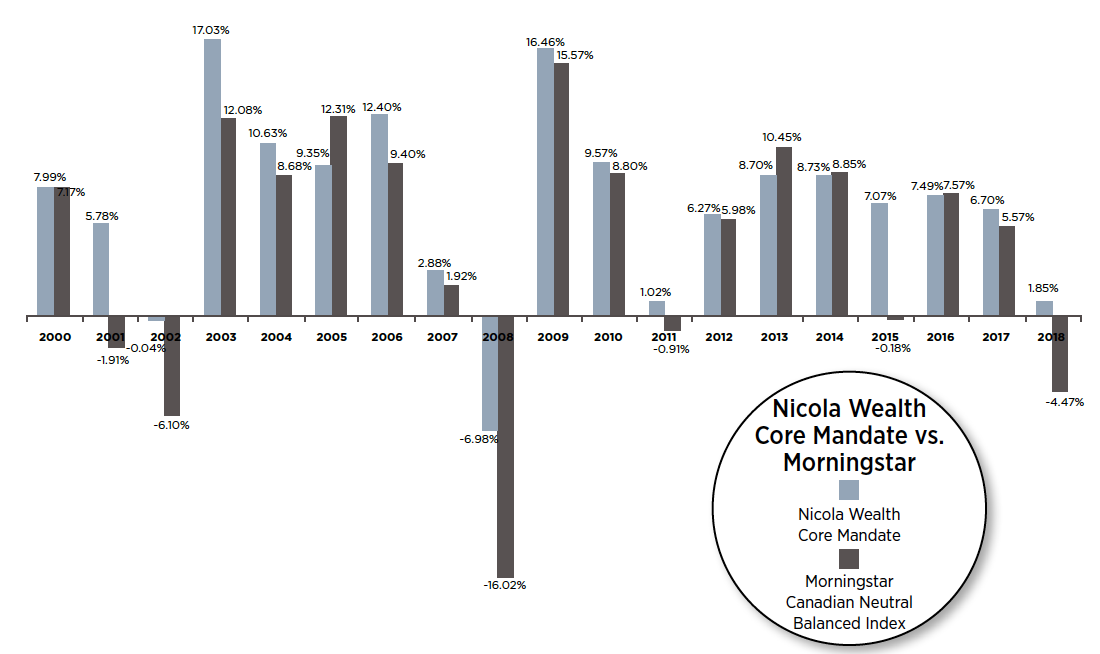

Here's the best portfolio I know that exists in Canada. It's the core portfolio created by Nicola Wealth out of Vancouver. The average annual rate of return for this portfolio is 7% since the year 2000 (8.4%/year during the past 8 years). During that 20 years, there have been only 2 negative years (-.04% in 2002 and -6.98% in 2008) that's still a pretty stellar record.

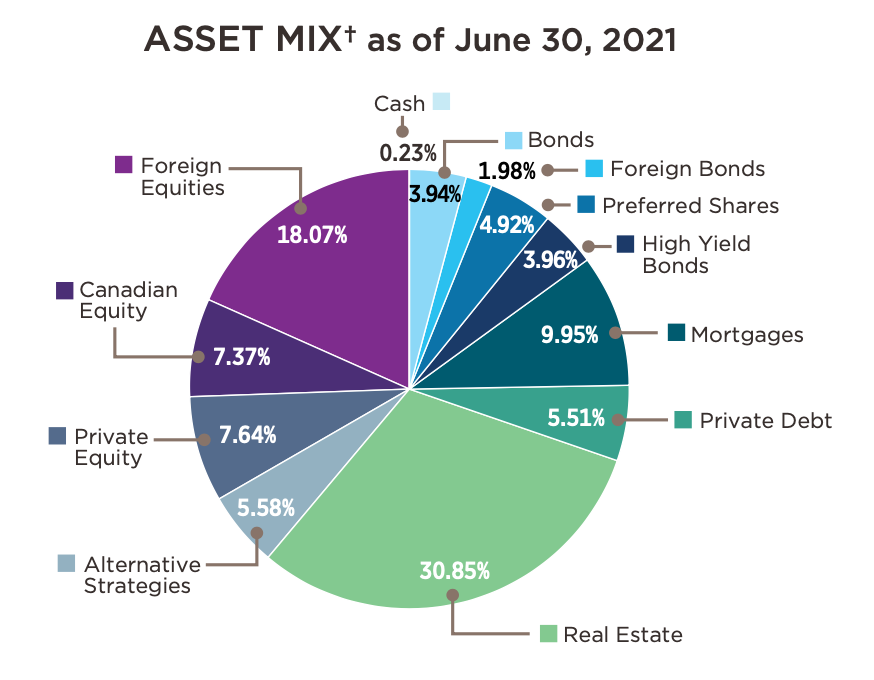

The reason this portfolio has been so consistent and predictable is because of the unique and broad asset mix within it.

Nearly 50% of the portfolio is made up of private assets that generate consistent and predictable monthly cash flows. Real estate is 30.85%. Why is this so important? Because it isn't correlated to the public stock markets with its constant ups and downs.

People confuse risk with safety

They are not the same thing, so I'll explain. First, a particular risk is only relevant within its own context. Let's say you have $25,000 to be used as a downpayment to buy a vacation property, and you want to make that purchase in 2 years. What's an appropriate investment? If you invest it in the stock market there is no guarantee that the money will be worth the same amount 2 years from now. It could be worth much more or much less. We just don't have a crystal ball to look into the future. Because of this lack of certainty, it would be too risky to take the chance so we just cannot guarantee that the money will be there when you need it.

The risk isn't that you are going to lose all of your money, but rather, the value may go down and you don't have enough time to wait for a recovery. The longer your time frame the risk is reduced, simply because of the probability of a return increases.

So what's a better alternative to investing in the stock market in this situation? Probably a 2-year GIC at 1% - this way you at least earn something. Is investing in the stock market risky? Depends on your time frame and it depends on what you buy. I mean the stock market is a massive market made up of varying degrees of quality. For example, you can put all of your money in one energy stock or you can buy an ETF that holds all of the largest energy companies in Canada. It's less risky to own a bunch of companies than it is to buy just one.

Imagine you are a farmer and you own 1000 acres of land. Last year the price of wheat was high so you decide to plant wheat on the entire 1000 acres this year. All the other farmers do the same thing and there is a bumper crop of wheat this year and it causes the price to drop significantly (oversupply). You took a big risk to devote all of your acres to just one crop. What if you instead, divide your land into 4 sections and plant 4 crops? You have reduced your overall risk. Investing is no different. You need to diversify your portfolio into different sectors within the economy and into different markets around the world. Canada is only 4% of the world markets, however, most people have all of their investments here in Canada - that's called a concentration risk.

Risk and Emotions

The other difficult and confusing part in understanding risk is the role of your emotions. The "how would you feel" questions. Really, emotions should not be allowed to play too big of a role in creating an investment portfolio. How you feel about something and what you know are two different things. The stock market fluctuates up and down and has a general upward movement. This is something we know to be true. On any given day the value of your investments can change in one direction or the other. If you are motivated by your emotions then you can make irrational decisions and sell off your investments at the worst time. Most often, a pullback on the markets is a buying opportunity.

There are 2 primary retirement investment objectives

Income - this is the part of your portfolio devoted to producing consistent and predictable cash flow to fund your lifestyle. Your target should be in the 4-6%/year range.

Growth - this is the part of your portfolio devoted to participating in the broader markets in order to keep growing so that you also have money for the long term. Your target is 6-10%/year.

Understanding Volatility

It's the measure of variance from the mean. When you are either in the accumulation or growth stage then volatility isn't as important. however, when you are in the income stage, or for the income part of your portfolio, then it is a very important factor. The risk factor that you are trying to navigate is the "Sequence of return".

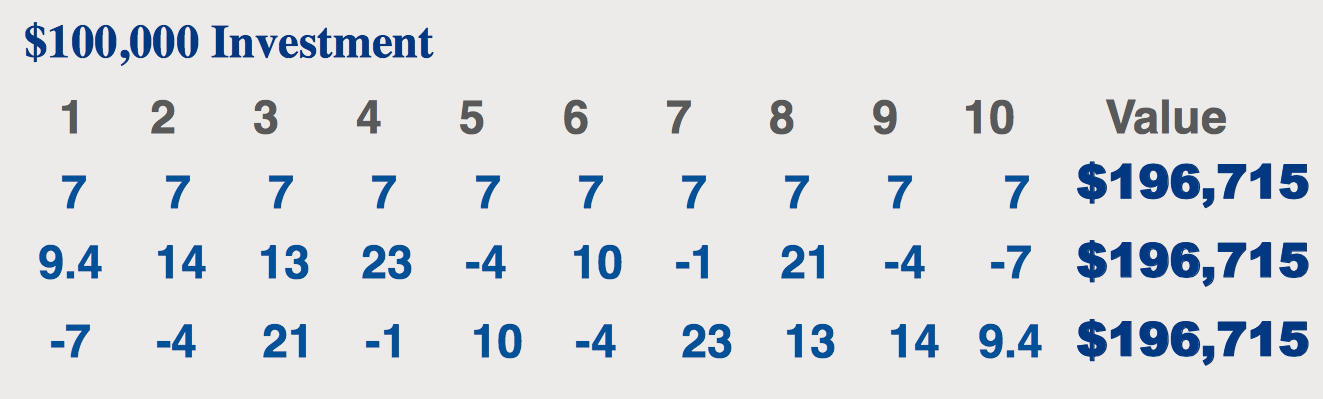

The chart below illustrates that during the growth stage over a 10 year period, that the end result can be the same even with a whole variance of annual returns. Here are 3 different portfolios that ended the same with each having an average rate of return of 7%.

Now look at what happens when you start taking income from the different portfolios at $7,000/year.

After 10 years there is a big difference between the 3 portfolios based on the order of the annual rates of return. The bottom portfolio that had most of the volatility and low rates of return in the early years never recovered and resulted in a net loss of capital. This is how people run out of money in retirement.

The key here is that consistent rates of return will enable your money to last longer and maybe even grow a little.

My position is that the whole $100,000 portfolio did not need to be invested the same way. You could devote 70% of the portfolio to income generation and 30% to growth.

Risk mitigation - you acknowledge the risk exists and put measures in place to protect yourself. Wearing a PPE on the job like steel-toed boots, gloves, safety glasses, etc.

Risk reduction - buying fire insurance on your home. You are sharing some of the risks of loss with an insurance company.

Risk avoidance - you see and understand the risk and choose to avoid it altogether. Like avoiding an icy sidewalk.

What are some of the risks associated with retirement that you should not ignore?

Longevity risk - the risk of living so long that you start to run out of money.

Inflation risk - the cost of living is increasing so fast that your investment returns combined with your withdrawal rate are going to cause you to run out sooner than you want.

Stock market risk - the markets go up and down and it is possible to have a multi-year run of negative returns.

Health risk - serious illness in retirement can mean that you forfeit enjoyment or you have to spend extra money on long-term care needs.

Medical emergency while travelling - experiencing a severe medical emergency while in another country.

Death of a spouse risk- most couples do not anticipate or plan for this, yet visit a retirement home and count the disproportionate amount of women to men. The average age of a widow in Canada is 56. There are all kinds of implications for the surviving spouse. Loss of income because of a reduction in OAS and CPP or other pensions. The income may go down but the expenses stay the same.

Conclusion

You can either have a future you plan for by choice or one that happens by chance. No one can predict the future, but if you are aware of some of the potential pitfalls you can plan accordingly and not be derailed.

There isn't a cookie-cutter approach to income planning or portfolio construction strategy that will be the same for everyone, simply because everyone's situation is so different. You need to have a customized plan based on your individual needs.

We work with couples and singles who are over age 55 and are in or near retirement. We can build you a comprehensive plan that will determine your sustainable income and how to take it in the most tax-efficient manner. We work on a flat-fee basis to build your plan or you can be one of our full-service clients where we build a plan and manage your investments for you.

Learn more about our process by clicking here.

Retirement Income, Investment, & Tax Planners,

Willis J Langford BA, MA, CFP

Nancy R Langford CRS