I guess the next logical question is: How do I create the right kind of portfolio with the right kind of investments?

When it comes to creating a retirement income from a portfolio of investments the first priority is determining how much income you need to cover your basic living expenses, lifestyle expenses, and health care needs.

The second priority is to decide how much of your money should be dedicated to creating guaranteed income to cover the basics.

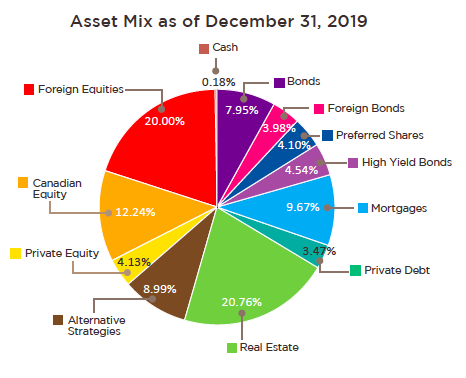

The third priority will be constructing the right kind of portfolio to create income while at the same time protecting and growing your nest egg. Our bias in this portfolio construction would lean toward the proper asset allocation. The portfolios we use for this include up to 12 different asset classes. As you can see from the illustration below.

In order to produce steadier returns, it is necessary to be well-diversified among several different asset classes (ways to make money). For the past 20 years, this portfolio management style has produced consistent returns in both up and down markets.

These types of portfolios will not fully participate in up markets, meaning if the overall markets are up by 20% like 2019-2021, these portfolios may be up 12%. It also means that they do not fully participate in down markets. When the markets were down dramatically in 2015 this portfolio was still up by 7.9%.

It's important in retirement to have a trusted advisor that you can work with for many years to come. 55% of pre-retirees will change advisors when they transition to retirement because they realize they need specialized planning with a focus on income protection.

If you are in or close to retirement and would like to meet with us to put together a retirement income plan, book time in our calendar for a meeting. We'll help you determine:

1. How long your money will last.

2. How much you can spend each year and still have confidence that you won't run out of money.

3. When should you take CPP and OAS?

4. Which of your assets you should spend first to create tax-efficient income.

5. How much you should be saving now so that you can generate the income you'll want in retirement?

We can help you create a sustainable, predictable cash flow from your portfolio in the most tax-efficient manner to ensure you never have to worry about running out of money.

Want to retire in the next few years? Our plans start at $2000. Click here to learn more.

Willis J Langford BA, MA, CFP

Fee-Only Retirement Income Planner