Eye on the Markets

This is a special blog to simply track the markets and market sentiment as we navigate a fundamental shift taking place in the economy and the markets in 2023.

We are providing the numbers along with some commentary.

The YTD numbers are taken from google and may not be 100% accurate

and there may be some currency conversion that isn't factored.

Year To Date Return to January 14

DOW is 3.52%

NASDAQ is up 6.67%

S&P 500 is up 4.57%

TSX is up 4.71%

The markets are off to a great start in 2023 and are showing initial signs of recovery. Inflation in the US appears to be subsiding, which has provided for the short-term rally. The volatility index (VIX) has dropped to 18.35, the lowest its been in a year.

The silver lining.

One of my mentors would often say to me when you are halfway across the lake it's the same distance to keep going as it is to turn back from where you started. There's a lot to be learned from that statement. When it comes to navigating this awful, no-good year on the markets we have to keep things in perspective.

Believe me, I'm as tired of talking about this as you are in listening to me - so we are all on the same page here. My message is still the same - hang on and endure the storm. Wait it out. Don't do anything you'll regret later.

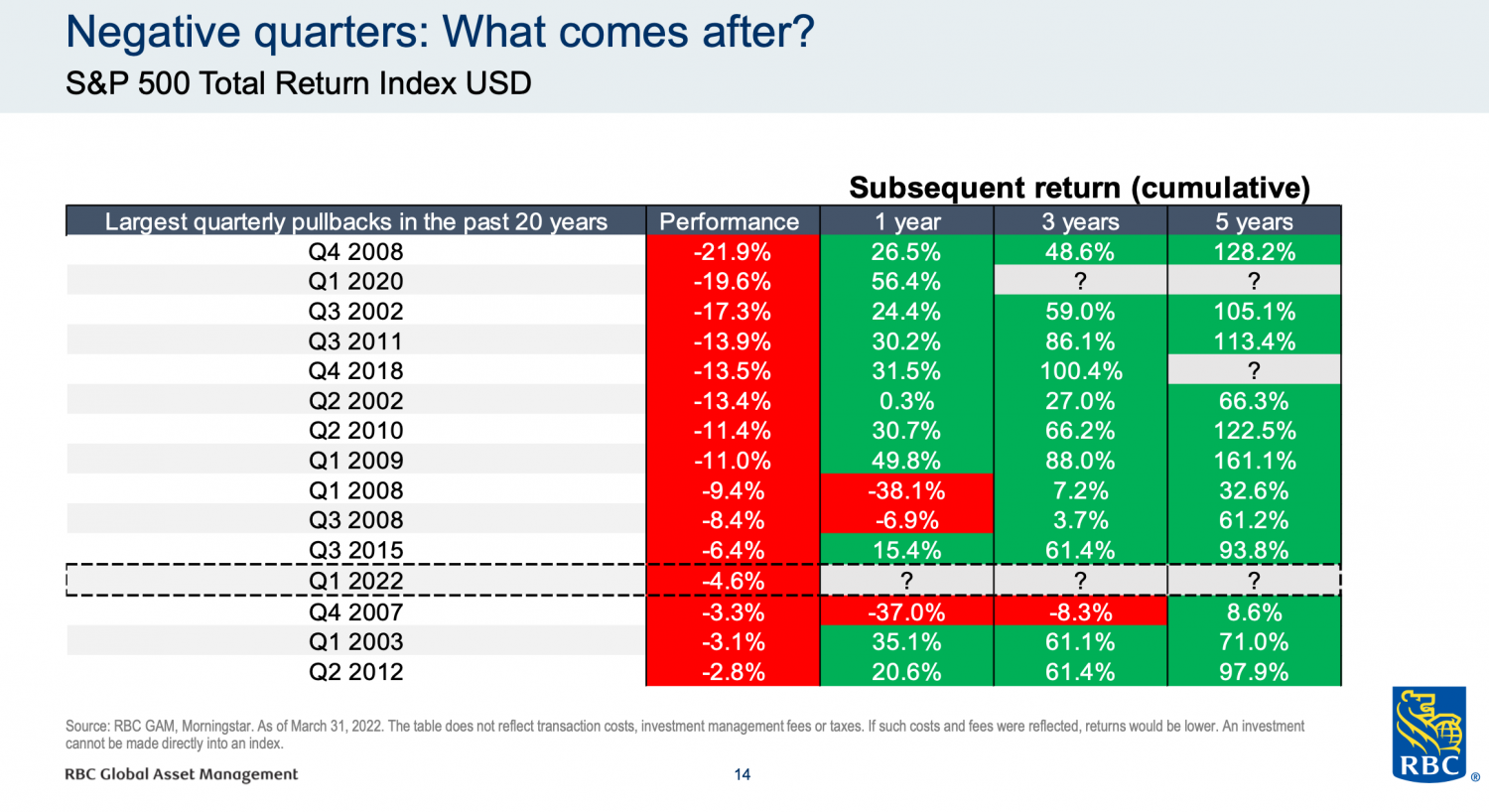

The reality is, we are more than halfway across the lake. The worst is behind us and at some point in the not too distant future the clouds will dissipate and the sun will shine again. Here's a chart that brings me some solace.

As ugly as it is right now, it will get better once the storm passes. History provides us with some comfort in knowing that a year, 3 years, or 5 years after a really bad year the markets can recover in a big way.

Inflation will abate. Interest rates will retreat and the markets will recover. In the meantime, stick with it. Don't look every day at your balances. If you are younger, keep adding your monthly PACs as you will benefit from dollar-cost averaging - this is an opportunity of a lifetime.

If you are older and ready to take out your money, be patient for a little while longer. Minimize your withdrawals if you can. There's still going to be some short-term volatility and we'll bounce along the bottom for a while yet, but we are more than halfway to the other side.

5-Day return for the week ending December 24:

DOW was up .57%

NASDAQ was down 1.96%

S&P 500 was down .23%

TSX was up .26%

Year To Date Numbers:

DOW -9.5%

NASDAQ -33.7%

S&P 500 -19.84%

TSX -8.15%

Three weeks of negative returns, although the TSX and the DOW eeked out a small gain. Jobs and economic growth was the story this past week. Normally this would be a good thing, but in the case of inflation, this activity results in the potential for more interest rate increases, which isn't good for the markets. Inflation seems to have peaked, but how long will it take to recede is the big unknown. Central banks want it back to 2% and are prepared to do what it takes to get it there. That's what's keeping so many people up at night.

5-Day return for the week ending December 17:

DOW was down 1.79%

NASDAQ was down 2.81%

S&P 500 was down 2.21%

TSX was down 2.01%

Year To Date Numbers:

DOW -10.02%

NASDAQ -32.38%

S&P 500 -19.68%

TSX -8.44%

Two back-to-back down weeks. The reality of more interest rate hikes and stubbornly high inflation is subduing the markets from posting a nice Santa Clause rally. The messages from central bankers are clear - they will keep raising rates until inflation comes down to a more sustainable level. This will create a difficult situation for investors as the wait is on and much patience is required to navigate the next few months. The VIX ended the week at 22.62, which is close to where ended last week. That's a good sign. Some of the sell-off this week could be due to Friday being option expiry day (3rd Friday of the month), an overreaction to the fed hike and tax-loss harvesting as the year closes out. We'll see how next week plays out as we approach the Christmas break.

5-Day return for the week ending December 9:

DOW was down 2.50%

NASDAQ was down 3.31%

S&P 500 was down 2.90%

TSX was down 2.48%

Year To Date Numbers:

DOW -8.50%

NASDAQ -30.49%

S&P 500 -17.97%

TSX -6.07%

The markets gave up some gains this week as the sentiment turned negative. Much of what happens in the short term is the markets trading on news and rumours, which is referred to as sentiment. On a long-term basis, the markets move in one direction or the other based on fundamentals. Right now, it's all about inflation, the pace of interest rate hikes, and the impending recession. It's constantly a wait-and-see approach and much patience is required. The VIX moved up to 22.83 by Friday, indicating that volatility has increased. A barrel of oil is around $71, which should be a good thing for reducing inflationary pressure. Next week the US will provide inflation data on Tuesday and its interest rate decision on Wednesday. That should provide some market direction, at least to the end of the year.

5-Day return for the week ending December 2:

DOW was up 0.45%

NASDAQ was up 2.82%

S&P 500 was up 1.66%

TSX was up 0.86%

Year To Date Numbers:

DOW -5.89%

NASDAQ -27.62%

S&P 500 -15.11%

TSX -3.54%

The markets are continuing to improve little by little. There's talk of a slower pace to rate increases which have helped the recovery. We can see some increased stability which is reflected in the VIX, now at 19.06 - down from 34 just 2 months ago. There are rate decisions in Canada and the US in the next week so we'll see how the markets react to this.

5-Day return for the week ending November 25:

DOW was up 2.20%

NASDAQ was down .27%

S&P 500 was up 1.51%

TSX was up 2.24%

Year To Date Numbers:

DOW -6.12%

NASDAQ -29.09%

S&P 500 -16.06%

TSX -4.02%

The markets had a strong week with the exception of the NASDAQ. The technology sector is still struggling, which is reflected in the NASDAQ. The VIX dropped to 20.5. Another good sign is that there is a little less volatility at the current moment. You can see that there has been a transition from growth to value over the past year and investors are seeking a more conservative approach to their money in looking for stable businesses that pay dividends. It's also interesting to look at the 30-day returns.

The TSX is up 5.33%

The DOW is up 7.22%

The S&P 500 is up 5.75%

NASDAQ is up 4.02%

5-Day return for the week ending November 18:

DOW was up .25%

NASDAQ was down .78%

S&P 500 was down .32%

TSX was down -.38%

Year To Date Numbers:

DOW -7.76%

NASDAQ -29.6%

S&P 500 -17.33%

TSX -5.91%

The markets were rather flat for the week. The VIX ended the week at 23.12, a little higher than last Friday. The markets want to stage a rally, but every time things are looking a little better, some speaker from the Federal Reserve will talk things down. They want to slow the economy with the threat of raising interest rates to fight inflation. Until we have clear direction on the pace of increases, we'll likely see more of what we have seen all year - volatility. A recession within the next few months is looking more likely. The big questions will be how deep and for how long?

The other thing I have noticed is that the markets tend to pop on any hint of good news. That's encouraging in the sense that we may not retest the lows of earlier this year. Over the next 2-3 months, we should reach the peak of interest rates, the economy should be slowed or in recession, and the cycle will start over again. At some point in the latter part of 2023 rates will decrease to spark the economy. No one knows for sure and we don't have a crystal ball. I still believe the best place to be is in the market because you want to participate in the eventual rally - which can happen fast. If you lock up too much of your money in GICs you'll be stuck and have to wait a long time (up to 5 years) to access that money to get it back into the markets.

5-Day return for the week ending November 12:

DOW was up 3.99%

NASDAQ was up 7.67%

S&P 500 was up 5.61%

TSX was up 3.0%

Year To Date Numbers:

DOW -7.76%

NASDAQ -28.48%

S&P 500 -16.75%

TSX -5.30%

The big story this week that spurred the markets higher was the lower-than-expected CPI numbers in the US. It appears that inflation has peaked and is now retreating. This is good news for the markets because it signals that the Federal Reserve will be able to decrease the amount of interest rate hikes moving forward, which is good for stocks. The VIX came down to 22.52, which is the lowest it's been in 2 months. All in all, we had a good week and the worst may be behind us for the time being. The US midterm elections were going to be a big story, but nothing has been officially decided by the end of the week.

5-Day return for the week ending November 4:

DOW was down 1.07%

NASDAQ was down 5.02%

S&P 500 was down 2.87%

TSX was up .22%

Year To Date Numbers:

DOW -11.43%

NASDAQ -33.84%

S&P 500 -21.39%

TSX -8.31%

There were a lot of key data points this past week that impacted the markets. The federal reserve increased its prime rate by another .75%, sending the markets up for a few minutes and then closing down significantly by the end of the day on Wednesday as Jerome Powel held a news conference and got asked more questions. Thursday was another down day and then Friday we saw wild swings, but the markets ended up at the finish.

Is there going to be a recession and if so, how bad will it be?

Central bankers only have one tool for combating rising inflation - interest rates. However, there is another tool being used - the media. All of the news about an impending recession that we have been hearing for months may just be a ploy by the government, which owns the media, to help drive down inflation by talking up recession.

It sounds like a good idea. There's nothing like the worries of recession to cause most people to start tightening their belts. This will have an impact on inflation as people start spending less on everything, but the necessities.

What's working against a recession?

Jobs. There is an apparent lack of employees in the developed world. It's hard to have a recession when the unemployment numbers keep getting better. The numbers improved again in October. My thoughts: There is an obvious slowing of the economy taking place, but it doesn't appear that we are going to have a long, deep recession. However, I do think we will have higher inflation for a longer period than what the central bankers want us to believe.

The 2 types of inflation are a problem. There's price inflation, which as we know has gone wild. We all see this every day we go shopping. The second is wage inflation and it hasn't moved much. If incomes were increasing at the same pace as everything else, we wouldn't be talking about this as much.

Not sure if you noticed in the federal budget update that there is a tax credit available for corporations that invest in their businesses and develop their workers and improve wages.

There's also a 2% tax on any publicly traded company that is focused on share buybacks. For example, when a large energy company has excess revenue they have to do something with that extra cash. Typically, they can return some to their shareholders in the form of a dividend, or a special dividend, which many are doing. Or, they can reinvest that extra money into growth. Since there's no capacity to ship oil and gas they don't want to invest in finding and producing more.

The other strategy these companies employ is to buy back their shares on the open market. The fewer shares that are outstanding, the higher the share price will go. Again, this adds to shareholder value, which is the primary objective of every publicly traded business.

There are some positive signs in the world.

1. Russia is running out of money. Its economy is suffering greatly. Hopefully, they will end the war in Ukraine soon.

2. China's COVID ZERO policy appears to be changing. There were some rumours this past week that the policy was changing their markets immediately shot up. China is the world's second-largest economy and they have not even started the post-pandemic recovery. If they do stop this silly covid 19 lockdown that economy will roar back to life and will have a significant impact on world trade and especially the flow of goods.

3. Interest rates are nearing their peak or at least nearing the fast and high rate of increase. Most likely we will see Canada and the US do another .75% in December and then have much smaller increases in early 2023 - maybe .25%. Once this plays out in the next couple of months we should see some stability return to the markets and a more sustained rally.

4. Government spending. This is the leading cause of rapid inflation. There seems to be some commitment among governments in the G7 to reign in spending and printing money.

Michael Campbell points out the G7's Debt Problem

The G7 group of nations have a sovereign debt problem. Debt levels have reached positively spooky heights:

Japan – 259.43 percent of GDP

Italy – 150.03 percent of GDP

United States – 128.13 percent of GDP

Canada – 112.85 percent of GDP

France – 112.80 percent of GDP

United Kingdom – 95.35 percent of GDP

Germany – 68.60 percent of GDP

It's not all doom and gloom.

I know it's been a tough year and many of you are wondering what's going on in the world and what you should do with your money in light of needing to grow savings and also draw a retirement income. My encouragement is to hang in there for a little while longer. I believe the next 3-4 months are crucial before making any significant changes.

You don't want to tie up money in long-term GICs. That's why we push the savings account at CI Direct which pays 3.55% on a daily interest basis. No commitments, fees, or restrictions. It is a good idea to keep a little stockpile of cash for a rainy day.

Consider more guaranteed income from Annuities. Payouts from annuities are the highest they have been in years. Learn more about annuities from this blog post.

5-Day return for the week ending October 28:

DOW was up 5.37%

NASDAQ was up 2.17%

S&P 500 was up 3.77%

TSX was up 2.94%

Year To Date Numbers:

DOW -10.18%

NASDAQ -29.88%

S&P 500 -18.67%

TSX -8.31%

Another week of positive gains, especially on the DOW. The VIX dropped to 25.75, which is the lowest it's been since early September. This is a reminder of how quickly the markets can turn and how important it is to stay invested. You don't want to miss the best days in the markets because you were sitting in cash. Everyone is always waiting for those moments when the bottom occurs and they get in. The problem is the bottom is usually long gone before anyone realizes it.

5-Day return for the week ending October 21:

DOW was up 3.48%

NASDAQ was up 2.69%

S&P 500 was up .88%

TSX was up .27%

Year To Date Numbers:

DOW -15.04%

NASDAQ -31.41%

S&P 500 -23.32%

TSX -12.32%

Another week of volatility. That's the most common theme of 2022. This week saw some improvement as the corporate quarterly earnings kicked off. The markets eeked out some gains by Friday to close in positive territory.

5-Day return for the week ending October 15:

DOW was up .73%

NASDAQ was down 3.18%

S&P 500 was down 1.77%

TSX was down 2.77%

Year To Date Numbers:

DOW -19%

NASDAQ -34.81%

S&P 500 -25.3%

TSX -13.7%

Another volatile week of wild swings. Highs and lows. The US inflation numbers are not retreating. The consumer price index was up .4% in September. The expectation of more interest rate increases in the coming weeks. Most likely .75% in both November and December. It sounds like a broken record. More wait and see. There's not a lot to say other than what we have been saying for many months - hang in there and weather the storm.

5-Day return for the week ending October 7:

DOW was up 1.53%

NASDAQ was down .06%

S&P 500 was up .83%

TSX was down .21%

Year To Date Numbers:

DOW -19.92%

NASDAQ -32.72%

S&P 500 -24.12%

TSX -12.49%

More volatility in the markets. During the first half of the week the markets took off like a rocket, but then they returned to earth by Friday. The DOW ranged by 3.6% from top to bottom. The NASDAQ was up as much as 4.7%, the S&P 500 by 4.16%, and the TSX had a range of 4.18%. That's a lot of fluctuations in one week. The fundamentals remain the same, but when we see this much volatility it can only be attributed to the constantly changing sentiment. The silver lining this week is that at least there is some green.

5-Day return for the week ending September 30:

DOW was down 2.75%

NASDAQ was down 2.38%

S&P 500 was down 2.64%

TSX was FLAT

Year To Date Numbers:

DOW -21.48%

NASDAQ -33.20%

S&P 500 -25.25%

TSX -13.15%<