How do you keep your emotions in check in the midst of so much volatility?

Momma said there be days like this. Days where the risks seem to pile up higher than the rewards. Sometimes it's only a few days, sometimes it's a few weeks and sometimes, it's a whole year, like 2022.

There will always be headwinds that you have to navigate and you cannot run and hide.

Let's delve into some ideas on keeping your emotions in check to prevent you from making decisions that will negatively impact your future wealth.

Behavioural Finance

Everyone wants to make money from their investments and it’s easy to do if you can follow a plan. Understanding your behaviour is key to successful investing. Most of what we do each day is based on habits and mental shortcuts our brains have developed. Here are a few that relate to investing.

Linear thinking. We think in terms of straight lines. If something is going in one direction we think it will continue to go in that direction. If house prices are going up, they will continue to go up. If the stock market is going down it will continue to go down. The truth, however, is that just about everything goes in cycles. The economy goes in a cycle of recession, growth, peak, trough, and recession. House prices go in cycles. The animal kingdom operates on the same principle.

Chasing performance. Imagine you have 3 investments and one earns 14%, one earns zero and the 3rd has a -9% return. Instinctively, you would want to sell the loser and buy more of the winner. We do this because we think that the winner will continue to go up in value. There are many factors that have to be analyzed to determine what you should sell and what you should buy. Maybe you don't do anything.

Mental framing. Let's say you are in the market for some new running shoes and you find a pair for $50, but you then notice an advertisement of the same shoes at a store across the city for only $25. That's a 50% savings. So, would you drive across town to save $25? Most people would. However, let's say that you are in the market for a couch set that costs $3000. Would you drive across town to save $25? It's the same amount of money, but in our minds, we frame things differently. We do the same thing with our investments. Our decisions are based on the research that we listen to, which is usually the media. If the markets are down, the media commentary is negative and it will always be negative. They will go out of their way to find the most pessimistic advisor to support their perspective. The opposite happens after a few good days on the markets.

Overconfidence. Because we think in straight lines, we can become overconfident when things are going up and begin to think that our good fortune is the result of our good investment skills. At that point, we tend to only listen to and seek out information that confirms our bias. This is also called, confirmation bias - we only listen to information that confirms what we already believe. Alternatively, when the markets are correct, as they always do, we feel ripped off and uncertain of our abilities.

Fear of loss. We feel the pain of loss far greater than we do the gratification of gain. Realizing that you have lost the $50 bill in your wallet is far worse than the joy of finding a $50 bill on the street. How does this affect our investment decisions? Well, our risk appetite is far greater when the markets are going up. When the markets are heading south, we quickly become risk-averse. This leads to the reality of what most people do - buy high and sell low. The reality is that we should be more inclined towards risk when the markets are down, not up. Warren Buffet puts it this way: "Be fearful when others are greedy and greedy when others are fearful."

Confirmation bias. This is where we seek out and only listen to information that confirms what we already believe. If we believe that the economy is bad, we read, listen to, and pay attention to anything that confirms that perspective. Most of our decisions in life are based on our beliefs, not knowledge.

Herd Bias. Sometimes called the fear of missing out. What it is: The tendency for people to follow the crowd rather than basing investment decisions on their own analysis. An investor with herd bias will invariably be attracted to the most recent hot stock (or sector or fund) or property. Overweighs the opinion of the majority and buys or sells solely because everyone else is.

Anchoring. When an investment attains a certain high value we anchor to that number and believe that its worth is now attributed to that number and we believe to sell it for anything less is to sell at a loss. Most homeowners are guilty of this bias and struggle with selling their homes when market conditions change.

When you have to make investment decisions on buying, holding or selling your investments it is a good idea to discuss your options with someone who can take a more objective perspective. Often speaking with a professional can help you analyze your choices and help you make a confident decision.

You only have three options when dealing with a market meltdown.

SELL.

The first is to get out of the market and into cash. If you can’t sleep at night, it might be time for you to get out but get out permanently. You can be guaranteed that this won’t be the last time this happens to the market. If you can't handle the heat - get out of the kitchen. If you are thinking about getting out temporarily and then jumping back in when the market starts to improve, I think that is probably the riskiest strategy out there because market timing is a really tough game to play. You may be better off taking your losses and finding something else that makes you feel better about your portfolio.

HOLD.

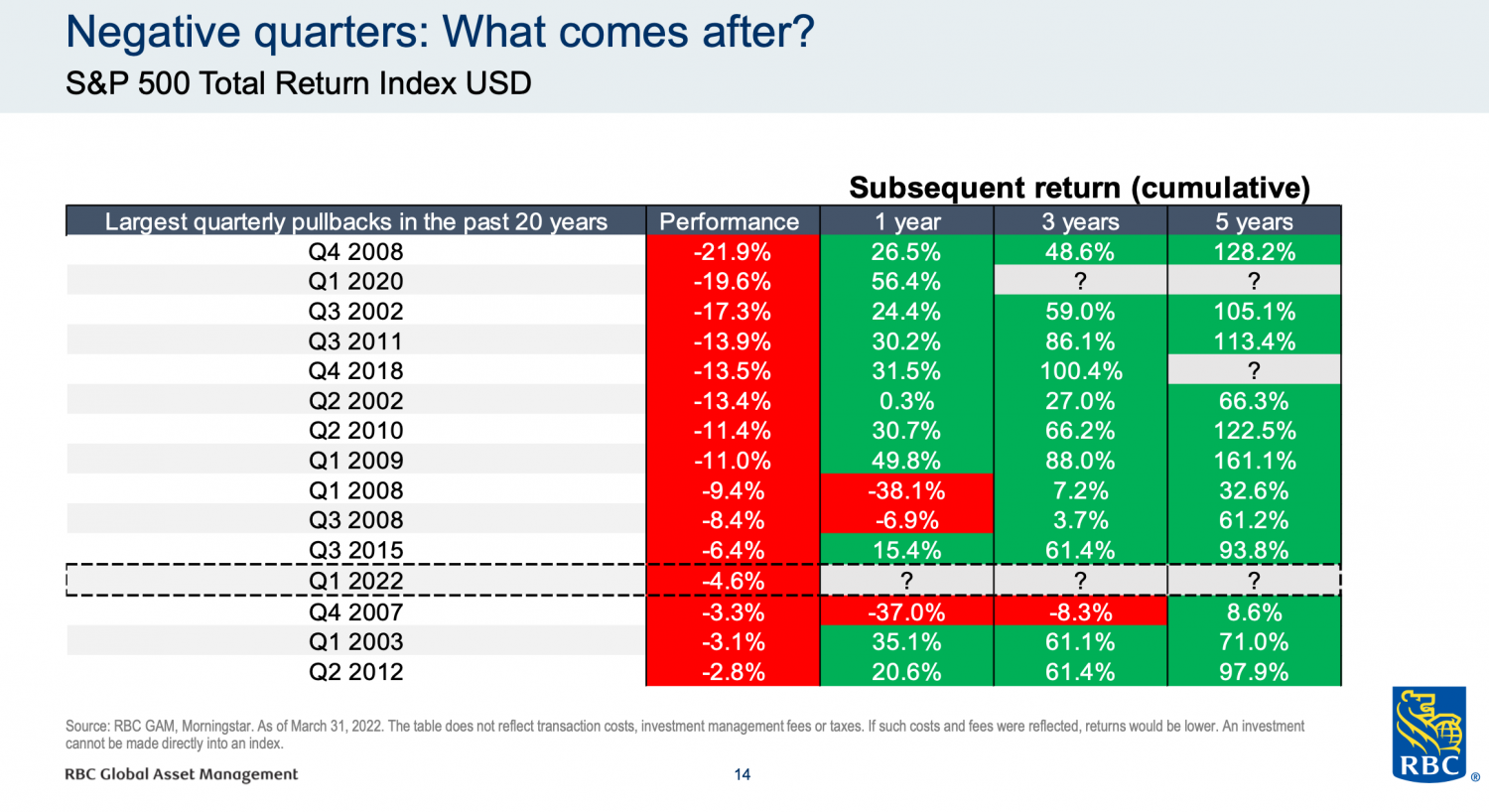

The other option is to wait it out. In reality, this is the right strategy. Just like we have seen markets drop before, we’ve also seen them recover. That’s never changed. Although there is no guarantee, markets historically recover after severe drops within 6 to 12 months. Typically when big drops happen, most of the drop has already happened. Staying put is easy if you hold good quality investments.

Look at this chart: A few years after a market meltdown the markets can have an incredible comeback.

BUY MORE.

Market declines can be the best time to buy. Investing in the markets is the only business I know where when something goes on sale nobody buys. Remember that logic says you should buy low and sell high. Unfortunately for most, emotion causes people to do the opposite. They want to keep their winners and sell their losers (Buy high and sell low). I understand that buying now is probably one of the hardest things to do but if you really think about it, it makes sense. Personally, every extra dollar I have is going back into the market to buy more of what I already own.

Learn more about our planning process and how to book an appointment by clicking here.

Hope this helps,

Willis J Langford BA, MA, CFP