Predicting the future is like forecasting the weather. If we get it right we are loved, but if we get it wrong - well you know how you feel about the weather people.

2020 Market Outlook

The general consensus from the experts that we follow is that 2021 should be a very good year for the economy and the markets. However, the growth is expected in the second half of the year, because the unknown right now is how quickly the vaccine can be rolled out and whether or not it is effective.

A huge part of our process in determining how to allocate your investments is based on the research of the experts we follow.

Who are these experts?

Philip Peterson, the chief investment strategist at Manulife.

Sadiq Adatia, the chief investment strategist at Sun Life.

David Fingold, portfolio manager at Dynamic Funds.

We also regularly read the market commentary from Nicola Wealth out of Vancouver. None of the experts are trying to sell newspapers or advertising. They are responsible for Billions of dollars of client money and getting it right is vitally important to them and to us.

What are they saying?

Over the past 3 weeks, we attended their annual webinars to get a sense of what is happening and what is likely to happen in the next 12 months. Keep in mind that this isn't a guaranteed thing and as you are well aware, there are events that can happen that are beyond anyone's control. These events can impact outcomes, especially in the short-term. The US election is behind us, stimulus continues to roll out and the vaccine appears promising.

The central theme is "Pent-up Demand".

Households are sitting on a lot of unspent cash from the past year. At some point in the coming months, the pandemic is going to be in the rearview mirror and people are going to start spending money. Businesses will reopen and employees will return to work. Retirees will start travelling and the economy will heat up. The result of this will be increased economic activity all over the world. Cars, appliances, houses, cottages, garages, vacations, trips to see family and so on.

Commodity boom.

Oil has seen a resurgence in 2020 and this should continue in 2021. Various minerals used in the production of goods will increase. This could bode well for Canada, unless our government screws it up somehow - which is highly likely.

Where are the best opportunities?

Over the past few years, the USA has had the biggest gains. Looking forward, the rest of the world is catching up. The emerging markets from the south pacific, China and South Korea are expected to become the leaders this year. It's a matter of first in - first out. First into the pandemic and first out of the pandemic. These economies are also seeing their citizens moving quickly into the middle class and becoming high on consumption, like the rest of the developed world.

Our recommended asset mix.

We lean towards a diversified global mix. Over the past 2 years, we were recommending 50% in the USA and 40% international and 10% Canadian. Our new growth mix is 40% USA, 40% International Value, 10% Emerging Markets and 10% Canadian.

Keep in mind that this mix is not always recommended for everyone. Your mix is based on your appetite for risk, income needs, size of your portfolio, time horizon and account type. For example, a TFSA with a time horizon of more than 10 years should be following this growth mix.

Canadian Dollar.

If the commodity boom takes off as expected, so will the loonie. The US dollar is expected to weaken. They want a weaker dollar, so that their exports are cheaper, which in turn, helps grow their economy.

Inflation.

Just imagine what's going to happen by next September if the vaccine is working and the borders are open. People will be flying like the coop. The airlines will not be able to keep up and you can be guaranteed that prices will be increasing quickly. This could happen with all goods and services. It would be a matter of supply and demand.

Interest rates.

The B of C announced this week that they plan to keep interest rates low until at least 2023. They pretty much have to as they are the biggest borrower right now. They want to keep interest rates low. However, if inflation starts to take off as expected, then we will see interest rates start to rise.

Real Estate.

Activity and home prices have remained steady throughout the pandemic. If you are a buyer, then I would recommend buying sooner than later. Currently, you can lock in the lowest rates in history. If you are a seller, then waiting until the second half of the year may work to your benefit, because that's when things are likely to heat up. There is a move away from the city, which is making rural properties more valuable. As a result of the pandemic many people, especially younger people, want to get away from crowds, grow their own food, and have greater food security. Wait until they find out that you can't grow toilet paper:)

Ideas

It's not a great idea to be sitting on large sums of cash. We have plenty of investing ideas and opportunities.

Consider getting a line of credit attached to your home while rates are at historic lows. We have contacts that can help you with this process. Borrowing against your home is an opportunity in some cases and we are happy to discuss this with you and determine if it fits within your overall plan.

Top up TFSAs now.

Top up RRSP contributions if you have room before the deadline of March 1st.

Open a Non-Registered investment account if you have maximized TFSAs and RRSPs.

Consider a Universal Life insurance plan where you can overfund and tax shelter growth.

ESG investing.

This stands for Environmental, Social, Governance. This is a big trend and it will continue for years to come. If it isn't in your vocabulary it is now and you will hear more about it this year. There is a general desire among the population to invest in companies that have a better environmental record, higher element of social conscience and equality at all levels within the corporation. We are proud to say that our Sun Life funds have the best ESG ratings among their peers, according to Morningstar's rating system.

How did we do?

2020 and 5-Year Index Returns

|

Index |

2020 Return |

5-year Return |

|

TSX (Can) |

5.6% |

7.83% |

|

MSCI World index |

16.5% |

13.59 |

|

S&P 500 (US) |

18.4% |

16.75% |

|

NASDAQ (US) |

43.65% |

34.2% |

|

Dow Jones (US) |

2% |

17.53% |

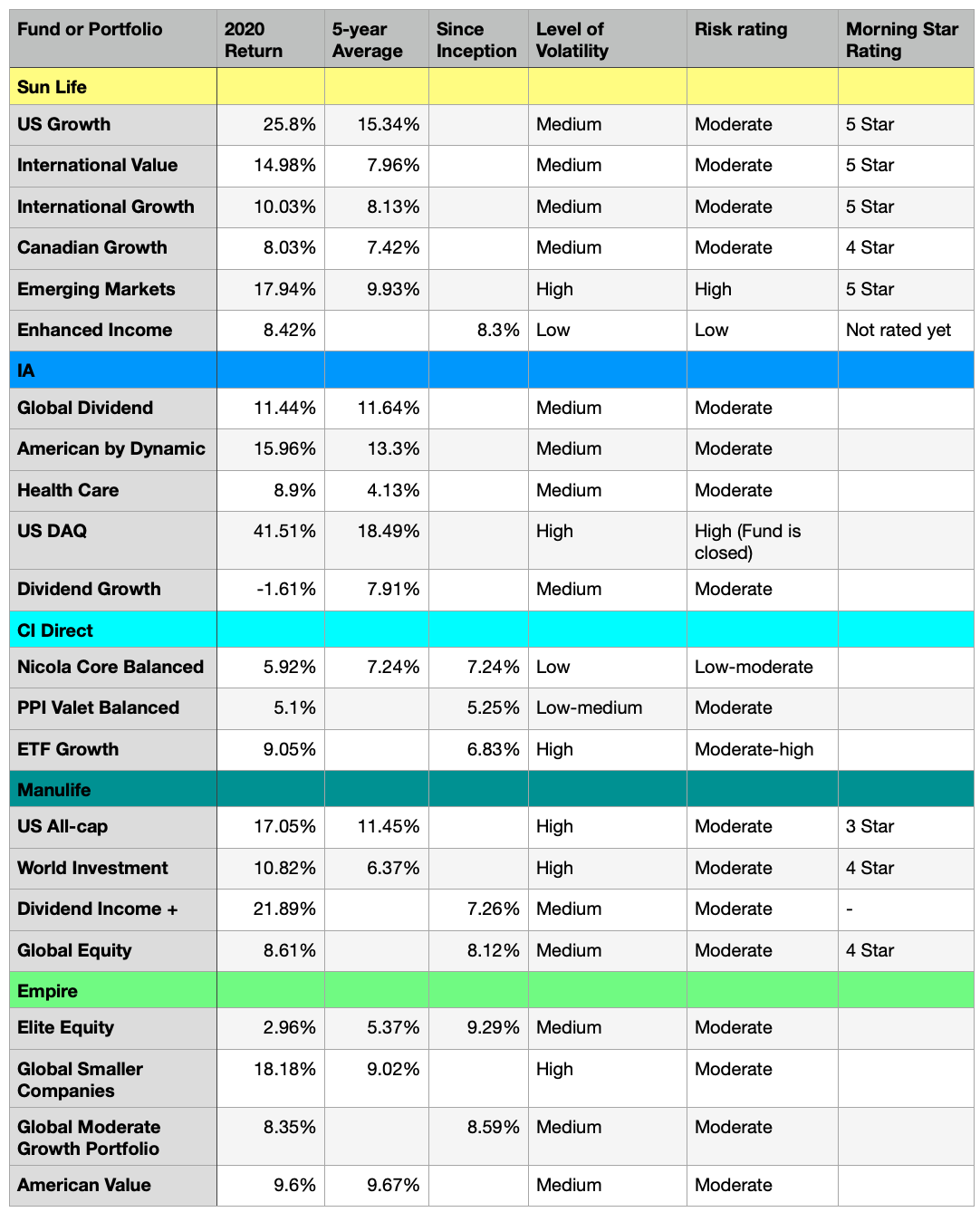

The Funds on our Platforms:

We are a husband and wife team and we work exclusively with financially successful individuals over age 55 who want to get their total financial house in order and start living the life they have always dreamed about. We want to help you - 'to get on with it'.

Have a few questions? - Book A 10 Minute Call

Retirement Income Planning For Those 55+

Willis J Langford BA, MA, CFP

Nancy Langford CRS