The most anticipated recession of all time is about to unfold - or is it?

You can't say you didn't see it coming because you'd have to be living in a cave to miss this one. What we don't know is if it's going to happen for real, how bad, and how long. The so-called "Experts" have many opinions on the outcomes. Regardless, it's now time to review your portfolio and see if you need to make some changes.

Laying the foundation

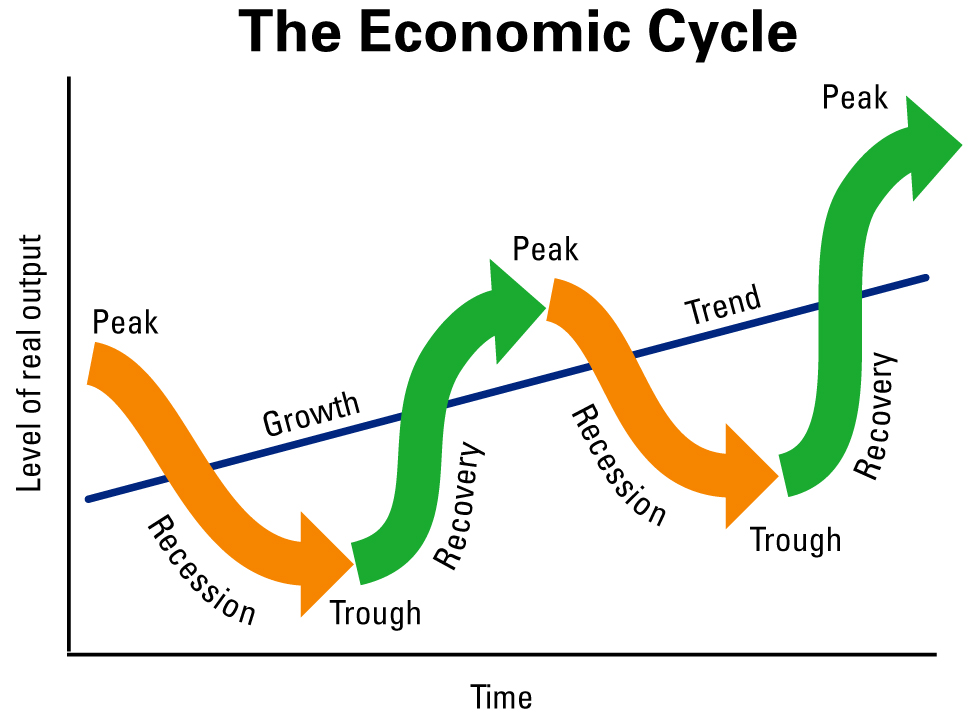

The markets do not go in one direction forever - up or down. There's a cyclical nature to the stock market and it is tied to the economic cycle, but not at the same timing.

The stock market is always pricing in the future, not the past. We are now coming off of a peak and going into a slowdown or recession. That's why we have already seen such a dramatic decrease in 2022. In essence, the stock market has already priced in a recession. So let's just assume it's here. If this concept holds true, the stock market will start recovering long before the end of the recession as well. You have to be careful making the assumption that they are one and the same - they are not. In fact, they are not correlated, but inter-connected.

How did we get here?

Ever since the financial crisis of 2008, governments around the world have pumped excessive amounts of money into the financial system and brought interest rates to near zero. Some people got a 5-year mortgage for .99% just a year ago. We were told that this would eventually bring about out-of-control inflation for the past decade, but it never happened, until 2022. One of the impacts of the pandemic, and the excessive government spending, was the rapid appreciation of almost every asset class you can think of. Now that's unwinding. The easy money is gone. The cost of borrowing is going up. This impacts both consumers and corporations who depend on borrowing to fund purchases and growth.

What impact has this had on your portfolio?

A serious impact in the short term as most people have seen a significant decrease in market values. Don't panic or make irrational and emotionally based decisions. There's long-term money and short-term money. There's a large part of your portfolio that you don't need to access for years. It could be your non-registered account, TFSA, or parts of your RRSP. Don't crystalize losses right now and buy GICs. The only way you can earn back what you lost - on paper - is to stay the course. The stock market is the only 'easily accessible' opportunity to significantly grow wealth. Secondly, GICs will mean you have to lock up your money for 3-5 year terms to get 5%. Sure you don't have any risk of losing, but you are now absolutely limited on the upside. In a year or so from now, and the markets are growing, you'll kick yourself in the arse for not being able to participate in the rally. You'll also limit your growth and wealth build opportunities because of the limitations.

Short-term money. This is money you need to buy stuff to live now and in the next year or two. You have access to government benefits, pensions, HELOC, and the cash portion of your portfolio. Just concern yourself with what you need for the next 1-2 years in the way of income. Secure that in cash or in a low-volatility portfolio and don't worry about the long-term money. The short-term cash flow money can be held in a high-interest savings account, a 1-year GIC, or just cash under your mattress.

Trust the process. It's not all doom and gloom. The economic cycle will play itself out over the next 12-18 months and if you are patient, you'll benefit from following a simple plan.

Recession-proofing your portfolio

A lot of what has happened in the past 2 years (2021 & 2022) is we had a huge increase of 20+% in 2021, followed by an equal decrease of 20+% in 2022. We have gained nothing in the 2-year time frame.

A shift to Value from Growth

Basically, as we move into this time of recession, corporations have a higher cost of borrowing. The highest it's been in years. Companies that do not need to borrow in order to grow will fair the best, and companies that need to borrow a lot of money to run their businesses and grow their businesses will struggle. These types of businesses are what we call growth companies - a lot of what we see in the area of technology and listed on the NASDAQ. Growth companies have done really well over the past decade as they had access to cheap and easy money. That's changing in the near-term until rates decline.

There's only one thing that drives share value over the longer term - profits.

Value companies

These are mature companies that generate a lot of free cash flow each year and then use that cash flow to fund growth, and pay dividends to shareholders. Much of what you see on the TSX, S&P 500, and even the DOW, represent Value companies. That's the big shift taking place. It doesn't mean you have to sell all of the growth and lock in losses, but you have to make some adjustments. New money should be put toward the value side of the markets and/or fixed-income allocations. New money going into bonds, has the potential to receive a much higher yield. New bonds are better than old bonds. Short-term bonds(5 years) are more attractive than long-term bonds (20-30 years).

The markets are off of their lows for 2022 and now is a good time to make some tweaks to your portfolio and get ready for the next season. We have to look forward, not backward and make some decisions. Past performance is no indicator or predictor of the future. It's a different world. The pandemic has reshaped everything.

We want to own more Canadian equity. We still want to be in the US but have less growth and more value equities. Cut losses on some of the losers and on long-term bonds. And, hold more value and fixed income.

Real estate is still a hedge against inflation. The balance private portfolio we have at CI Direct has had a stellar performance in 2022 with an 8%.

Housing and real estate

Canada is set to welcome about 1.5 million new emigrants in the next 3 years. That's 4% of our population. Calgary's population is 1,336,000. If we get 4% of these new Canadians that's 53,440 new residents in the next 3 years. Where are they all going to live? Real estate in Canada has undergone a much-needed correction, but it's not going to tank or stay down for long. Demand will outpace supply. There's a major resurgence right now to buy condos and rent them out. It's been 8 years since you could do this. Condos are the hot spot of the real estate market at the current time. They have been underselling for a long time and now the opportunity is ripe.

"Canada’s population growth hit its fastest pace in five decades thanks to record immigration.

Over the past 12 months, the number of international migrants to Canada totalled 822,866 — by far the largest influx in historical data to the mid-1970s, Statistics Canada reported Wednesday in Ottawa.

That figure, which includes immigrants and non-permanent residents like students, pushed Canada’s annual population growth rate to an average of 2.3% over the past year, the fastest since 1972.

From July 1 to October 1, the number of Canadians grew 362,453 to 39.3 million, the agency said. That’s equivalent to 0.9% of the population, the fastest quarterly gain since 1957 when the country was in the midst of a baby boom and welcoming refugees fleeing the Hungarian revolution.

Prime Minister Justin Trudeau’s government has consistently raised Canada’s immigration targets each year to grow its workforce. The latest plan is for the country to bring in about 500,000 permanent residents annually." -Wealth Professional.

The Workforce

The last jobs report for the end of 2022 saw an increase of 104,000 new jobs. Apparently, there are 1 million unfilled job openings at the present moment. Do you know that every single day in Canada 1200 people turn 65? The majority of these people are leaving the workforce or reducing their working hours. Who's going to replace them? This is why the government is trying to bring in more people. Forgive me for painting with a broad brush, but most workers today are not willing to put in as many hours as they previously did. This is one way the pandemic has reshaped us.

The gig economy

In the past, when we had recessions and people got laid off, they applied for EI and hoped that their EI would last until they found a new job. That's not the case anymore, as more and more people participate in the gig workforce. You can make money online doing just about anything from anywhere.

The bottom line

>If we are not heading for a recession then we are heading for higher inflation and higher interest rates for a much longer time.

>Wage inflation will need to catch up to price inflation.

>We could get stuck in a stagflationary environment for a period of time.

>Volatility is here to stay.

Doing something for the sake of doing something

Making a change may make you feel good in the short term, but eventually, if that doesn't show signs of improving quickly, you'll get bored with that as well. Doing the right thing for the right reason always brings about the right outcome in time.

Investing requires time and patience. Anything can happen in the next few weeks or months. But, what is likely to happen over the next few years? Growth will happen, but you have to stay the course to participate and then enjoy it.

Putting things into perspective

The past year was pretty ugly...

Year To Date Numbers:

DOW -9.40%

NASDAQ -33.89%

S&P 500 -19.95%

TSX -8.72%

...but over the past 5 years, it looks good:

The TSX is up 21.5%

The DOW is up 30%

The S&P 500 is up 40%

NASDAQ is up 45%

You can take some gains and shift the money into income-generating investments.

From Philip Petursson from IG Wealth:

This theme of peaks and troughs may seem at odds; a more optimistic view on equities in the face of what may be a recessionary environment. In our view, we feel any economic contraction is more likely to be mild rather than severe. Within that broad theme, here are our key expectations for 2023.

Inflation and interest rates are likely near their peak

We’ve seen a significant shift in both inflation and inflation expectations. Central banks began 2022 by insisting that inflation was transitory, only to then raise interest rates to bring inflation down. The rapid increases in central bank rates through 2022 are likely near their end; the Bank of Canada and the U.S. Federal Reserve may have one or two more rate hikes before they pause and allow them to work their way through the economy.

Equity markets may be near a trough as valuation starts to matter again

As we look ahead to 2023, we believe the valuation gaps that exist across asset classes may become a greater focus for investors. While valuation is a poor predictor of short-term performance, it does suggest the potential for international equities (including emerging markets and Canada) to outperform U.S. equities over the medium term.

Asset class correlations may be at their peak

The major equity markets and bond markets moved in the same direction in 2022. These correlations tend to break down after a period of time, so in 2023, economies will likely move along their market cycles at different paces. We believe this will open up more diversification opportunities across asset classes.

A return to income in fixed income

The challenges that faced fixed-income investors in 2022 have led to a better outlook for bonds in 2023. Interest rates and bond yields are at levels not seen in over 10 years, and we believe this will allow for an improved return profile over the next decade.

Will this be a RINO economy: Recession in name only?

The data suggests a likely recession in the U.S. in 2023. Typical recession indicators, such as falling housing starts, an inverted yield curve and the Conference Board’s Index of Leading Economic Indicators falling negative, started appearing in the middle of 2022.

We believe there’s also a strong risk of recession in Canada, parts of Europe and Asia. We’re already seeing signs of a slowdown in global manufacturing activity. The question is, how long and how deep of a recession might it be?

We believe this may be a recession in name only. Typically, recessions come about following an excess within the economy. This recession followed an excess of money supply in 2020 and 2021. However, that excess has gone, and that, coupled with healthy labour markets in North America could lead to a gentler economic contraction.

For historical comparisons, we would point to the recessions of 1970 and 2001, which were shorter and much milder than the historical average.

Nevertheless, we’re seeing a contraction in manufacturing activity globally and starting to see a contraction in export growth in China and South Korea, the latter typically being a bellwether for global economic growth.

In Canada, any economic weakness is likely to be around the housing market, given how it’s more sensitive to changes in interest rates than other areas of the economy. Similar to the United States, however, we believe the strong labour market may make for a milder recession.

We fully realize that labour is a lagging indicator in a recession (job losses typically come at the end of a recession rather than the beginning). However, we consider that there has been a demographic shift, with the numbers leaving the labour market exceeding those entering. Therefore, the unemployment rate, which typically spikes during a recession, may remain low in this exceptionally tight labour market.

A year for resolving uncertainties

Overall, we don’t believe that potential recession risks will overshadow fixed income and equity opportunities in 2023, thanks to the reset of market valuations, interest rates and return expectations in 2022. The last three years have been unprecedented with respect to the global pandemic, the 2020 market crash, the central bank response, recovery, market rally, inflation and eventual reset.

We believe 2023 will be about resolving uncertainties. We feel that much of the recession has already been factored into equity and bond market valuations and that investors will be rewarded with an improved market environment.

Conclusion

Do not panic and make decisions that will ultimately hurt you.

Be patient. If you don't have a plan for navigating the market volatility, then get one, because volatility will always be a part of your life as a retiree.

If you don't have the stomach for investing and tend to avoid pain and making difficult decisions, then you should consider having someone else manage your money for you.

What Now?

We help our clients create sustainable, predictable cash flow from their portfolio in the most tax-efficient manner to ensure they never have to worry about running out of money.

Want to retire in the next few years? Click here to book an appointment

Retirement Income & Investment Planners,

Willis & Nancy Langford

587-755-0159