What's the difference between Inflation and Stagflation?

Inflation is the cost of goods and services going up. If you have been grocery shopping lately, you know what I mean. This past week I noticed a beef roast listed at $47. Probably enough to feed a family of 4. Well, who would spend that much on one meal? Price increases are impacting every area of our lives.

What are the causes of inflation?

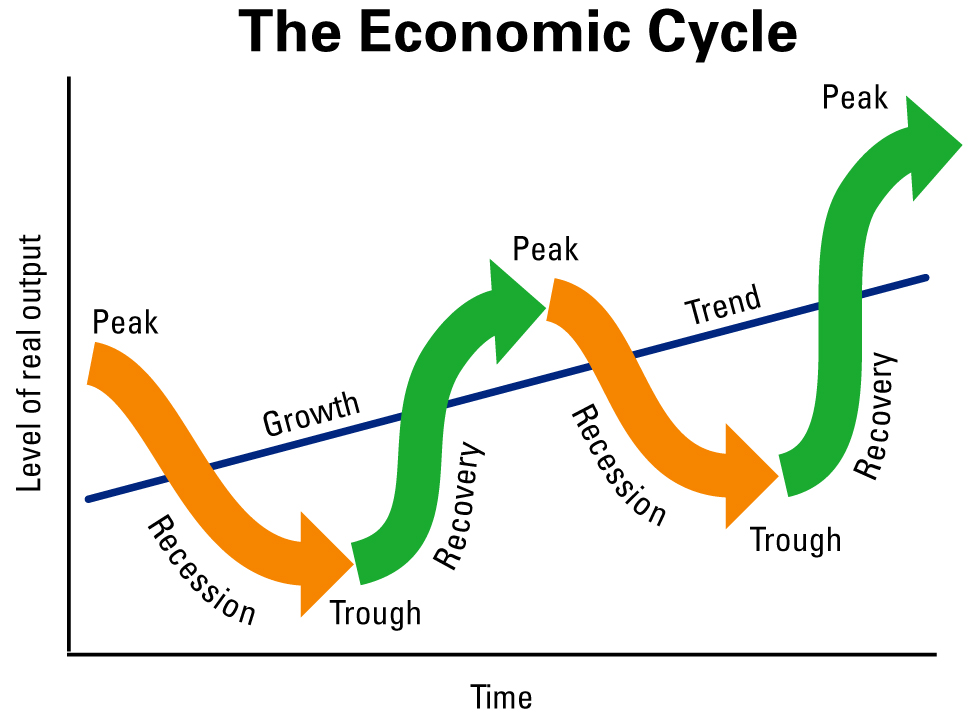

You have to understand the economic cycle and know that the economy operates in a cycle of peak growth, then it contracts (recession), flatlines and then starts the recovery all over again. As the economy peaks and people are working, earning money and spending money, there is more demand and this demand drives up the cost of goods. Inflation. This is normally seen at the peak, but we are not at the peak. We are in recovery. You have to understand the economic cycle and know that the economy operates in a cycle of peak growth, then it contracts (recession), flatlines and then starts the recovery all over again. As the economy peaks and people are working, earning money and spending money, there is more demand and this demand drives up the cost of goods. Inflation. This is normally seen at the peak, but we are not at the peak. We are in recovery.

What is stagflation?

This is an economic event where inflation is rising but employment is declining. Economic output, measured by GDP, is declining - fewer jobs, less spending. A cooling is taking place, while at the same time, inflation is still increasing. This is a serious threat right now. Learn more about stagflation.

Why is this important?

Currently, we have a decently recovering economy, despite the pandemic, however, it's showing signs of cooling off because employers can't get workers or they can't get supplies to make stuff because of the bottlenecks in the supply chain brought on by the pandemic.

Add insult to injury, the price of energy is rising too fast. There's a bottleneck that's been oddly created as a result of dealing with a pandemic for almost 2 years. Side note: This may impact other countries more than Canada. We are an exporter of energy and the price increase will benefit our GDP.

Another point to note is that the job market is changing as the digital world emerges. There's a technological revolution taking place and not enough people with the proper skills. The pandemic has also created a gap in learning and training.

Canada has an unemployment rate of 5.5% and Alberta is at 6.5%. It seems bizarre when at the same time we see "Now Hiring" signs everywhere.

What's going to happen?

No one knows for sure.

- The government is removing the stimulus to motivate people to go back to work.

- The central banks are curbing quantitative easing, which will slow down cheap money in the system.

- Interest rates will start to increase in 2022. Maybe 1-2%.

- The urgency to roll out vaccines is a part of this plan - to keep the economy moving.

- They are trying to improve the supply chain issues and get stuff moving again. This should help to decrease inflation.

- There's a supposed energy transition taking place - a green economy - renewables. This makes for great political fodder, but no one seems to know much about how to do it.

There is a concerted effort, especially here in Canada and the US to spend money to get the economy moving stronger. A key tenant of Modern Monetary Theory - something both Trudeau and Biden support, believes that the way to combat inflation is to increase productivity (GDP). Debt is only a function of GDP. As long as your debt to GDP ratio is good, and you have the ability to control your own currency - nothing else matters. Right now the ratio is the worst it's ever been. This is one of the reasons Biden is pushing so hard for his $1.75 trillion dollar spending plan.

The modern monetary theory is called a theory because no one knows if it's going to work. It's an experiment.

I'm not an economist. I read a lot. I like to learn about these things and then try and summarize my findings in a way that the average person can understand. I'm not a predictor of the future. I think we need to know what's going on around us and respond prudently, in a proactive not reactive manner. There's no need to panic or be alarmed. The people running the central banks are a lot smarter than the people running the governments.

What impact does all of this have on investing?

I'll talk more about it later, but I want to set the table a little.

The stock market and the economy are interconnected, but not correlated. They do not run in tandem.

This is a chart of US GDP since 2008. The highest rate is about 3%. And 7 out of 13 years were negative.

Now, look at the US stock market (S&P 500). The other indexes are similar.

The S&P 500 - a benchmark for the top 500 companies on the index has increased by 441% since January 2009.

Canada would be similar, except the TSX has not grown nearly as much (only 127%).

The last 13 years have been incredible.

Why? Record low-interest rates and government stimulus.

What will the next 13 years look like? Good, but what we have seen in the last few years isn't sustainable.

We'll dig deeper into this in another post.

Read: Rethinking Your Portfolio - Especially Bonds

Learn more about our planning and process and book an appointment.

Fee-Only Retirement Income, Investment, & Tax Planning,

Willis J Langford BA, MA, CFP

Nancy R Langford CRS

|