How we bought our 1989 Pontiac 6000

It was 1993 and Nancy and I needed to get a new car. We didn't have any money and couldn't get a loan at the bank. Nancy's dad remembered that we could borrow some money from his life insurance policy and repay it over time. So we borrowed $6000 from his policy and bought a Pontiac 6000 from a family friend. The Sun Life insurance policy allowed us (or him) to borrow from the built-up cash value inside the policy and we simply paid it back, with interest, over a couple of years. No qualifying. No bankers involved.

This is the basic idea behind the Banker's secret, also called the Infinite Banking Concept. This concept has been experiencing a resurgence lately, mainly due to some great marketing. Is it a good idea? How does it work? What are the pros and cons? Well, let's uncover this secret and see if it is as good as it sounds.

Under the hood.

Basically, a permanent life insurance policy allows you to grow cash value inside the policy. This cash value can grow significantly over time and provide you with easy access to funds for whatever purpose you see fit.

How is the cash value determined?

There are two types of permanent life insurance policies. Whole life and universal life.

A whole life policy will cover you for your whole life and pay out a death benefit to your named beneficiaries. It's a matter of when not if. When you own a whole life policy you own a part of a shared poled of money and you share in the dividends of the pooled investment.

There are literally thousands of people who also own policies and every month they all pay a premium. These premiums are pooled together, managed by a team of investment pros, and used to make investments. The investments may be in long term bonds, stocks, real estate, and private equity and policy loans (Which I'll explain shortly). This pool of money has new money coming in each month from premiums and also from the returns of the investments. It also has money going out of the pool as people die and the proceeds of their policy are paid out to beneficiaries.

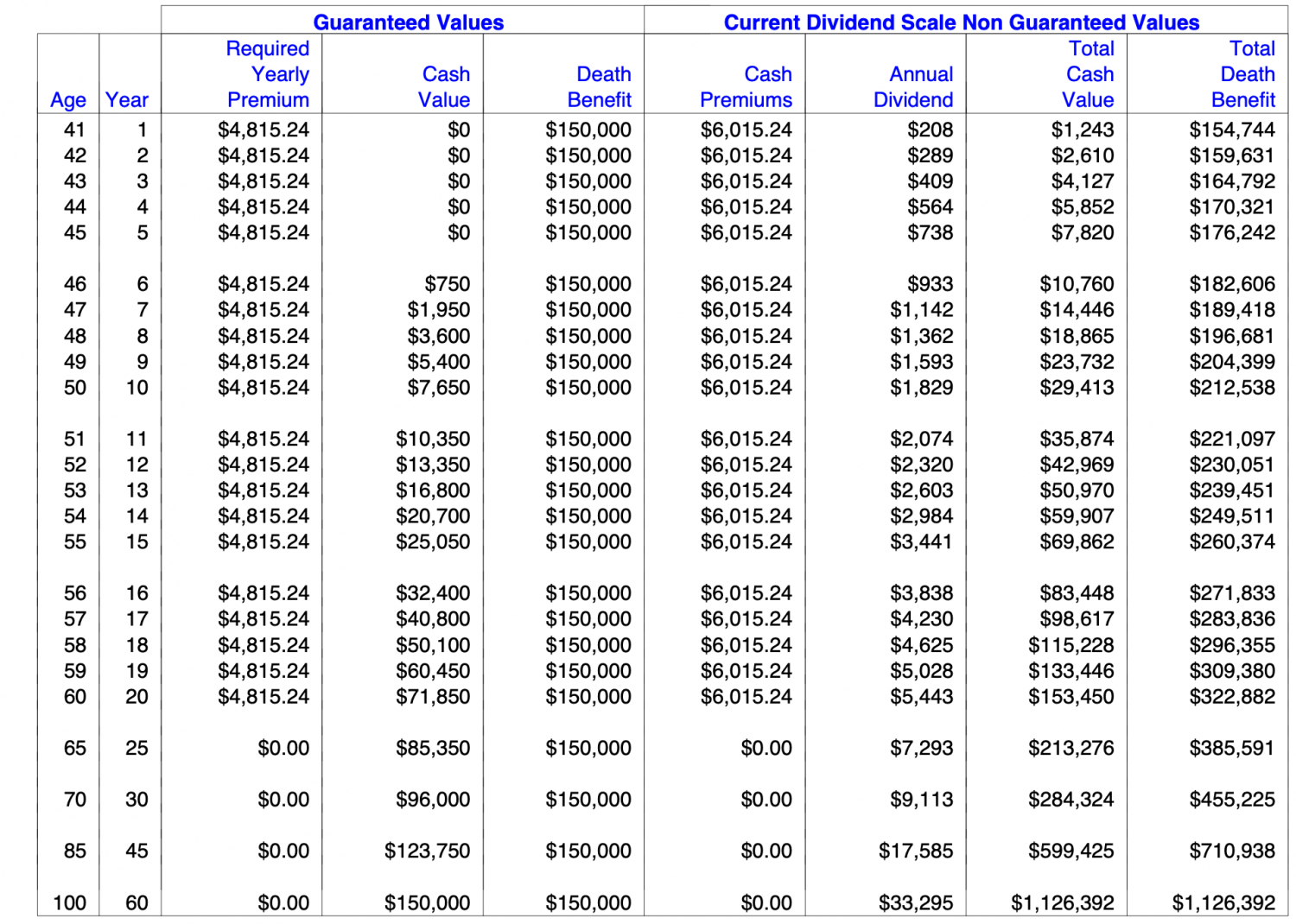

As an owner of one of these policies, you participate in this pool of money (receive dividends) and you are a part-owner, proportionally, based upon the size of your policy. The cash value has a guaranteed portion and a non guaranteed portion. The non-guaranteed cash value is the projected growth based upon the current dividend payout, which changes from year to year. Below is an example of how a whole life policy would work for a 40-year old non-smoking male, paying $500/month for 20 years.

The premium is $4815/year and in this case, he is putting in an additional $100 monthly. The policy will be fully paid up in 20 years. The death benefit keeps growing because the annual dividends are buying additional insurance each year - that feature is optional. This client will put approximately $120,000 into the policy and the payout at age 85 (life expectancy) would be $710,938. The main benefit is accessing the cash value on a tax-free basis. Note: Any loan amount above the ACB of the policy would be taxable. The insurance company keeps track of the ACB and would make you aware if you were going to exceed that amount with a loan.

A Universal policy is similar, but, the key difference is instead of participating in a pooled investment, you get to choose your own investments from a selection of funds offered by the insurance company or a guaranteed interest rate. There is no guaranteed cash value as the value will fluctuate with the markets and will go up or down daily. Over time, these policies have performed well, but they do have a higher element of risk because of public market exposure.

The Banker's Secret works better with a whole life policy.

Is this a good concept?

Yes, in theory, it is a good idea and insurance can serve as another asset class for building wealth and managing cash flow with greater tax-efficiency.

The upside

You can take control of your finances and not have to depend on the bank's approval to access money. You can grow money inside a policy on a tax-favorable basis and access that cash tax-free in most cases. You do that through a policy loan. You can add additional money to both of these types of policies on an annual basis up to a maximum set by CRA - this is called overfunding.

How do policy loans work?

Once you have accumulated some cash value inside your policy you can access up to 90% of that value at any time and pay the posted interest rate determined by the insurer. You do not have to qualify or tell them why you want the loan. This is the idea of becoming your own banker. The interest rate the insurance company charges can range in the 5-8% range. You can also use the cash value of the policy as collateral and get a loan at any of the chartered Canadian banks. This may help you get a lower rate, however, the banks will probably only want to deal with a policy worth $100,000 or more. There is no requirement to repay the loan and the interest will accumulate. Upon death, the policy will first pay off the outstanding loan and the remaining proceeds will go to the named beneficiaries.

Other applications

1. Retirement income. You can use this strategy to build up a sizable cash value and then access that cash in the latter half of retirement on a tax-free basis. If you look at the illustration above this person would have $284,324 of cash value at age 70 and could borrow up to 90% of that in the form of a loan.

2. Long term care needs. Everyone needs to plan for the potential of needing long-term care as they age. Rather than hold back savings you could have one of these policies where you can access the cash value on a tax-free basis and also the loan proceeds would have no impact on qualifying for any other government benefits.

3. Giving money to family while you are still alive. Perhaps you would rather give money to your kids or grandkids while you are alive so you can watch them enjoy it.

The downside

To make this work you will need to buy a fairly large policy and commit to a large monthly premium. You have to be healthy enough to get approved for the insurance. The loan interest rate is on the high side unless you can use the policy to get a loan elsewhere. You have to ensure you have the cash flow to pay the monthly premiums for 20 years. Also, the earlier you start one of these policies the better as you'll have more time to see it grow. It would also be best to have the policy paid for before retirement.

Conclusion

The banker's secret isn't that big of a secret, after all, just sexier marketing than talking about whole life insurance.

This isn't a replacement for other investments. We would recommend saving through RRSPs and TFSAs first and then use this strategy with the extra cash flow you have available for saving. This is a great strategy for higher-income earners as the tax shelter can be significant. There are many nuances with these types of policies and there are pros and cons from one insurer to the next, so you really need to complete your research before buying and also, understand the role it can have in your financial plan. These policies are a great way to build wealth and we personally own 5 of them (3 on our own lives, 1 on our son, and 1 on our granddaughter).

If you would like to discuss this concept feel free to contact us and we'd be happy to assist you.

Check out our fee-only retirement planning services here.

info@langfordfinancial.ca or 587-755-0159

Income, Investment & Tax Planning for Retirement,

Willis J Langford BA, MA,

Nancy R Langford CRS

We are both licensed insurance advisors with the Alberta Insurance Council.