Would you like to access more tax-free cash flow in retirement?

The largest asset that you have in retirement is your home, it represents a large chunk of dormant equity. It's like you have this piggy bank, but the money is trapped inside.

How can you access this cash?

Reverse mortgages have been around for over 25 years in Canada. Still, many Canadians do not fully understand them. Are they a good idea? Is it 2 steps backward to go 1 step forward?

How Do Reverse Mortgages Work:

- You have to own your home outright or have a significant amount of equity in your home

- You can access the equity in your home - up to 55% of the appraised value

- You have to be at least 55 years old

- The lender will provide you with either a lump sum or monthly/annual loan

- When you sell your home you have 180 days to pay the loan plus interest back to the lender

The Pros:

- Allows you to access the equity in your house while still living in your house

- You don't need income to qualify, just equity in your home

- Enables you to enjoy your equity while still alive, rather than saving it for someone to inherit later

The Cons:

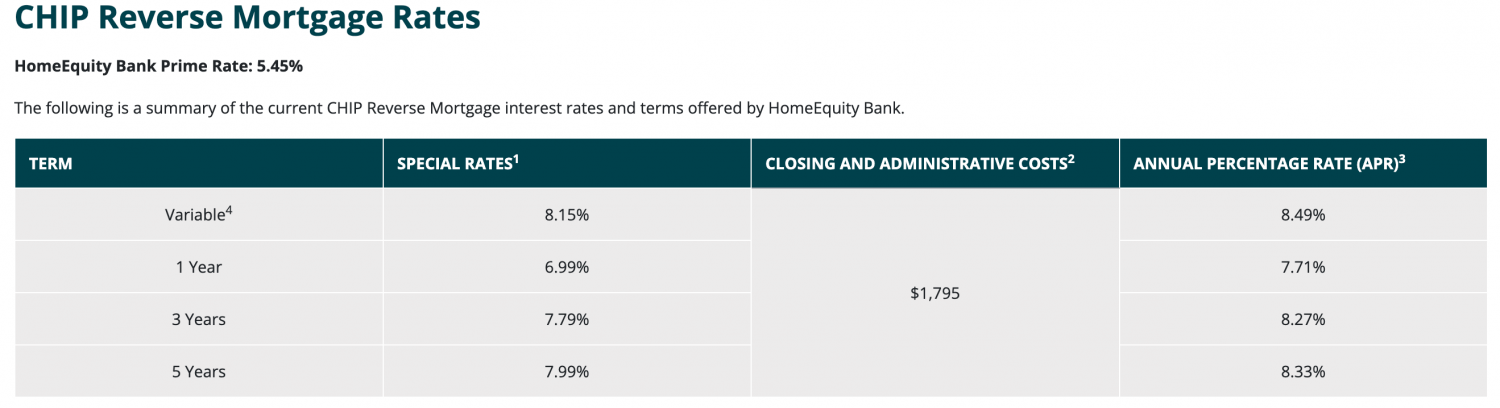

- You will pay about 2-3% more than the current interest rates for borrowing.

- You have to personally pay the appraisal fee ($400 or more).

- You have to pay an administration fee of $1795.

- Legal Fees may be added as well.

- The lender will embed the fees into the new loan, which means you will be amortizing and paying interest on them for many years.

- Depending on how long you live, you could owe the entire value of your house back to the lender when you sell it.

- The lender could force you to sell your house to pay off the loan once you've maxed out the amount you can borrow. This leaves you potentially at the mercy of unfavourable market conditions at the time. CHIP does offer some guarantee to prevent this from happening.

As of October 2022.

Home Equity Line of Credit

- Much lower interest rates

- Very low setup fee, often the bank will pay for the appraisal

- Legal work is done by the bank's legal dept at no cost to you

- You will have to pay monthly interest charges

- You are always in control of how much you borrow and when you pay it back

Downsize to a smaller house or condo

- The proceeds of your house sale could be invested and now you can earn interest/dividends rather than paying interest.

- These investments enable you to increase your wealth whereas a reverse mortgage depletes it.

- You no longer have all the worry, labour or expenses associated with homeownership (Taxes, Up-keep, Insurance)

- The earnings from your investments could pay all or a part of your new mortgage or rental costs

Conclusion

We are not fans of Reverse Mortgages, however, they can be a viable option in some circumstances. We would advise not using this strategy unless you have to, and only after all other options have been considered. We encourage pre-retirees to add a Line of Credit to their home before they retire.

Check out our article titled, "Is it a good idea to tap into your home's equity before you retire?". As Retirement Income specialists, we prefer the alternatives with the lowest and most efficient long-term cost for generating cash flow.

Feel free to reach out to us with any feedback, questions or if you would like to chat about:

- Generating guaranteed income from your investments

- Ensuring you don't outlive your money

- Strategies for tax-efficient investing

- Our RRSP Exit Strategy

Check out our fee-only planning services: Click Here

Retirement Income, Investment & Tax Planning,

Willis J Langford BA, MA, CFP

Nancy Langford CRS

Hervin Pesa BA, CFP

"Helping you get your total financial house in order so you can retire more confidently with purpose and peace of mind"