Tax Credits and Deductions

A non-refundable tax credit means that you receive a credit that can only be applied to taxes owed. If you don’t owe any taxes, the credit is of no value. Once your income tax is reduced to zero, there is no further tax credit. A refundable tax credit is money you can receive even if you had no taxes owing - for example, the climate action incentive.

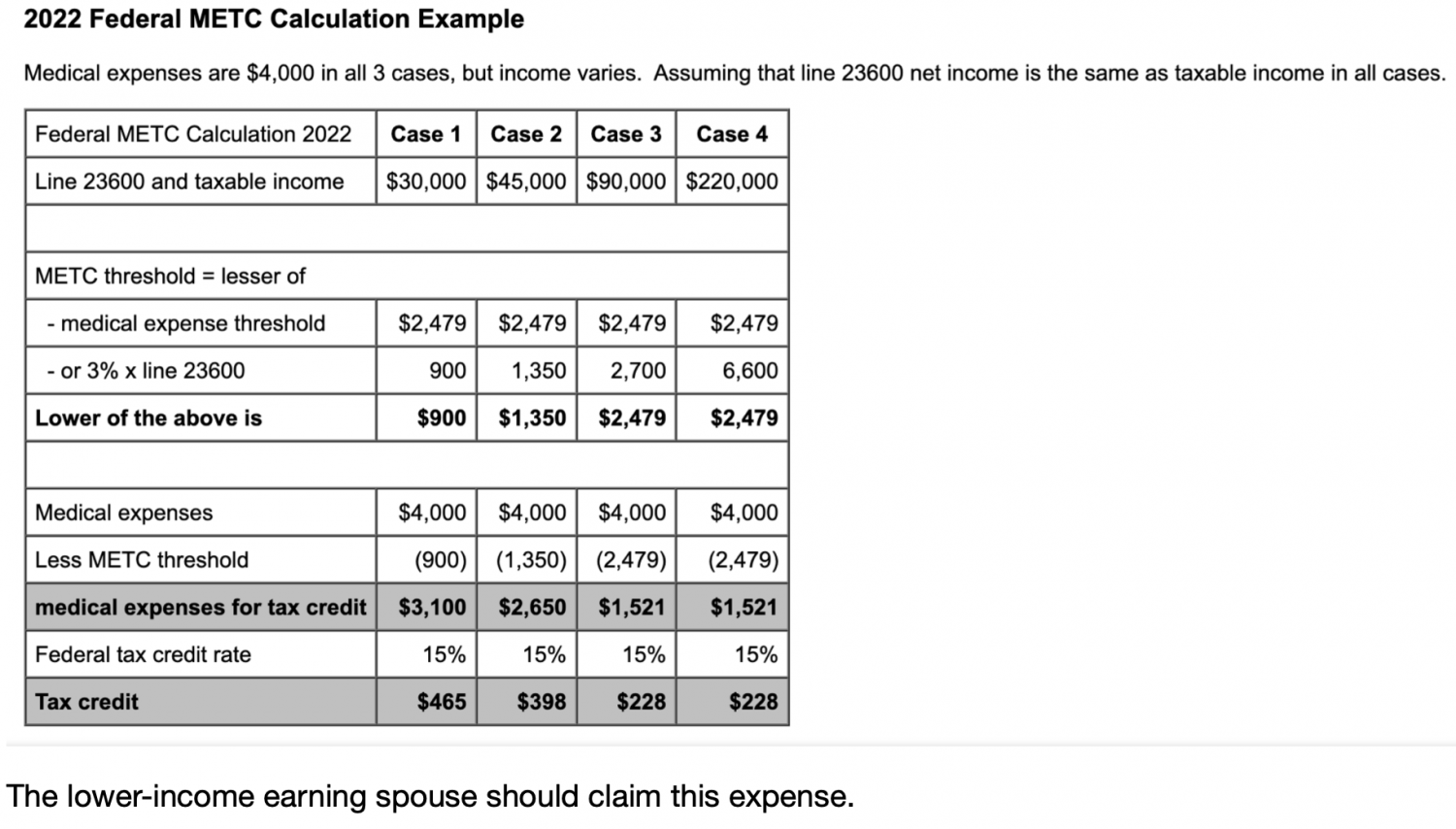

Medical Expenses Tax Credit. For a list of eligible expenses check out the CRA website.

Age 65 tax credit

• This is a significant tax credit for individuals 65+. It is a non-refundable tax credit of $8396 in 2023. The full credit is available for total taxable income up to $42,335. The credit is clawed back as your income increases and is eliminated at $98,308.

CHARITABLE GIVING

• The first $200 of giving receives a 15% tax credit and after that it is 29%. Ensure that the giving you do is combined and you actually get a tax receipt. It’s best to make these donations in the early years of retirement when you have more taxable income because once you have used up most of your savings, there may be little tax owing.

ELIGIBLE PENSION INCOME TAX CREDIT

• This is a tax credit on the first $2000 of eligible pension income. A Defined Benefit pension will qualify for the tax credit once you start at any time after age 55. RRIF/LIF income after age 65 qualifies. It’s a 15% tax credit federally and the provincial amount varies by province. In essence, a 65-year-old can withdraw $2000/year from their RRIF tax-free. It’s a good idea to convert $14,000 of RRSP into a RRIF at age 65 and take out $2000 a year until age 71.

Canada Caregiver Credit

Do you support a spouse, common-law partner, or dependant with a physical or mental impairment? The Canada caregiver credit (CCC) is a non-refundable tax credit that may be available to you in the amount of $2350.

You may also be able to claim the CCC for one or more of the following individuals if they depend on you for support because of physical or mental impairment:

-

your (or your spouse's or common-law partner's) child or grandchild

your (or your spouse's or common-law partner's) parent, grandparent, brother,

sister, uncle, aunt, niece, or nephew (if they resided in Canada at any time in the year)

An individual is considered to depend on you for support if they rely on you to regularly and consistently provide them with some or all of the basic necessities of life, such as food, shelter and clothing.

Disability amount

If you, your spouse or common-law partner or your dependent has a severe and prolonged impairment in physical or mental functions and meets certain conditions, they may be eligible for the disability tax credit (DTC) which is worth $8870 in 2023.

To determine eligibility, you must complete Form T2201, Disability Tax Credit Certificate, and have it certified by a medical practitioner. Canadians claiming the credit can file online whether they have submitted the form to the CRA for that tax year or not. Type 1 diabetes now qualifies. The definition of disability is broad - meaning a reduced quality of life.

Learn more about our retirement income planning process and how to book an appointment by clicking here.

Willis J Langford BA, MA, CFP

Langford Financial Inc. 2022