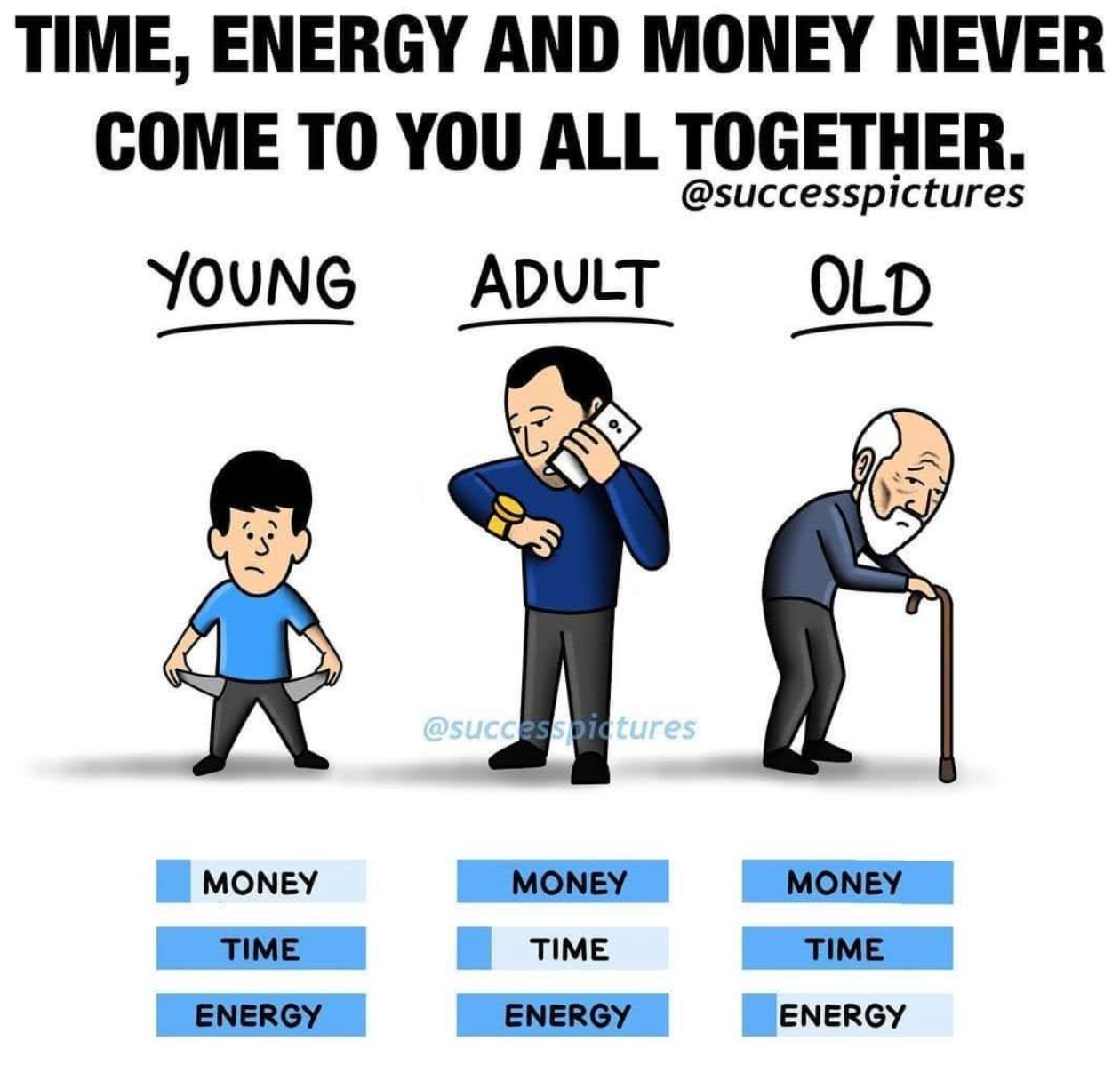

Maybe it's not possible to have the perfect retirement, but it is possible to aim for a better one, and it has 3 key ingredients - time, energy and money.

When you are young you have energy and time, but no money.

As an adult you have energy, maybe the money, but not enough time.

As a retiree, you can have all 3, time, energy, and money, but only if you retiree before you start running out of one of them.

If you are not careful, your time can be sabotaged as a retiree. Other people think you have nothing to do or perhaps you are bored, so they will find lots of stuff for you to do. Babysitting the grandkids. Volunteering. Helping someone with a project. Before you know it you have a full calendar and no time for the things you want to do.

Money. Well, most people have enough even though they spend most of the early years fretting about running out. They are too cautious and underspend. The fact of the matter is you don't want to be the richest person in the graveyard and at the same time, you don't want to be a burden to your family. The solution is to have a proper plan that provides you with a framework so you can spend confidently in the early years and still have enough for the latter years.

Energy. Other than a health crisis, this one is within your ability to control. You can eat well, and stay active and healthy; as this will provide the energy to do what you want to do. A key point to remember is that your energy levels will decrease over time, so you have to be intentional as to where you spend your energy. Whatever you do, don't be that old person with all kinds of money and time, but no energy left to do anything but sit around the house complaining and counting your beans.

My advice:

Retire early, stay healthy, and do stuff you love.

You only have so much time, money, and energy so be careful to spend each of them on the right things and maybe, you will have mastered the recipe for the perfect retirement!

Life is Short. Retire. Be Happy!

Learn more about our fee-only planning process and how to book an appointment by clicking here.

Retirement income, investment, and tax planning,

Willis J Langford BA, MA, CFP