What is Sequence of Return Risk?

Oftentimes, investors are instructed to own a well-diversified portfolio in accordance with their risk tolerance and then maintain it through all market conditions until their situation changes or they are faced with a major life event.

This is all well and true, but if you’re an investor who is entering your retirement years, generating a high return, while important, is only one factor which ultimately influences how long your savings will last.

Another important factor is the order in which returns are earned. To put it simply, regular withdrawals diminish the dollar value of a portfolio, and it is precisely this dollar value upon which your future returns are compounded.

Experiencing negative returns early in retirement can result in running out of savings much sooner than if the portfolio experienced positive returns at the outset – definitely something you as an investor want to avoid.

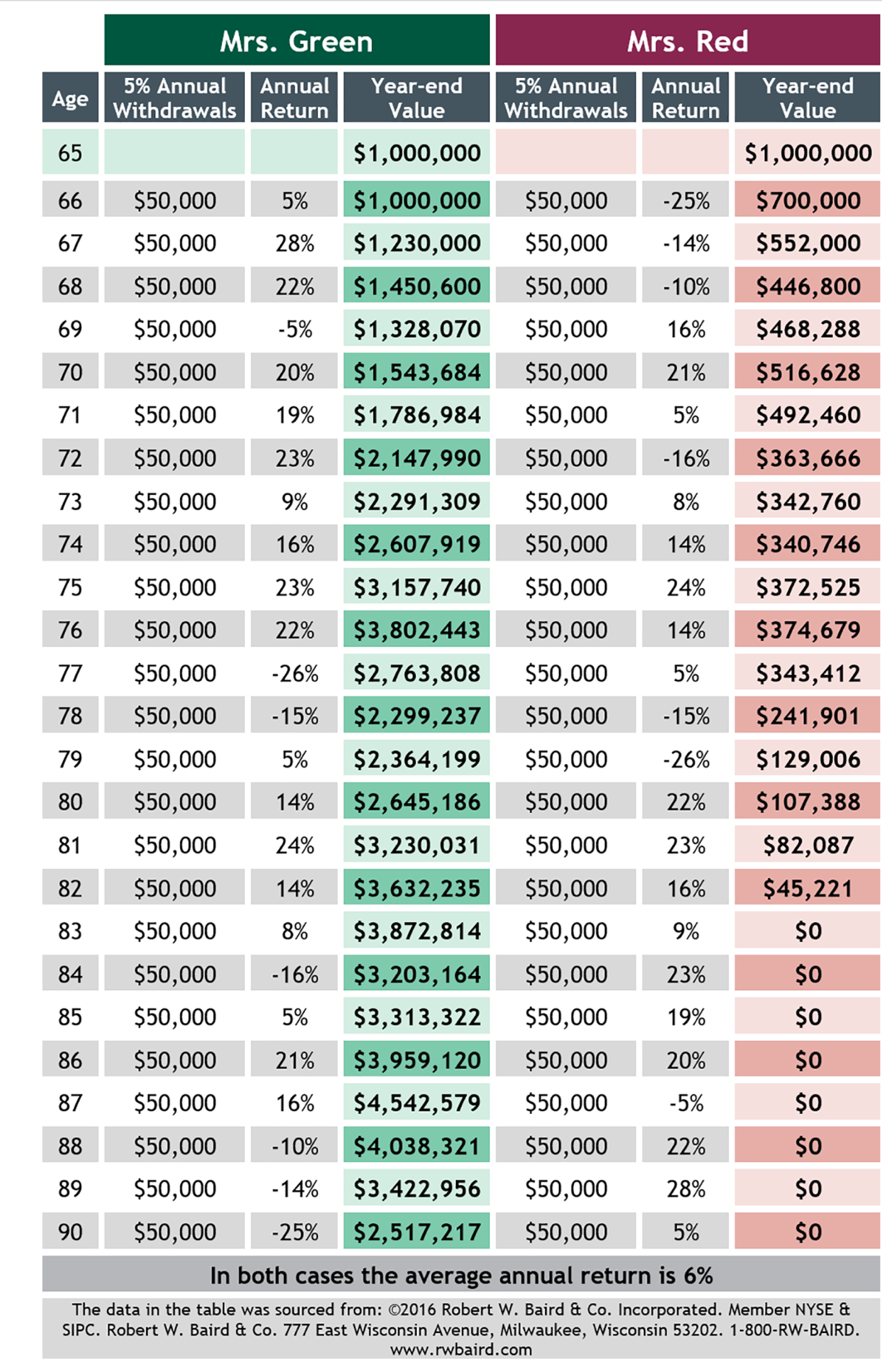

Let us consider the two scenarios below. In both cases, the new retiree is beginning with $1 million in capital and both will withdraw $50,000 per year. The only difference in this particular situation is that the sequence of returns has been reversed. That is, Mrs. Green experienced positive returns early in her retirement years whereas Mrs. Red experienced negative returns early on.

The annual average growth rate is the same across both scenarios and if there were no withdrawals, the final dollar amounts would be the same too. However, in the scenario where withdrawals were made, the sequence in which returns are earned is quite relevant - Mrs. Red is left with a shortfall at age 83 while Mrs. Green still has $2.5 million at age 90. Quite the difference in retirement dollars.

So, how do you reduce your sequence of returns risk in retirement?

Well, mitigating the effects of market volatility is one way.

Proper diversification among multiple asset classes that don’t correlate and create lower portfolio volatility, especially when nearing the decumulation years, can generate income and minimize the risk of drawing down on assets during a down market. And, while the numbers used in the above example are extreme and unlikely to manifest in actual market conditions, they do illustrate the concept well; namely, that the sequence of returns from an investment portfolio experiencing withdrawals can have a material impact on the overall retirement picture and it is prudent to manage this risk.

How do you manage this risk?

You have to be diversified across multiple asset classes, sectors, and geographical locations. This way you have more options as to where you draw your cash flow each year. You can also include more privately managed assets within your portfolio. If all you have are investments that trade on the public markets you will always be at the mercy of the markets and the volatility. As the saying goes, a rising, or lowering tide, affects all boats.

Another idea is to use a cash wedge strategy. This is simply placing your cash flow ($50,000/year as in the above illustration) into an account to be drawn as needed. This account can be in cash, a near cash equivalent, or a low-volatility investment holding. The lesson here is to not draw money willy-nilly from wherever it seems easiest or from the portfolio in general.

Life is Short. Retire. Be Happy!

Learn more about our planning process and how to book an appointment by clicking here.

Fee-Only Retirement Income, Investment, & Tax Planning,

Willis Langford BA, MA, CFP

Nancy Langford CRS

References

The data in the table was sourced from ©2016 Robert W. Baird & Co. Incorporated. www.rwbaird.com