Fixed Income Part of Your Retirement Portfolio

What happened to bonds?

Governments all around the world have lowered their key lending rates to zero and in some cases sub-zero.

Greg Taylor, chief investment officer at Purpose Investments, an investment firm out of Toronto, says the "60/40 allocation method doesn’t work because markets have evolved, and the two portions no longer fit together as tightly as they once did."

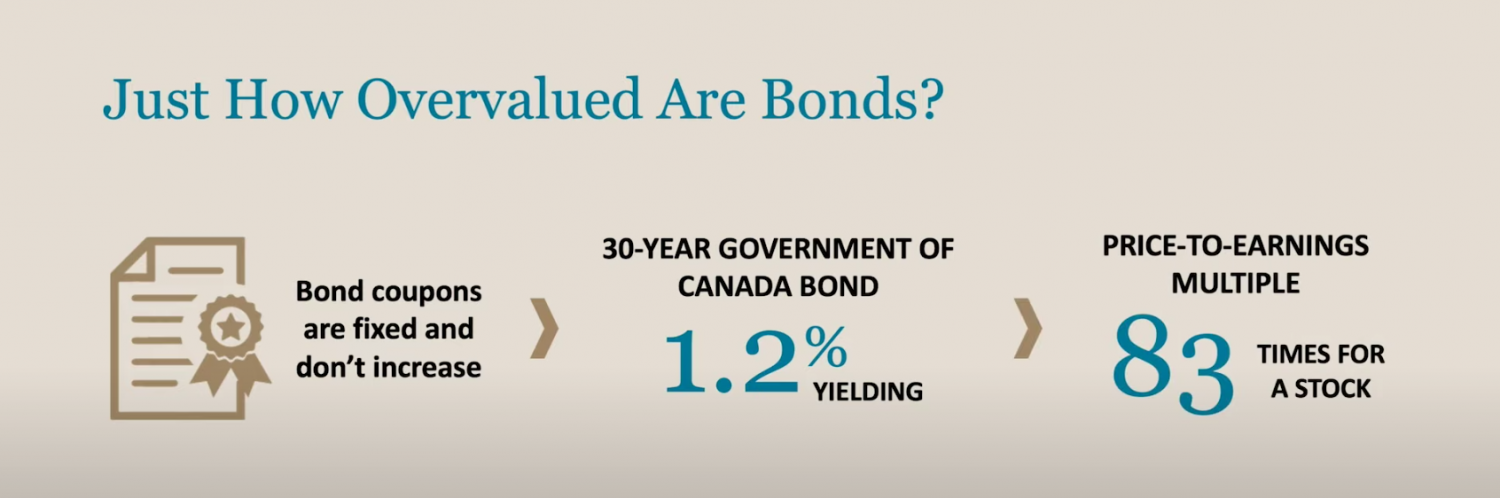

The PE ratio on many stocks is around 20-30. You would be paying 83 times for the 30-year government of Canada bond.

The PE ratio on many stocks is around 20-30. You would be paying 83 times for the 30-year government of Canada bond.

With the 60/40 split, you end up with 40% of your portfolio adding nothing in the way of returns. This means that the other 60% that is in equities has to do all of the work.

Check this out from Bloomberg: Bonds Have Never Been So Useless as a Hedge To Stocks Since 1999.

Because of their enormous debt, governments want interest rates to remain low for a long time. Corporate bonds refer to the issuing of debt by larger corporations that need to raise money to expand their businesses.

For example, they can issue a 20-year bond that pays a semi-annual interest payment. This interest payment is based on their credit rating. The better their credit rating the lower interest they have to pay. In order to receive a higher interest rate on a bond, you have to buy bonds from less credit-worthy issuers, who could default on their debt obligations. The term high-yield bonds refer to bonds that could have a junk bond status.

Alternatives

Anyone retiring with less than $1 Million of accumulated savings should consider incorporating annuities into their portfolio as a replacement for bonds. An annuity is simply the exchange of a lump sum of money for a regular monthly income stream that is guaranteed for as long as you live.

The 30-year Government of Canada bond yield is about 1.26%. This means that you would need to have, and need to tie up a million dollars for the next 30 years to get paid $12,600/year. No one is going to do this, but it is the risk-free rate of return and now serves as the baseline for retirement income planning. Adding insult to injury, with inflation coming in at 3-4% your GICs or bond money could be creating more risk for you than you realize. Your money is losing significant purchasing power - at least in the near term.

There’s an alternative to the traditional strategy of using bonds for the fixed income part of your portfolio during retirement.

A 65-year old single female could use $237,000 and buy a lifetime annuity that will pay $12,600 for the rest of her life with a guaranteed period of 19 years.

A couple in their mid 60's would need to use $267,000 with a 21-year guarantee. If at least one of them is still alive at age 90 the annualized rate of return is 1.43%. For every additional year, their rate of return increases. At age 91 the rate is 1.72%. By age 95 the rate is 2.60%.

So basically, an annuity eliminated the need of using bonds altogether, and with the guarantee added there’s no way they can lose their money. Either they or their beneficiary will receive all of the money, but the probability is very high that the retiree will get much more based on life expectancy.

Why tie up too much or your nest egg in creating fixed income when you can use much less of your money to buy an annuity and have money left over to invest where you can accept more risk and get a much higher rate of return?

Let’s take the example of the couple and say they still have $733,000 of savings to work with. Now they can put $100,000 of that money into a more conservative or balanced fund that is designed to generate lower volatility returns in the 3-4% range. This can even be accomplished using a fund that focuses on private equity as opposed to public markets. They can keep $33,000 in cash and the remainder of their money, $600,000 can have a greater degree of equity exposure for growth because they have a longer time horizon before needing the money.

Using and maximizing a TFSA is the best investment account for your ‘growth-oriented money’ because the growth is tax-free. Without growth, a TFSA is of no value. RRSP or RRIF withdraws can come from your ‘balanced income-oriented’ fund.

Typical 65-year-old single female retiree.

OAS: $7368

CPP: $8400

Annuity $12,600

Total: $28,368 (Guaranteed income for life)

If she were to take $12,000/year from RRSP/RRIF then she has $40,368 of taxable income for the year and will qualify for all of the tax credits available. It’s the perfect number. If she wants or needs additional income then draw it from her TFSA, on a tax-free basis. Her tax bill is approximately $3800 for the year - that’s less than 10%.

Typical 65-year-old couple.

OAS: $14,736

CPP: $16,800

Annuity: $12,600

Total: $44,136 (Guaranteed income for life)

If they add $24,000 from RRSP/RRIFs then they now have $68,136 of annual income and because they can split this income and take advantage of tax credits their total tax bill is only $4376 with the age 65 tax credit amount. They may have other tax credits from donations and medical expenses.

During retirement, you do not have payroll deductions or ongoing retirement saving commitments. You actually have much more after-tax and after-expense disposable income in your pocket.

The purpose of retirement savings is to create retirement lifestyle income, not to leave an inheritance or die with a large bank account. If you want to leave an inheritance, then it is best to use another strategy. Most retirees are so afraid of running out of money that they hold back on their spending and end up with too much leftover or not enough time to enjoy it.

What you are trying to avoid is overspending and becoming a burden to others or underspending and becoming the richest person in the seniors' home.

The idea that you have to preserve your retirement capital is unfounded, especially if you have less than $1 Million of savings to work with, in the first place.

Private Income Portfolios

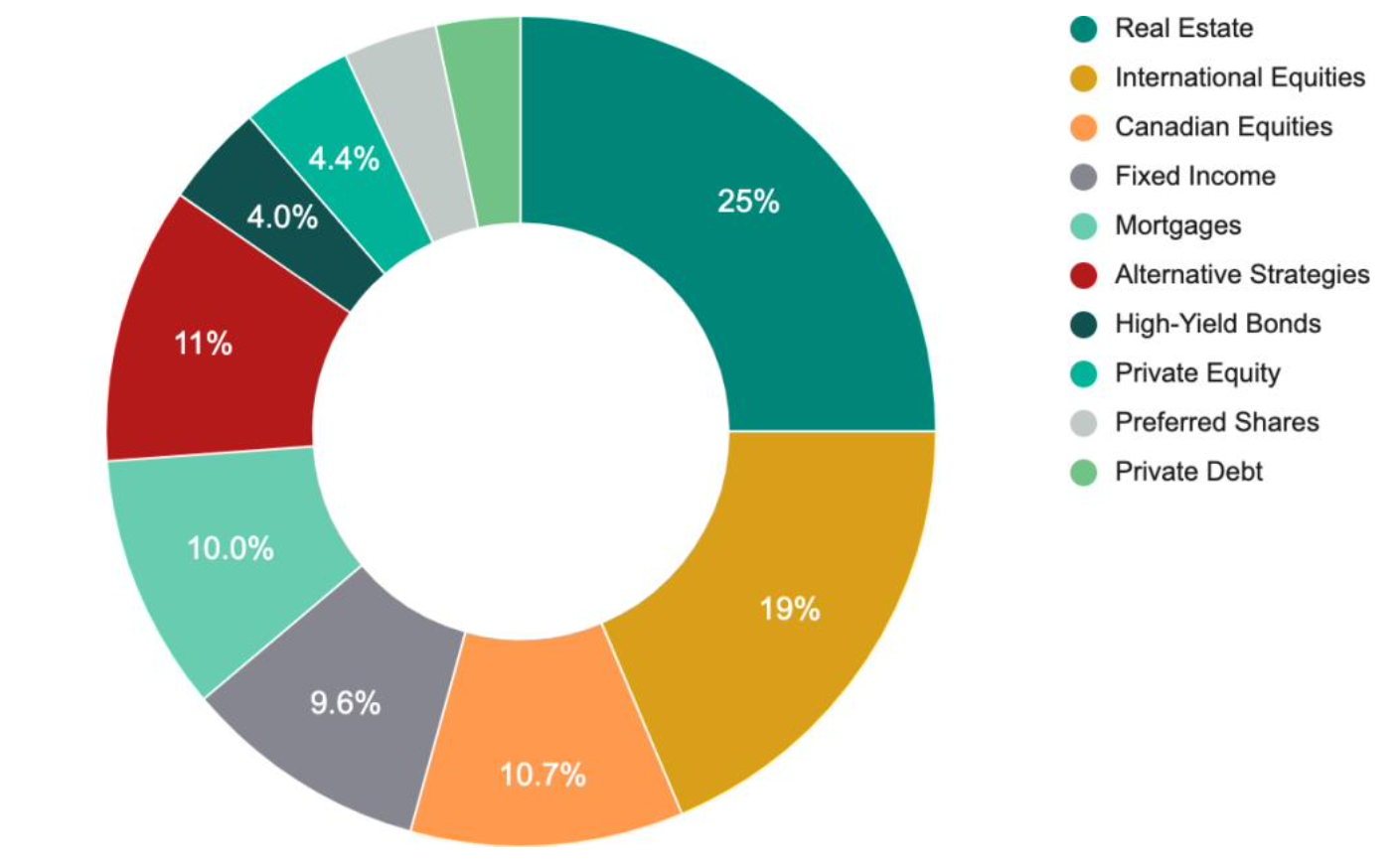

There are many wealth firms that have put together income-generating portfolios with very few public bonds or stocks. What they use instead is private debt, mortgages, private equity, preferred shares, and cash-generating assets like an apartment building. Here's an example of the Nicola Wealth Core Income Portfolio.

This fund has been in existence for 20 years. It has had an average annual return of 7% and over the past 5 years, the return has been 8%. It has had a negative return only 2 times - it was down .04% in 2002 and down 6.98% in 2008, after the crash. However, it rebounded by 16.46% in 2009. The reason for the consistency is because the portfolio isn't too correlated to the public bond or stock markets.

This fund has been in existence for 20 years. It has had an average annual return of 7% and over the past 5 years, the return has been 8%. It has had a negative return only 2 times - it was down .04% in 2002 and down 6.98% in 2008, after the crash. However, it rebounded by 16.46% in 2009. The reason for the consistency is because the portfolio isn't too correlated to the public bond or stock markets.

Look at the big picture

When it comes to managing your retirement income portfolio it is necessary to look at your BIG picture and your total income from all sources, both guaranteed and non-guaranteed. How much risk you need to take on is dependent on how much guaranteed and non-guaranteed income you need. Anyone retiring with any amount of accumulated savings could and should be incorporating annuities and other strategies into their portfolio as a replacement for bonds.

One of the most common mistakes

Thinking that your entire nest egg should have the same risk profile. In fact, each investment account you have should have its own risk tolerance profile, based on the time frame, objective, income, or growth need. Most retirees end up either taking too much risk or not enough. You are planing out the next 30 years of your life - take the time to do it right.

Retirement income planning is about looking at all of your various sources of income and then determining the most tax-efficient order for taking that income with as little market risk as possible. This is what we do for our clients. If you are uncertain about how to do this or you lack confidence in your current advisor’s ability to this for you, then schedule a meeting with us.

Click Here to learn more about our process for creating your financial roadmap for retirement, getting your total financial house in order, and confidently living your ideal lifestyle.

Retirement Income, Investment & Tax Planning Exclusively for Those 55+

Willis J Langford BA, MA, CFP

Nancy R Langford CRS