Do you have a retirement investment income strategy? Are you aware that it should be different than your accumulation strategy? Growing wealth is quite different than preserving wealth and taking an income at the same time. A couple of bad years will increase the risk that you will run out of money before you die.

Here's a good example of an investment strategy focused on income.

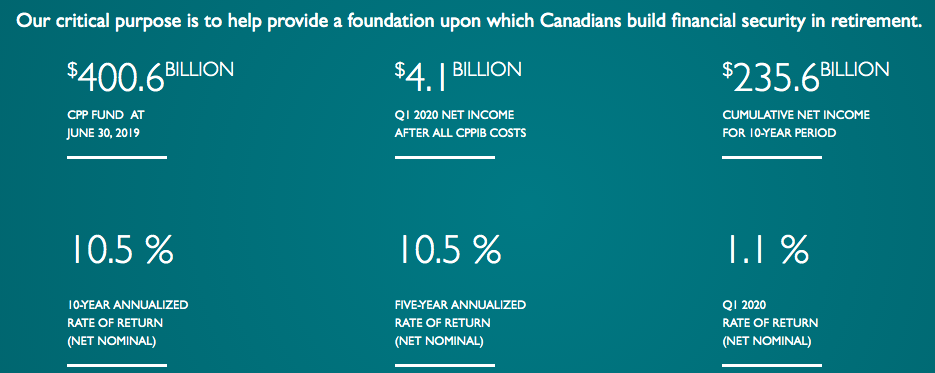

Many people may not know that the Canada Pension Plan is run by an independent investment board. The government may enact legislation as to the mandate of the plan and what the level of the contribution is to be, but it's this arms-length board that makes the investment decisions. As you can see from the screenshot below, the plan has over $400 Billion currently and has earned an average rate of return of 10.5% over the past 10 years. This is very good.

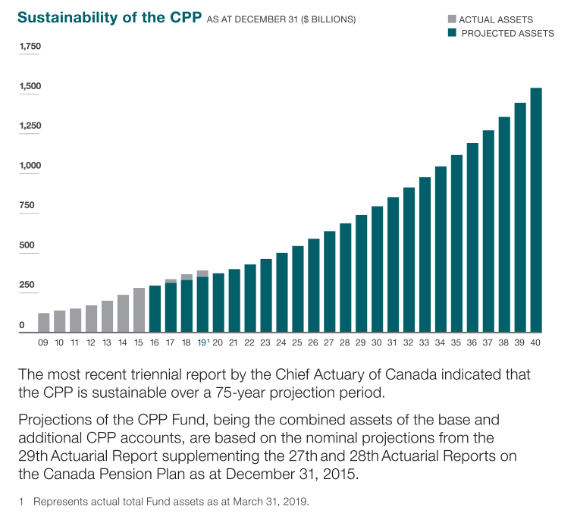

You may be wondering about the sustainability of the plan over the long term and if there will be money there for you when you are ready to retire. According to the chief actuary, the plan is sustainable over the next 75 years. This graph was created before the new CPP rules came into effect in January of 2019 that will see CPP contributions increase from 4.95% to 5.95% over a five year period.

What I find interesting about the CPPIB is how they are investing the money inside the plan to generate returns in the 10% range. You may be surprised to learn that they invest very little in Canada, just 15.5%. The portfolio is invested in multiple asset classes from all over the world.

Their mandate is set out in legislation. It states that:

- We invest in the best interests of CPP contributors and beneficiaries.

- We have a singular objective: to maximize long-term investment returns without undue risk, taking into account the factors that may affect the funding of the Canada Pension Plan and its ability to meet its financial obligations.

- We provide cash management services to the Canada Pension Plan so that they can pay benefits.

The 2 phases of retirement income portfolio management.

1. The first phase of anyone's journey is accumulation. The earlier you can start - the better. Depending on what your time horizon is you want investments that can produce long-term growth for you. The stock market has been a great place to get long term growth. Market volatility, in this case, can be your best friend, in that it provides you with the opportunity to buy more for less money.

2. The second phase of your journey is the income years. At some point, you will deposit your last paycheque and have to depend on your portfolio and other assets to generate income for many years. The worst nightmare of most Canadians is running out of money, so the makeup of your portfolio has to change from growth-oriented investments to income-producing investments, as market volatility can be your worst enemy. This approach is similar to the makeup of the CPP, which holds a diversity of investments in numerous asset classes from various industries and sectors from all around the world. The CPPIB has 9 offices globally managing the investments and looking for more opportunities to make investments that can produce long-term consistent cash flows.

You may also enjoy reading about: Cashable Annuities - The Perfect Fit For Market Turmoil

The average retiree will find it difficult to do this kind of work and would rather spend their retirement enjoying life, not managing and rebalancing their retirement portfolio. That's where we come in. We partner with professional money managers that have a similar approach as the CPPIB and look after our client's funds in a sustainable manner to preserve their capital, while at the same time generating income in the 4-6% range annually.

If you are preparing to transition into retirement in the near future the best thing you can do for your peace of mind and to increase your degree of confidence is to get a retirement Income Plan. We work with singles and couples, over age 55, whether they have $100,000 or $1 million. Our plans range from $1500-$2500 (based on complexity) and will answer your most pressing questions like:

- When is the best time for me to take CPP & OAS?

- What are all of the government benefits that I may be able to qualify for?

- How much money can I expect to have in retirement?

- What is the proper order for taking income from my various sources?

- How can I be sure I won’t run out of money?

- Are there ways I can reduce taxes?

- What are suitable investments for me at this stage in my life?

Our process is simple. Book the first meeting so that we can understand your situation and review your finances. Your plan cost will be determined before the end of the meeting. We create the plan. At the second meeting, we will present your plan and review the unique strategies and recommendations available to you to increase your income and save you money.

We have been helping our clients increase their retirement income by $1000s with strategies they were not aware of. For example, getting an extra $100/month in CPP benefits can equal an extra $35,000 of income over your lifetime. It's worth making a small investment in your future to get this objective, expert advice, and planning that will save you $1000s and give you the confidence you need to retire and avoid costly mistakes.

We provide unbiased advice on a flat-fee basis and an all-inclusive full-service model. Click here to learn more about our pricing and our process.

Retirement Income, Investment & Tax Planning,

Willis J Langford BA, MA, CFP

Nancy R Langford CRS