If you are approaching 60 years of age, then you have a critical decision to make in the coming months. When is the optimal time to take CPP? Our government has decided for us that the Normal Retirement age should be 65, but does it work for you? That's a decision only you can make, but before you make that decision get educated about these benefits so that you can make an informed decision.

With that being said, they have provided some flexibility as to when you can choose to take your government pensions such as the Canadian Pension Plan (CPP) and the Old Age Security (OAS).

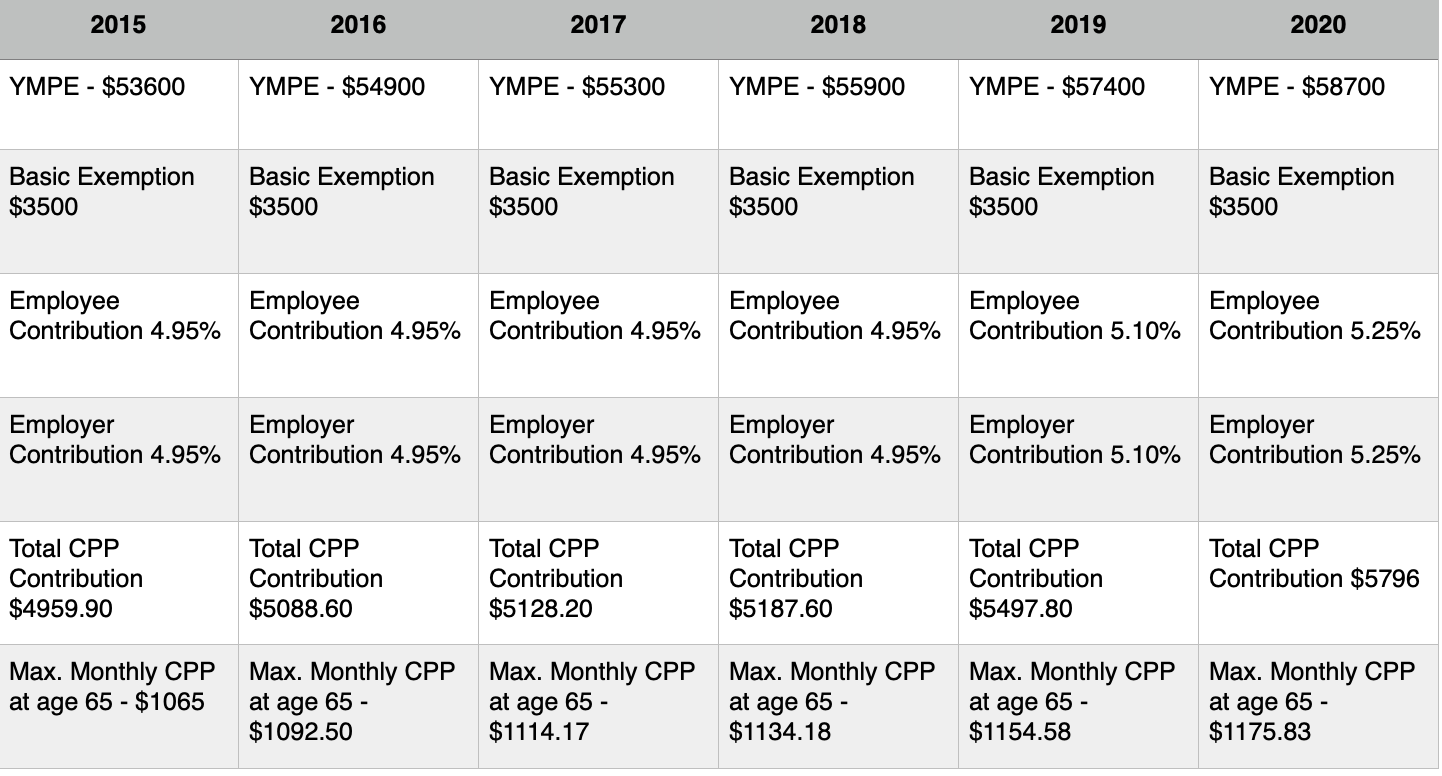

CPP - if you take it at age 65 you will be entitled to a "normal age 65" amount based on the maximum that a person could receive ($1175.83/Month for 2020). Very few Canadians receive the maximum. The average is somewhere around $672.00/Month. You have the option to take your CPP at age 60 at the reduced rate of .6% per month from the "normal age of 65". That is 60 months, which means that a person taking their CPP at age 60 (60 months early) will see a reduction of 36%. (Calculated as .6 X 60 = 36%.). A person taking their CPP at age 60 in 2020 that is entitled to the full CPP amount will receive $752.53.

Alternatively, you also have the option to delay taking your CPP until age 70. If you delay taking your CPP pension you will receive .7% per month more than the Normal age 65 amount. That means that a person waiting until age 70 will receive an increase of 42% (Calculated as .7 X 60 = 42%). In 2020, a person who qualifies for the maximum CPP benefit would receive $1669.68.